Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 1, Diggton Company used the process costing system. It had a work-in- process inventory of 10,400 units. The units were 80% complete

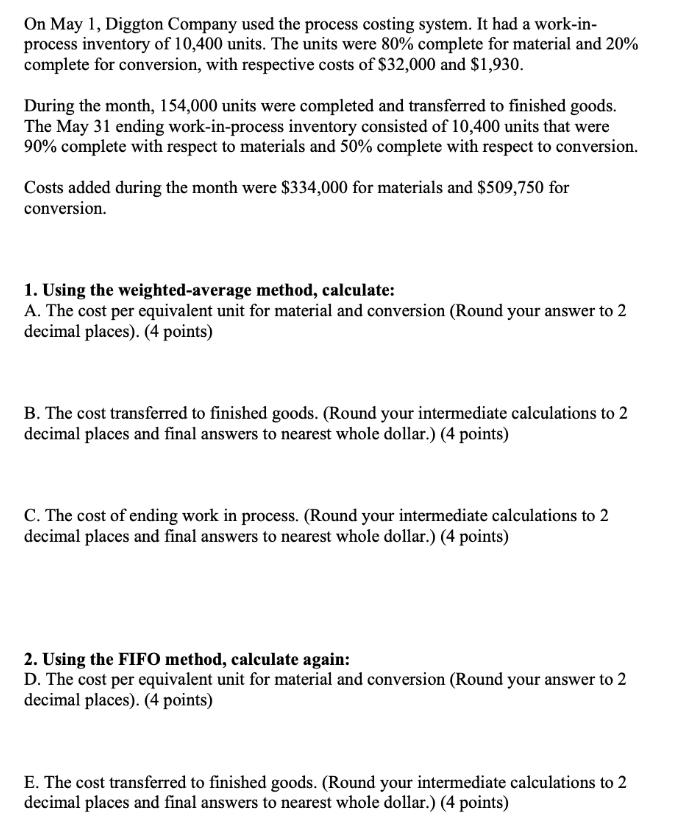

On May 1, Diggton Company used the process costing system. It had a work-in- process inventory of 10,400 units. The units were 80% complete for material and 20% complete for conversion, with respective costs of $32,000 and $1,930. During the month, 154,000 units were completed and transferred to finished goods. The May 31 ending work-in-process inventory consisted of 10,400 units that were 90% complete with respect to materials and 50% complete with respect to conversion. Costs added during the month were $334,000 for materials and $509,750 for conversion. 1. Using the weighted-average method, calculate: A. The cost per equivalent unit for material and conversion (Round your answer to 2 decimal places). (4 points) B. The cost transferred to finished goods. (Round your intermediate calculations to 2 decimal places and final answers to nearest whole dollar.) (4 points) C. The cost of ending work in process. (Round your intermediate calculations to 2 decimal places and final answers to nearest whole dollar.) (4 points) 2. Using the FIFO method, calculate again: D. The cost per equivalent unit for material and conversion (Round your answer to 2 decimal places). (4 points) E. The cost transferred to finished goods. (Round your intermediate calculations to 2 decimal places and final answers to nearest whole dollar.) (4 points)

Step by Step Solution

★★★★★

3.42 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

A Cost per equivalent unit for materials Cost of beginning work in process Cost of materials added during the period Total equivalent units for materi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started