Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 9 and 10 Given information for questions 5 to 10: Covivi Supplies is an entity which was formed by the two partners Mutondi and

Question 9 and 10

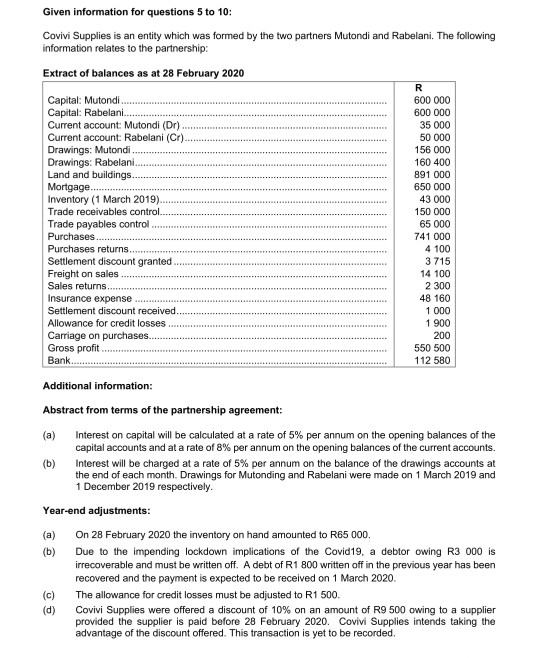

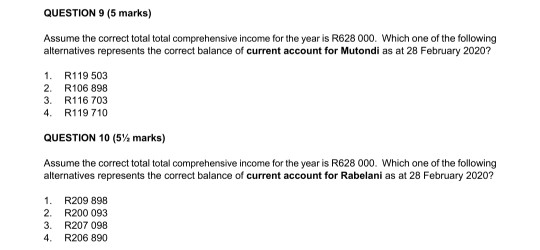

Given information for questions 5 to 10: Covivi Supplies is an entity which was formed by the two partners Mutondi and Rabelani. The following information relates to the partnership: Extract of balances as at 28 February 2020 R Capital: Mutondi 600 000 Capital: Rabelani. 600 000 Current account: Mutondi (Dr) 35 000 Current account: Rabelani (Cr). 50 000 Drawings: Mutondi 156 000 Drawings: Rabelani 160 400 Land and buildings. 891 000 Mortgage... 650 000 Inventory (1 March 2019) 43 000 Trade receivables control 150 000 Trade payables control 65 000 Purchases. 741 000 Purchases returns 4 100 Settlement discount granted 3 715 Freight on sales 14 100 Sales returns 2 300 Insurance expense 48 160 Settlement discount received. 1 000 Allowance for credit losses 1 900 Carriage on purchases. 200 Gross profit 550 500 Bank 112 580 Additional information: Abstract from terms of the partnership agreement: (a) Interest on capital will be calculated at a rate of 5% per annum on the opening balances of the capital accounts and at a rate of 8% per annum on the opening balances of the current accounts. (b) Interest will be charged at a rate of 5% per annum on the balance of the drawings accounts at the end of each month. Drawings for Mutonding and Rabelani were made on 1 March 2019 and 1 December 2019 respectively. Year-end adjustments: (a) On 28 February 2020 the inventory on hand amounted to R65 000. (b) Due to the impending lockdown implications of the Covid19, a debtor owing R3 000 is irrecoverable and must be written off. A debt of R1 800 written off in the previous year has been recovered and the payment is expected to be received on 1 March 2020. (c) The allowance for credit losses must be adjusted to R1 500 (d) Covivi Supplies were offered a discount of 10% on an amount of R9 500 owing to a supplier provided the supplier is paid before 28 February 2020. Covivi Supplies intends taking the advantage of the discount offered. This transaction is yet to be recorded. FAC1601/RFA1601 MAY/JUNE 2020 (e) The terms of the mortgage loan provide for interest on the loan to be calculated at a rate of 9% per annum on the outstanding amount of the loan at the end of the financial year. QUESTION 9 (5 marks) Assume the correct total total comprehensive income for the year is R628 000. Which one of the following alternatives represents the correct balance of current account for Mutondi as at 28 February 2020? 1. R119 503 2. R106 898 3. R116 703 4. R119 710 QUESTION 10 (5% marks) Assume the correct total total comprehensive income for the year is R628 000. Which one of the following alternatives represents the correct balance of current account for Rabelani as at 28 February 2020? 1. R209 898 2. R200 093 3. R207 098 R206 890 4. Given information for questions 5 to 10: Covivi Supplies is an entity which was formed by the two partners Mutondi and Rabelani. The following information relates to the partnership: Extract of balances as at 28 February 2020 R Capital: Mutondi 600 000 Capital: Rabelani. 600 000 Current account: Mutondi (Dr) 35 000 Current account: Rabelani (Cr). 50 000 Drawings: Mutondi 156 000 Drawings: Rabelani 160 400 Land and buildings. 891 000 Mortgage... 650 000 Inventory (1 March 2019) 43 000 Trade receivables control 150 000 Trade payables control 65 000 Purchases. 741 000 Purchases returns 4 100 Settlement discount granted 3 715 Freight on sales 14 100 Sales returns 2 300 Insurance expense 48 160 Settlement discount received. 1 000 Allowance for credit losses 1 900 Carriage on purchases. 200 Gross profit 550 500 Bank 112 580 Additional information: Abstract from terms of the partnership agreement: (a) Interest on capital will be calculated at a rate of 5% per annum on the opening balances of the capital accounts and at a rate of 8% per annum on the opening balances of the current accounts. (b) Interest will be charged at a rate of 5% per annum on the balance of the drawings accounts at the end of each month. Drawings for Mutonding and Rabelani were made on 1 March 2019 and 1 December 2019 respectively. Year-end adjustments: (a) On 28 February 2020 the inventory on hand amounted to R65 000. (b) Due to the impending lockdown implications of the Covid19, a debtor owing R3 000 is irrecoverable and must be written off. A debt of R1 800 written off in the previous year has been recovered and the payment is expected to be received on 1 March 2020. (c) The allowance for credit losses must be adjusted to R1 500 (d) Covivi Supplies were offered a discount of 10% on an amount of R9 500 owing to a supplier provided the supplier is paid before 28 February 2020. Covivi Supplies intends taking the advantage of the discount offered. This transaction is yet to be recorded. FAC1601/RFA1601 MAY/JUNE 2020 (e) The terms of the mortgage loan provide for interest on the loan to be calculated at a rate of 9% per annum on the outstanding amount of the loan at the end of the financial year. QUESTION 9 (5 marks) Assume the correct total total comprehensive income for the year is R628 000. Which one of the following alternatives represents the correct balance of current account for Mutondi as at 28 February 2020? 1. R119 503 2. R106 898 3. R116 703 4. R119 710 QUESTION 10 (5% marks) Assume the correct total total comprehensive income for the year is R628 000. Which one of the following alternatives represents the correct balance of current account for Rabelani as at 28 February 2020? 1. R209 898 2. R200 093 3. R207 098 R206 890 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started