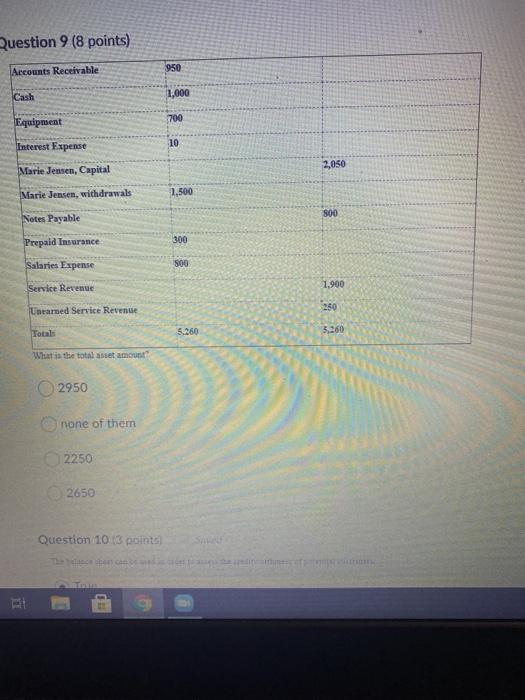

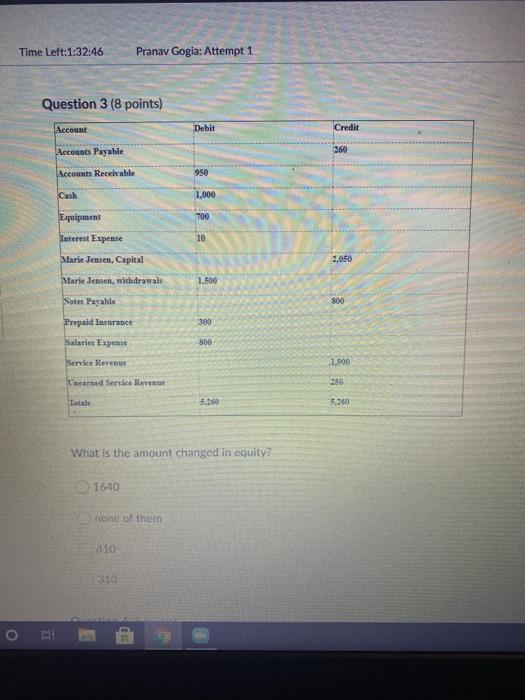

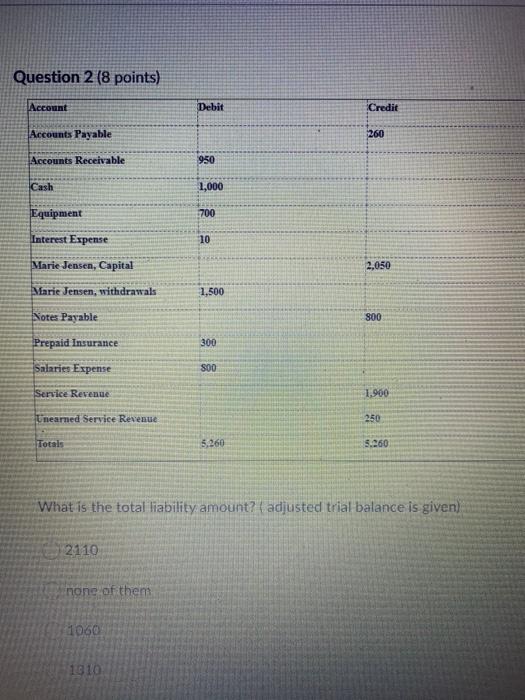

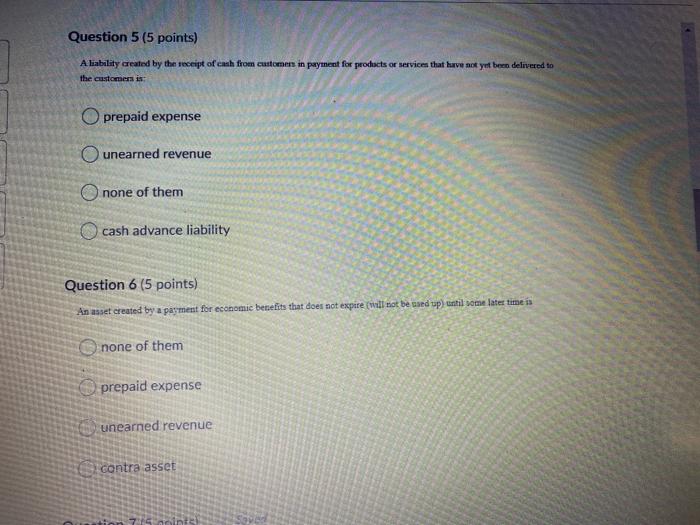

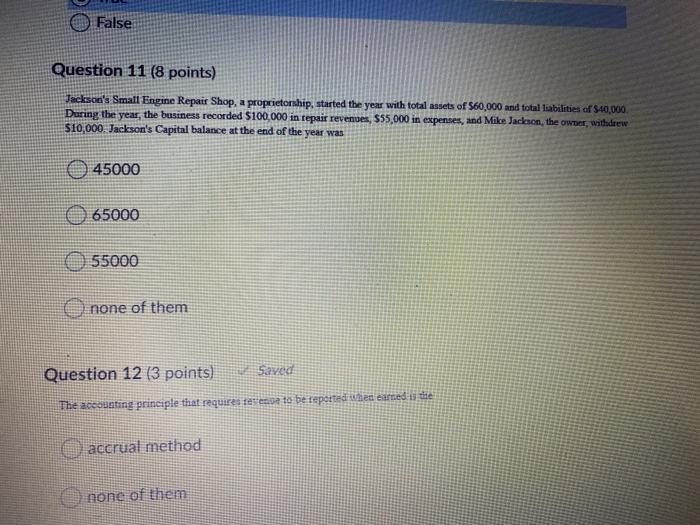

Question 9 (8 points) Accounts Receivable 950 Cash 1,000 700 Equipment 10 Interest Expense 2,050 Marie Jensen, Capital 1.500 Marie Jensen, withdrawals 800 Notes Payable 300 Prepaid Insurance Salaries Expense SOD Service Revenue 1,900 Uneared Service Revenge 250 Totals 5.260 5.260 What is the total asset amount 2950 none of them 2250 2650 Question 10.3 points) Time Left:1:32:46 Pranav Gogia: Attempt 1 Question 3 (8 points) Account Debit Credit Accounts Payable 260 Accounts Receivable 950 Cash 1,000 Equipment 700 Interest Expense 10 Marie Jensen, Capital 2.050 Marie Jensen, withdrawal 1,500 Notes Payable 800 Prepaid Insurance 33 Salaries Expense 1.900 Service Revenge Cearned Serie Revenue 250 Total 5.360 5.250 What is the amount changed in equity? 1640 none of them 10 310 Question 2 (8 points) Account Debit Credit Accounts Payable 260 Accounts Receivable 950 Cash 1,000 Equipment 700 Interest Expense 10 Marie Jensen, Capital 2,050 Marie Jensen, withdrawals 1,500 Notes Payable 800 Prepaid Insurance 300 Salaries Expense 800 Service Revenue 1.900 Unearned Service Revenue 250 Totals 5,260 5.260 What is the total liability amount? ( adjusted trial balance is given) 2110 none of them 1060 1910 Question 5 (5 points) A liability created by the receipt of cash from customers in payment for products or services that have not yet been delivered to the customers is O prepaid expense Ounearned revenue none of them cash advance liability Question 6 (5 points) An asset created by a payment for economic benefits that does not expire will not be used up) until some later time is Onone of them prepaid expense unearned revenue contra asset False Question 11 (8 points) Jackson's Small Engine Repair Shop, a proprietorship, started the year with total assets of $60,000 and total liabilities of $40,000 During the year, the business recorded $100,000 in repair revenues, $55,000 in expenses, and Mike Jackson, the owner, withdrew $10,000. Jackson's Capital balance at the end of the year was 45000 65000 55000 none of them Question 12 (3 points) Saved The accounting principle that requires tes to be teported the earned is the accrual method none of them