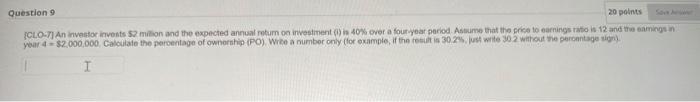

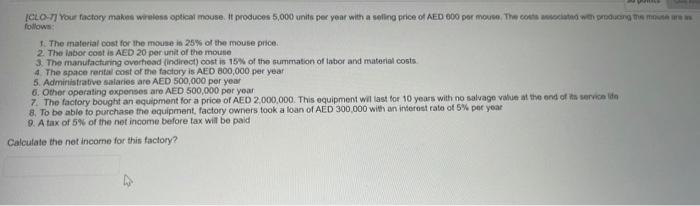

Question 9 20 points CLO-71 An investor invests $2 million and the expected annual return on investment is 40% over a four year period. Assume that the price to carings is 12 and the samings in year 4 $2,000,000. Calculate the percentage of ownership (PO) Write a number only (for example, if the results 30.2%, just write 302 without peronnages I CLO-7 Your factory make wrote optical mouse. It produces 5,000 units per year with a selling price of AED 800 per mono. The ecurs came with mong mama wa follows 1. The material cost for the mouse in 25% of the mouse price 2 The labor cost is AED 20 per unit of the mouse 3 The manufacturing overhead (Indirect cost in 16% of the summation of labor and material costs 4. The space rental cost of the factory is AED 100,000 per year 5. Administrative salaries are AED 500,000 per year 6. Other operating expenses are AED 500,000 per year 7. The factory bought an equipment for a price of AED 2,000,000. This equipment wil last for 10 years with no salvage value at the end of its service de 8. To be able to purchase the equipment, factory owners took a loan of AED 300,000 with an interest rate of 5% per year 9. A tax of 5% of the net income before tax will be paid Calculate the net income for this factory? Question 9 20 points CLO-71 An investor invests $2 million and the expected annual return on investment is 40% over a four year period. Assume that the price to carings is 12 and the samings in year 4 $2,000,000. Calculate the percentage of ownership (PO) Write a number only (for example, if the results 30.2%, just write 302 without peronnages I CLO-7 Your factory make wrote optical mouse. It produces 5,000 units per year with a selling price of AED 800 per mono. The ecurs came with mong mama wa follows 1. The material cost for the mouse in 25% of the mouse price 2 The labor cost is AED 20 per unit of the mouse 3 The manufacturing overhead (Indirect cost in 16% of the summation of labor and material costs 4. The space rental cost of the factory is AED 100,000 per year 5. Administrative salaries are AED 500,000 per year 6. Other operating expenses are AED 500,000 per year 7. The factory bought an equipment for a price of AED 2,000,000. This equipment wil last for 10 years with no salvage value at the end of its service de 8. To be able to purchase the equipment, factory owners took a loan of AED 300,000 with an interest rate of 5% per year 9. A tax of 5% of the net income before tax will be paid Calculate the net income for this factory