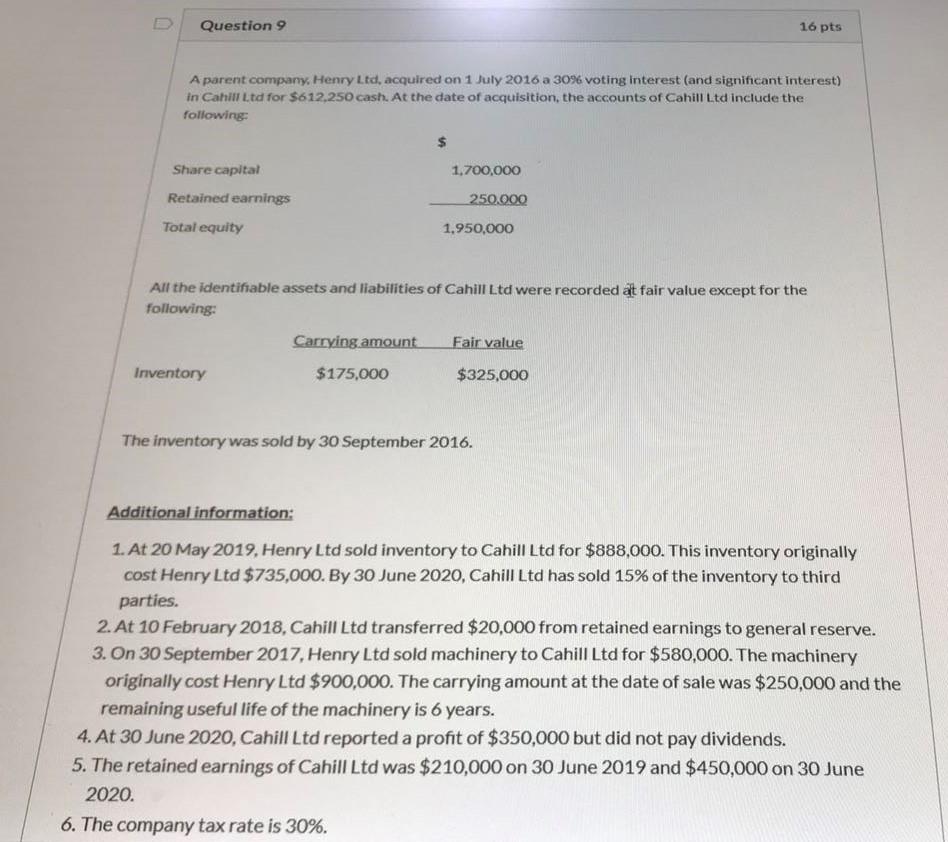

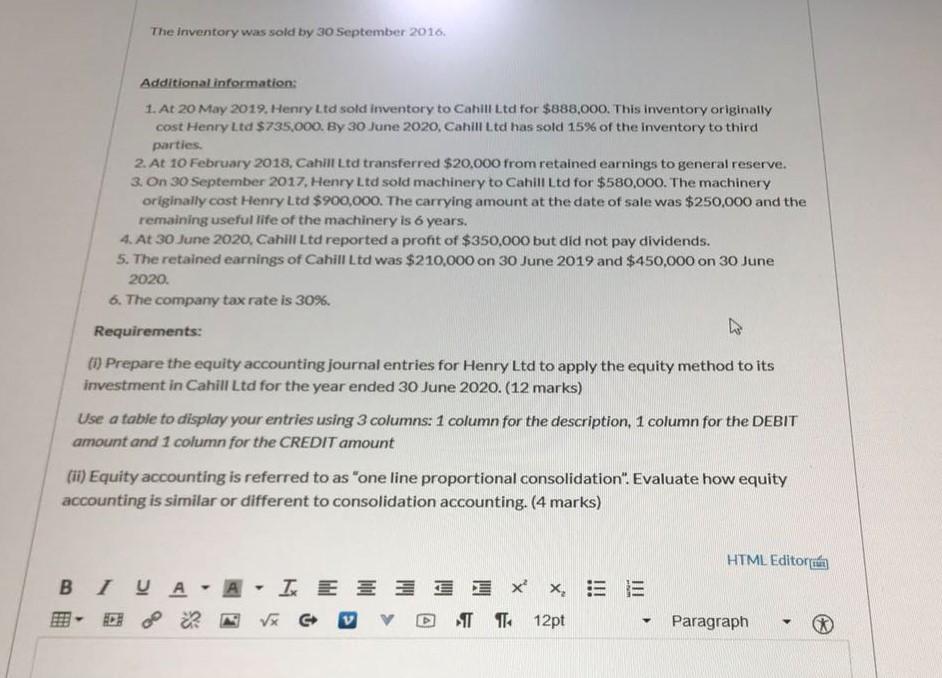

Question 9 16 pts A parent company, Henry Ltd, acquired on 1 July 2016 a 30% voting interest (and significant interest) in Cahill Ltd for $612,250 cash. At the date of acquisition, the accounts of Cahill Ltd include the following: $ 1,700,000 Share capital Retained earnings 250.000 Total equity 1,950,000 All the identifiable assets and liabilities of Cahill Ltd were recorded at fair value except for the following: Carrying amount Fair value Inventory $175,000 $325,000 The inventory was sold by 30 September 2016. Additional information: 1. At 20 May 2019, Henry Ltd sold inventory to Cahill Ltd for $888,000. This inventory originally cost Henry Ltd $735,000. By 30 June 2020, Cahill Ltd has sold 15% of the inventory to third parties. 2. At 10 February 2018, Cahill Ltd transferred $20,000 from retained earnings to general reserve. 3. On 30 September 2017, Henry Ltd sold machinery to Cahill Ltd for $580,000. The machinery originally cost Henry Ltd $900,000. The carrying amount at the date of sale was $250,000 and the remaining useful life of the machinery is 6 years. 4. At 30 June 2020, Cahill Ltd reported a profit of $350,000 but did not pay dividends. 5. The retained earnings of Cahill Ltd was $210,000 on 30 June 2019 and $450,000 on 30 June 2020. 6. The company tax rate is 30%. The inventory was sold by 30 September 2016 Additional information: 1. At 20 May 2019. Henry Ltd sold inventory to Cahill Ltd for $888,000. This inventory originally cost Henry Ltd $735,000. By 30 June 2020, Cahill Ltd has sold 15% of the inventory to third parties, 2. At 10 February 2018. Cahill Ltd transferred $20,000 from retained earnings to general reserve. 3. On 30 September 2017. Henry Ltd sold machinery to Cahill Ltd for $580,000. The machinery originally cost Henry Ltd $900,000. The carrying amount at the date of sale was $250,000 and the remaining useful life of the machinery is 6 years. 4. At 30 June 2020, Cahill Ltd reported a pront of $350,000 but did not pay dividends. 5. The retained earnings of Cahill Ltd was $210,000 on 30 June 2019 and $450,000 on 30 June 2020 6. The company tax rate is 30%. Requirements: (0) Prepare the equity accounting journal entries for Henry Ltd to apply the equity method to its investment in Cahill Ltd for the year ended 30 June 2020. (12 marks) Use a table to display your entries using 3 columns: 1 column for the description, 1 column for the DEBIT amount and 1 column for the CREDIT amount (ii) Equity accounting is referred to as "one line proportional consolidation". Evaluate how equity accounting is similar or different to consolidation accounting. (4 marks) HTML Editor BI y A-A I E 351 3XX, E TT12pt Paragraph Question 9 16 pts A parent company, Henry Ltd, acquired on 1 July 2016 a 30% voting interest (and significant interest) in Cahill Ltd for $612,250 cash. At the date of acquisition, the accounts of Cahill Ltd include the following: $ 1,700,000 Share capital Retained earnings 250.000 Total equity 1,950,000 All the identifiable assets and liabilities of Cahill Ltd were recorded at fair value except for the following: Carrying amount Fair value Inventory $175,000 $325,000 The inventory was sold by 30 September 2016. Additional information: 1. At 20 May 2019, Henry Ltd sold inventory to Cahill Ltd for $888,000. This inventory originally cost Henry Ltd $735,000. By 30 June 2020, Cahill Ltd has sold 15% of the inventory to third parties. 2. At 10 February 2018, Cahill Ltd transferred $20,000 from retained earnings to general reserve. 3. On 30 September 2017, Henry Ltd sold machinery to Cahill Ltd for $580,000. The machinery originally cost Henry Ltd $900,000. The carrying amount at the date of sale was $250,000 and the remaining useful life of the machinery is 6 years. 4. At 30 June 2020, Cahill Ltd reported a profit of $350,000 but did not pay dividends. 5. The retained earnings of Cahill Ltd was $210,000 on 30 June 2019 and $450,000 on 30 June 2020. 6. The company tax rate is 30%. The inventory was sold by 30 September 2016 Additional information: 1. At 20 May 2019. Henry Ltd sold inventory to Cahill Ltd for $888,000. This inventory originally cost Henry Ltd $735,000. By 30 June 2020, Cahill Ltd has sold 15% of the inventory to third parties, 2. At 10 February 2018. Cahill Ltd transferred $20,000 from retained earnings to general reserve. 3. On 30 September 2017. Henry Ltd sold machinery to Cahill Ltd for $580,000. The machinery originally cost Henry Ltd $900,000. The carrying amount at the date of sale was $250,000 and the remaining useful life of the machinery is 6 years. 4. At 30 June 2020, Cahill Ltd reported a pront of $350,000 but did not pay dividends. 5. The retained earnings of Cahill Ltd was $210,000 on 30 June 2019 and $450,000 on 30 June 2020 6. The company tax rate is 30%. Requirements: (0) Prepare the equity accounting journal entries for Henry Ltd to apply the equity method to its investment in Cahill Ltd for the year ended 30 June 2020. (12 marks) Use a table to display your entries using 3 columns: 1 column for the description, 1 column for the DEBIT amount and 1 column for the CREDIT amount (ii) Equity accounting is referred to as "one line proportional consolidation". Evaluate how equity accounting is similar or different to consolidation accounting. (4 marks) HTML Editor BI y A-A I E 351 3XX, E TT12pt Paragraph