Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 9 7. An investor owns an equity portfolio worth 20 million and decides to hedge the value of her position with stock index futures

question 9

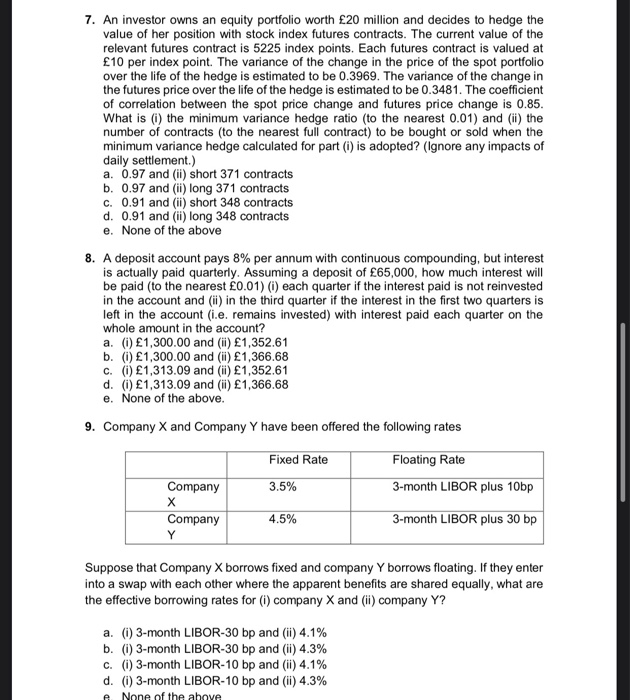

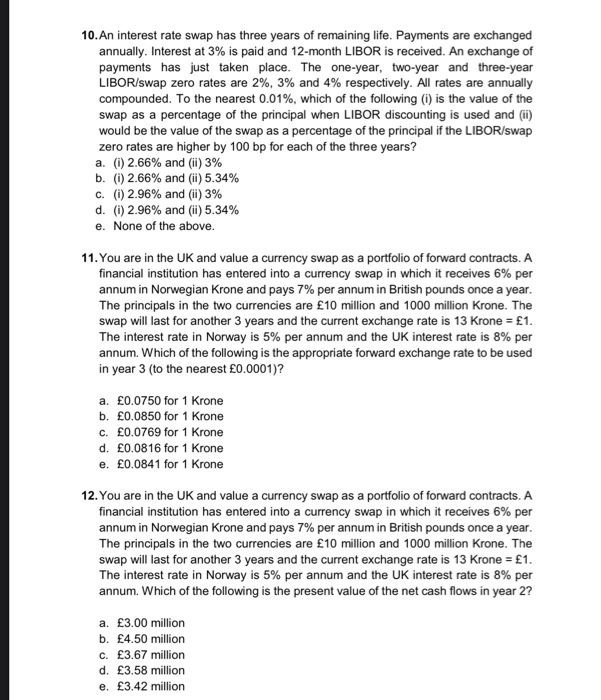

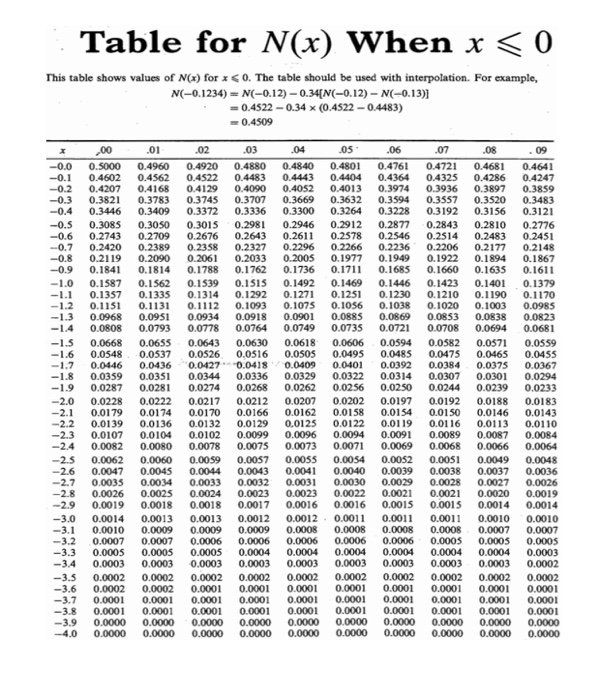

7. An investor owns an equity portfolio worth 20 million and decides to hedge the value of her position with stock index futures contracts. The current value of the relevant futures contract is 5225 index points. Each futures contract is valued at 10 per index point. The variance of the change in the price of the spot portfolio over the life of the hedge is estimated to be 0.3969. The variance of the change in the futures price over the life of the hedge is estimated to be 0.3481. The coefficient of correlation between the spot price change and futures price change is 0.85. What is (i) the minimum variance hedge ratio (to the nearest 0.01) and (ii) the number of contracts (to the nearest full contract) to be bought or sold when the minimum variance hedge calculated for part() is adopted? (Ignore any impacts of daily settlement.) a. 0.97 and (ii) short 371 contracts b. 0.97 and (ii) long 371 contracts C. 0.91 and (ii) short 348 contracts d. 0.91 and (ii) long 348 contracts e. None of the above 8. A deposit account pays 8% per annum with continuous compounding, but interest is actually paid quarterly. Assuming a deposit of 65,000, how much interest will be paid to the nearest 0.01) (i) each quarter if the interest paid is not reinvested in the account and (ii) in the third quarter if the interest in the first two quarters is left in the account (i.e. remains invested) with interest paid each quarter on the whole amount in the account? a. (0) 1,300.00 and (ii) 1,352.61 b. (0) 1,300.00 and (i) 1,366.68 c.) 1,313.09 and (i) 1,352.61 d. () 1,313.09 and (ii) 1,366.68 e. None of the above. 9. Company X and Company Y have been offered the following rates Fixed Rate Floating Rate 3-month LIBOR plus 10bp 3.5% Company X Company Y 4.5% 3-month LIBOR plus 30 bp Suppose that Company Xborrows fixed and company Y borrows floating. If they enter into a swap with each other where the apparent benefits are shared equally, what are the effective borrowing rates for (i) company X and (ii) company Y? a. (0) 3-month LIBOR-30 bp and (ii) 4.1% b. (i) 3-month LIBOR-30 bp and (ii) 4.3% C. (i) 3-month LIBOR-10 bp and (ii) 4.1% d. (i) 3-month LIBOR-10 bp and (ii) 4.3% a None of the above 10. An interest rate swap has three years of remaining life. Payments are exchanged annually. Interest at 3% is paid and 12-month LIBOR is received. An exchange of payments has just taken place. The one-year, two-year and three-year LIBOR/swap zero rates are 2%, 3% and 4% respectively. All rates are annually compounded. To the nearest 0.01%, which of the following (1) is the value of the swap as a percentage of the principal when LIBOR discounting is used and (ii) would be the value of the swap as a percentage of the principal if the LIBOR/swap zero rates are higher by 100 bp for each of the three years? a. () 2.66% and (ii) 3% b. (0) 2.66% and (ii) 5.34% c. (i) 2.96% and () 3% d. (i) 2.96% and (ii) 5.34% e. None of the above. 11. You are in the UK and value a currency swap as a portfolio of forward contracts. A financial institution has entered into a currency swap in which it receives 6% per annum in Norwegian Krone and pays 7% per annum in British pounds once a year. The principals in the two currencies are 10 million and 1000 million krone. The swap will last for another 3 years and the current exchange rate is 13 Krone = 1. The interest rate in Norway is 5% per annum and the UK interest rate is 8% per annum. Which of the following is the appropriate forward exchange rate to be used in year 3 (to the nearest 0.0001)? a. 0.0750 for 1 Krone b. 0.0850 for 1 Krone c. 0.0769 for 1 Krone d. 0.0816 for 1 Krone e. 0.0841 for 1 Krone 12. You are in the UK and value a currency swap as a portfolio of forward contracts. A financial institution has entered into a currency swap in which it receives 6% per annum in Norwegian Krone and pays 7% per annum in British pounds once a year. The principals in the two currencies are 10 million and 1000 million krone. The swap will last for another 3 years and the current exchange rate is 13 Krone = 1. The interest rate in Norway is 5% per annum and the UK interest rate is 8% per annum. Which of the following is the present value of the net cash flows in year 2? a. 3.00 million b. 4.50 million C. 3.67 million d. 3.58 million e. 3.42 million Table for N(x) When x 0 This table shows values of N(x) for x > 0. The table should be used with interpolation. For example, N(0.6278) = N(0.62) +0.78[N(0.63) - N(0.62)] -0.7324 +0.78 x (0.7357 -0.7324) =0.7350 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 3.9 4.0 .00 0.5000 0.5398 0.5793 0.6179 0.6554 0.6915 0.7257 0.7580 0.7881 0.8159 0.8413 0.8643 0.8849 0.9032 0.9192 0.9332 0.9452 0.9554 0.9641 0.9713 0.9772 0.9821 0.9861 0.9893 0.9918 0.9938 0.9953 0.9965 0.9974 0.9981 0.9986 0.9990 0.9993 0.9995 0.9997 0.9998 0.9998 0.9999 0.9999 1.0000 1.0000 .01 0.5040 0.5438 0.5832 0.6217 0.6591 0.6950 0.7291 0.7611 0.7910 0.8186 0.8438 0.8665 0.8869 0.9049 0.9207 0.9345 0.9463 0.9564 0.9649 0.9719 0.9778 0.9826 0.9864 0.9896 0.9920 0.9940 0.9955 0.9966 0.9975 0.9982 0.9987 0.9991 0.9993 0.9995 0.9997 0.9998 0.9998 0.9999 0.9999 1.0000 1.0000 .02 0.5080 0.5478 0.5871 0.6255 0.6628 0.6985 0.7324 0.7642 0.7939 0.8212 0.8461 0.8686 0.8888 0.9066 0.9222 0.9357 0.9474 0.9573 0.9656 0.9726 0.9783 0.9830 0.9868 0.9898 0.9922 0.9941 0.9956 0.9967 0.9976 0.9982 0.9987 0.9991 0.9994 0.9995 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .03 0.5120 0.5517 0.5910 0.6293 0.6664 0.7019 0.7357 0.7673 0.7967 0.8238 0.8485 0.8708 0.8907 0.9082 0.9236 0.9370 0.9484 0.9582 0.9664 0.9732 0.9788 0.9834 0.9871 0.9901 0.9925 0.9943 0.9957 0.9968 0.9977 0.9983 0.9988 0.9991 0.9994 0.9996 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .04 0.5160 0.5557 0.5948 0.6331 0.6700 0.7054 0.7389 0.7704 0.7995 0.8264 0.8508 0.8729 0.8925 0.9099 0.9251 0.9382 0.9495 0.9591 0.9671 0.9738 0.9793 0.9838 0.9875 0.9904 0.9927 0.9945 0.9959 0.9969 0.9977 0.9984 0.9988 0.9992 0.9994 0.9996 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .05 0.5199 0.5596 0.5987 0.6368 0.6736 0.7088 0.7422 0.7734 0.8023 0.8289 0.8531 0.8749 0.8944 0.9115 0.9265 0.9394 0.9505 0.9599 0.9678 0.9744 0.9798 0.9842 0.9878 0.9906 0.9929 0.9946 0.9960 0.9970 0.9978 0.9984 0.9989 0.9992 0.9994 0.9996 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .06 0.5239 0.5636 0.6026 0.6406 0.6772 0.7123 0.7454 0.7764 0.8051 0.8315 0.8554 0.8770 0.8962 0.9131 0.9279 0.9406 0.9515 0.9608 0.9686 0.9750 0.9803 0.9846 0.9881 0.9909 0.9931 0.9948 0.9961 0.9971 0.9979 0.9985 0.9989 0.9992 0.9994 0.9996 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .07 0.5279 0.5675 0.6064 0.6443 0.6808 0.7157 0.7486 0.7794 0.8078 0.8340 0.8577 0.8790 0.8980 0.9147 0.9292 0.9418 0.9525 0.9616 0.9693 0.9756 0.9808 0.9850 0.9884 0.9911 0.9932 0.9949 0.9962 0.9972 0.9979 0.9985 0.9989 0.9992 0.9995 0.9996 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .OR 0.5319 0.5714 0.6103 0.6480 0.6844 0.7190 0.7517 0.7823 0.8106 0.8365 0.8599 0.8810 0.8997 0.9162 0.9306 0.9429 0.9535 0.9625 0.9699 0.9761 0.9812 0.9854 0.9887 0.9913 0.9934 0.9951 0.9963 0.9973 0.9980 0.9986 0.9990 0.9993 0.9995 0.9996 0.9997 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 .09 0.5359 0.5753 0.6141 0.6517 0.6879 0.7224 0.7549 0.7852 0.8133 0.8389 0.8621 0.8830 0.9015 0.9177 0.9319 0.9441 0.9545 0.9633 0.9706 0.9767 0.9817 0.9857 0.9890 0.9916 0.9936 0.9952 0.9964 0.9974 0.9981 0.9986 0.9990 0.9993 0.9995 0.9997 0.9998 0.9998 0.9999 0.9999 0.9999 1.0000 1.0000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started