Answered step by step

Verified Expert Solution

Question

1 Approved Answer

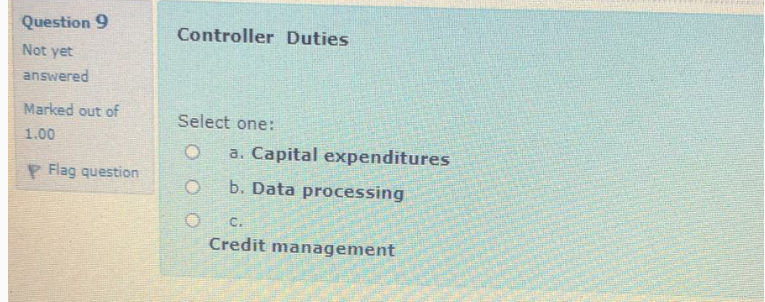

Question 9 Controller Duties Not yet answered Marked out of 1.00 Select one: a. Capital expenditures b. Data processing Flag question C. Credit management Question

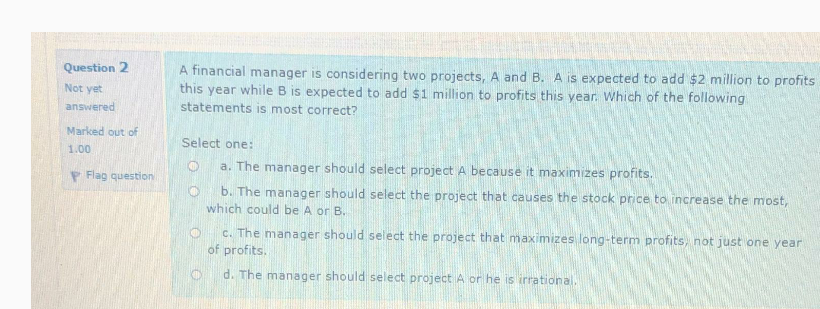

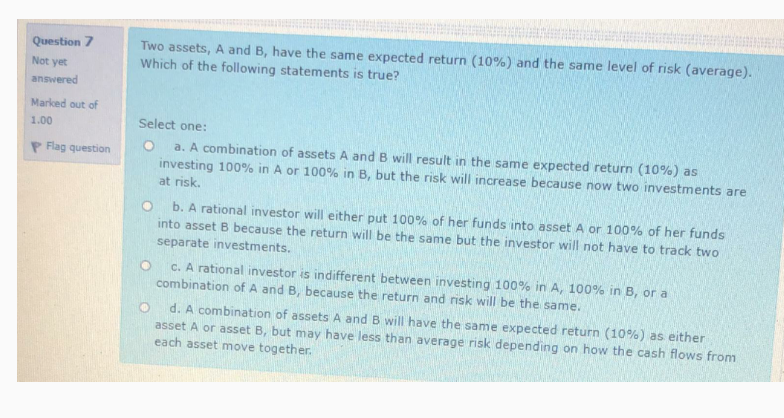

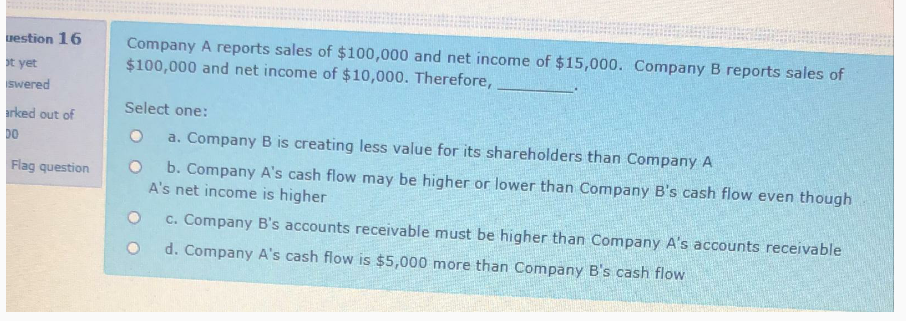

Question 9 Controller Duties Not yet answered Marked out of 1.00 Select one: a. Capital expenditures b. Data processing Flag question C. Credit management Question 2 Not yet A financial manager is considering two projects, A and B. A is expected to add $2 million to profits this year while B is expected to add $1 million to profits this year. Which of the following statements is most correct? answered Marked out of 1.00 P Flag question Select one: a. The manager should select project A because it maximizes profits. b. The manager should select the project that causes the stock price to increase the most which could be A or B. c. The manager should select the project that maximizes long-term profits not just one year of profits. d. The manager should select project A or he is irrational Question 7 Not yet Two assets, A and B, have the same expected return (10%) and the same level of risk (average). Which of the following statements is true? answered Marked out of 1.00 P Flag question Select one: a. A combination of assets A and B will result in the same expected return (10%) as investing 100% in A or 100% in B, but the risk will increase because now two investments are at risk. b. A rational investor will either put 100% of her funds into asset A or 100% her funds into asset B because the return will be the same but the investor will not have to track two separate investments. c. A rational investor is indifferent between investing 100% in A, 100% in B, or a combination of A and B, because the return and risk will be the same. d. A combination of assets A and B will have the same expected return (10%) as either asset A or asset B, but may have less than average risk depending on how the cash flows from each asset move together uestion 16 Company A reports sales of $100,000 and net income of $15,000. Company B reports sales of $100,000 and net income of $10,000. Therefore, st yet swered arked out of DO Flag question Select one: a. Company B is creating less value for its shareholders than Company A O b. Company A's cash flow may be higher or lower than Company B's cash flow even though A's net income is higher C. Company B's accounts receivable must be higher than Company A's accounts receivable d. Company A's cash flow is $5,000 more than Company B's cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started