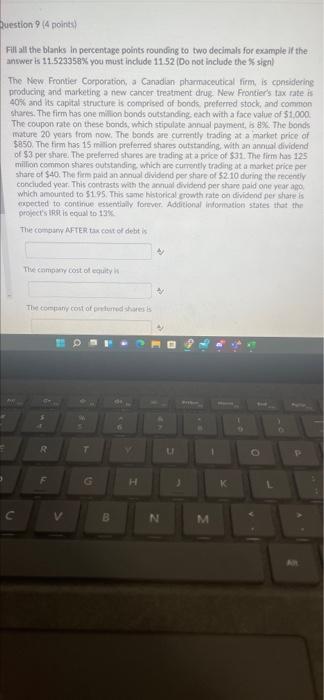

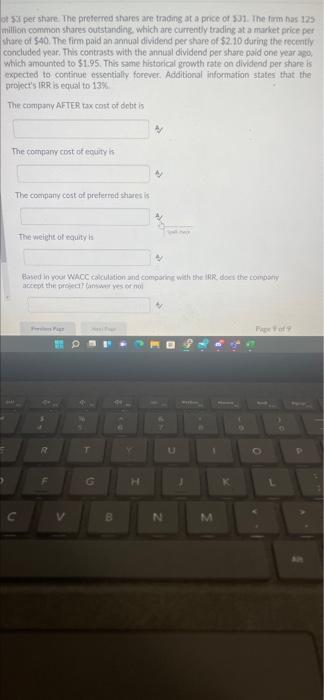

Question 9 (4 points Fill all the blanks in percentage points rounding to two decimals for example if the answer is 11.523358% you must include 11.52 (Do not include the sign The New Frontier Corporation, a Canadian pharmaceutical firm, is considering producing and marketing a new cancer treatment drug New Frontier's tax rate is 40% and its capital structure is comprised of bonds preferred stack, and common shares. The firm has one million bonds outstanding each with a face value of $1.000 The coupon rate on these bonds, which stipulate annual payment, 68%. The bonds mature 20 years from now. The bonds are currently trading at a market price of $850. The firm has 15 milion preferred shares outstanding, with an annual dividend of $3 per share. The preferred shares are trading at a price of $31. The firm has 125 million common shares outstanding which are currently trading at a market price per share of $40. The firm paid an annual dividend per share of 52.10 during the recently concluded year. This contrasts with the annual dividend per share paid one year which amounted to 51.95. This same historical crowth rate on dividend per shares pected to continue essentially forever. Additional information states that the project's RSL is equal to 136 The com AFTER X Conte debitis The company cost of equity The company cost of our shares ED T LI 3 G H . L V . N . o si per share. The preferred shares are trading at a price of 531. The firm has 125 million common shares outstanding, which are currently trading at a market price per share of $40. The firm paid an annual dividend per share of $2.10 during the recently concluded year. This contrasts with the annual dividend per share paid one year ago which amounted to 51.95. This same historical growth rate on dividend per share is expected to continue essentially forever. Additional information states that the project's IRR is equal to 13% The company AFTER tax cost of debt is The company cost of equity is The company cost of preferred shares is The weight of equity is Based in your WACC calculation and comparing with the IRR does the com accot the case yes or not PAD R T 5 F G K V B N