Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 9 (1 point) Which of the following statements is true if a company applies overhead to jobs on the basis of a predetermined overhead

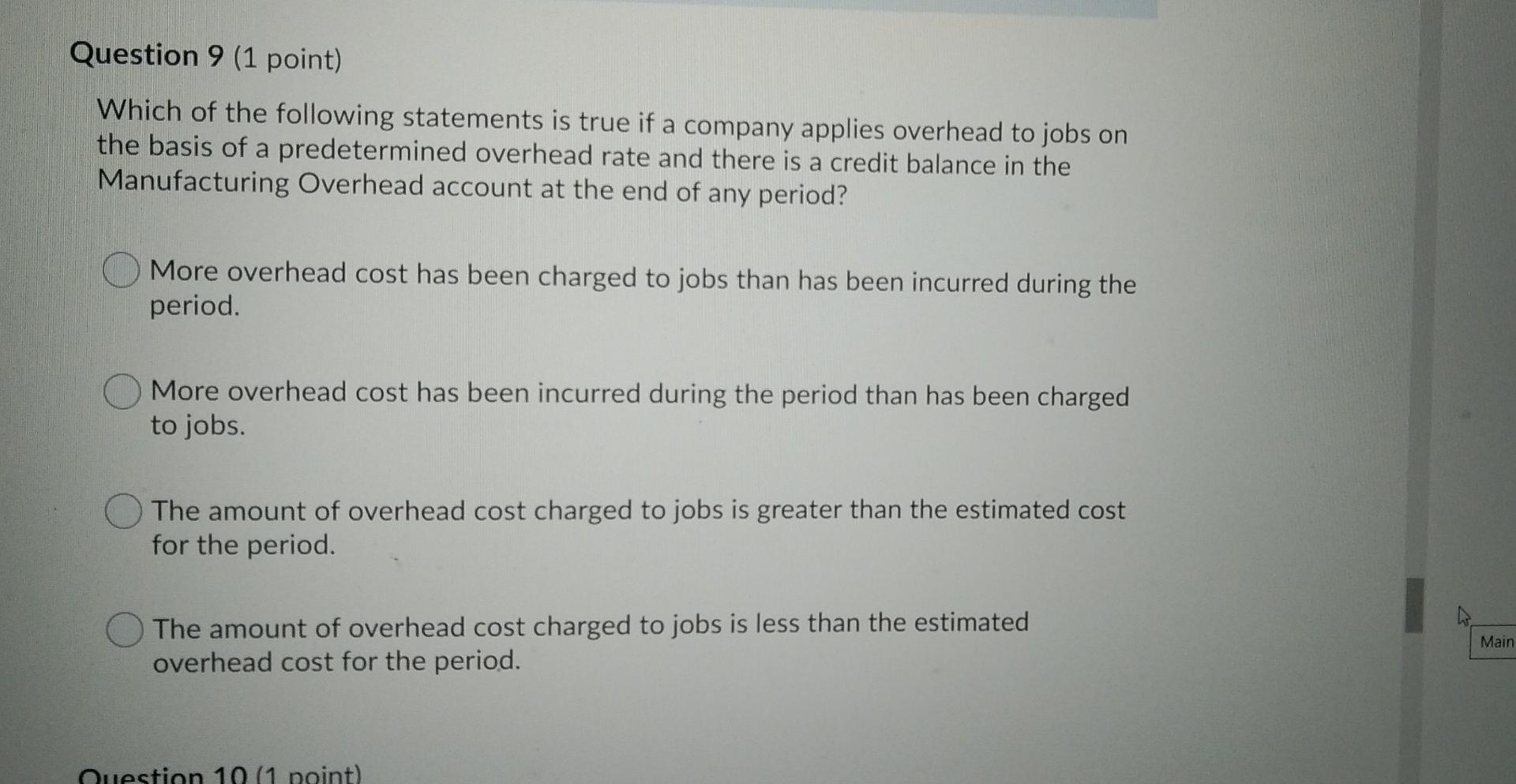

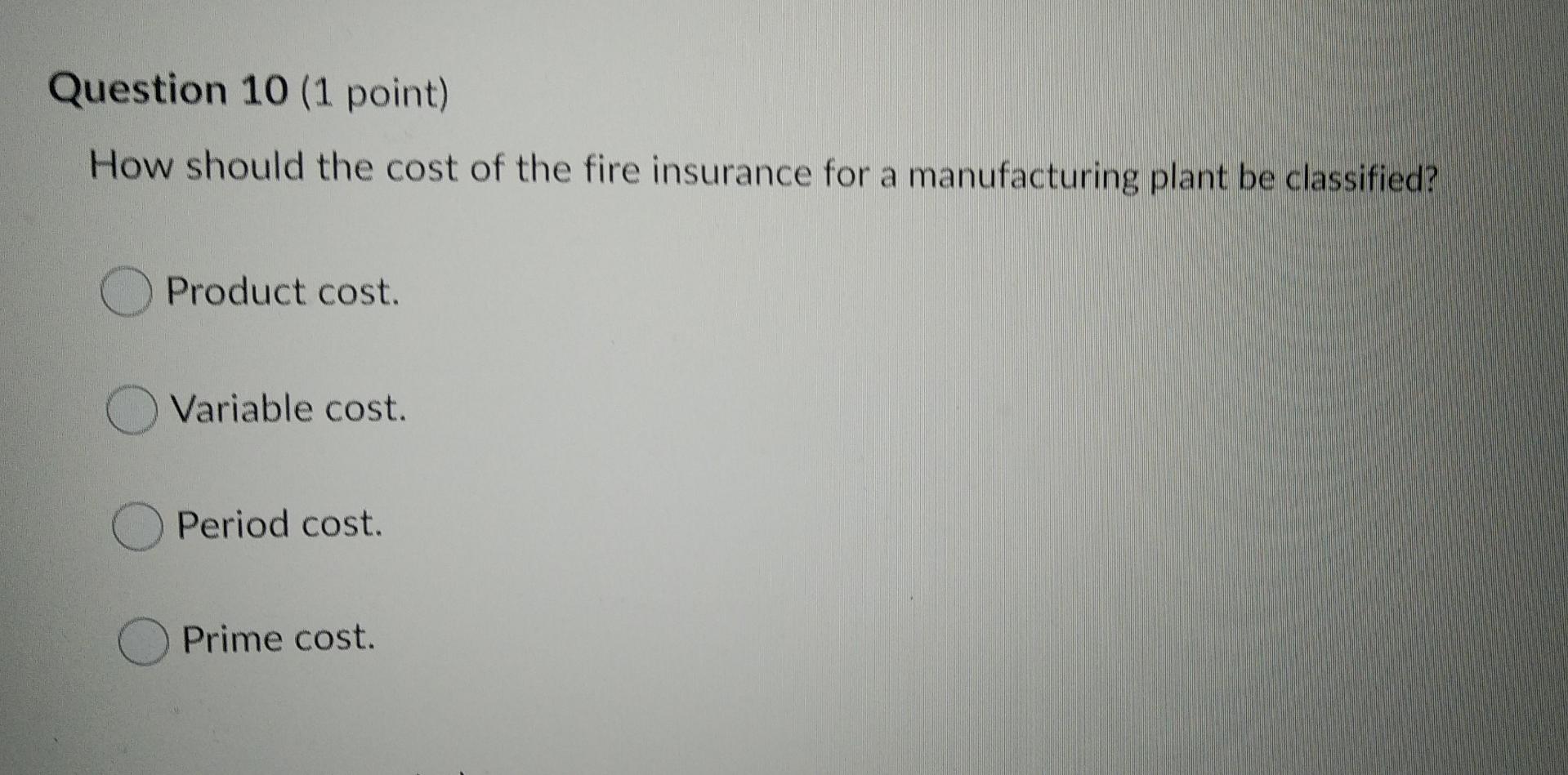

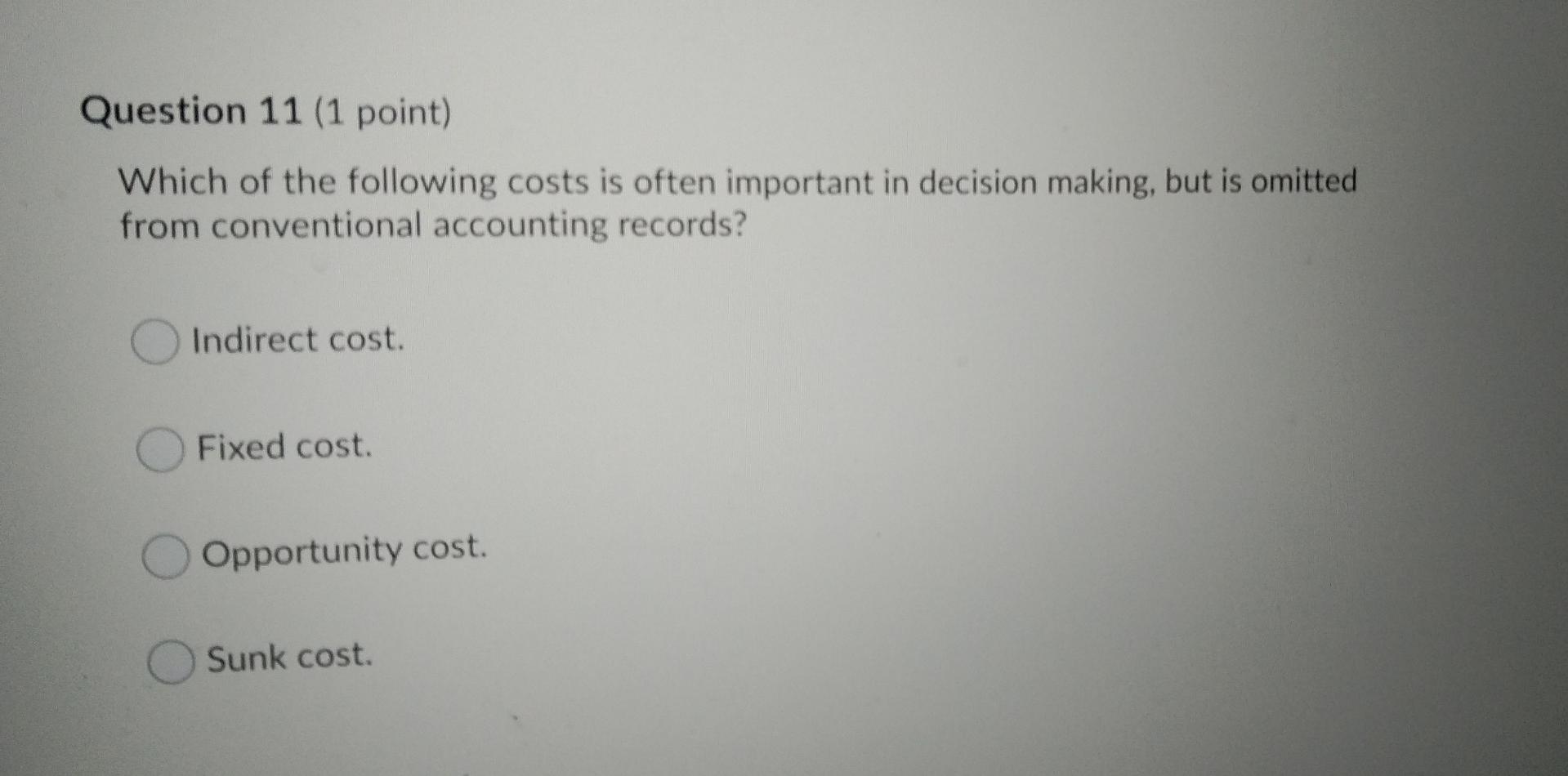

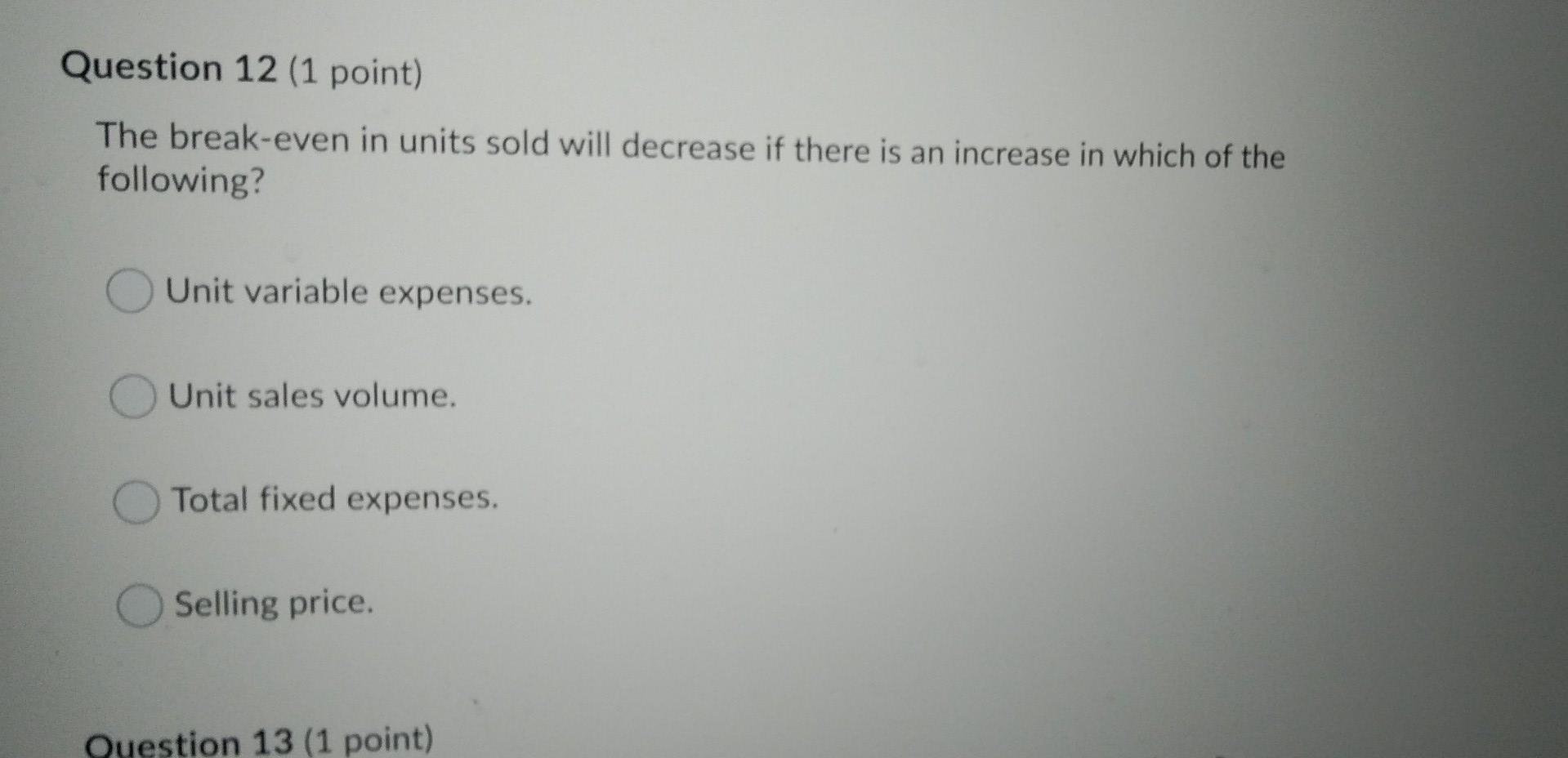

Question 9 (1 point) Which of the following statements is true if a company applies overhead to jobs on the basis of a predetermined overhead rate and there is a credit balance in the Manufacturing Overhead account at the end of any period? More overhead cost has been charged to jobs than has been incurred during the period. More overhead cost has been incurred during the period than has been charged to jobs. The amount of overhead cost charged to jobs is greater than the estimated cost for the period. The amount of overhead cost charged to jobs is less than the estimated overhead cost for the period. Main Question 10 (1 point) Question 10 (1 point) How should the cost of the fire insurance for a manufacturing plant be classified? a Product cost. Variable cost. Period cost. Prime cost. Question 11 (1 point) Which of the following costs is often important in decision making, but is omitted from conventional accounting records? Indirect cost. Fixed cost. Opportunity cost. Sunk cost. Question 12 (1 point) The break-even in units sold will decrease if there is an increase in which of the following? Unit variable expenses. Unit sales volume. Total fixed expenses. Selling price. Question 13 (1 point) Question 13 (1 point) Within the relevant range of activity, how will variable cost per unit behave? It will remain constant. Its behaviour cannot be determined without additional information. It will vary inversely with the level of activity. It will increase in proportion with the level of activity. Saved Question 14 (1 point) highted average method) for a department are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started