Answered step by step

Verified Expert Solution

Question

1 Approved Answer

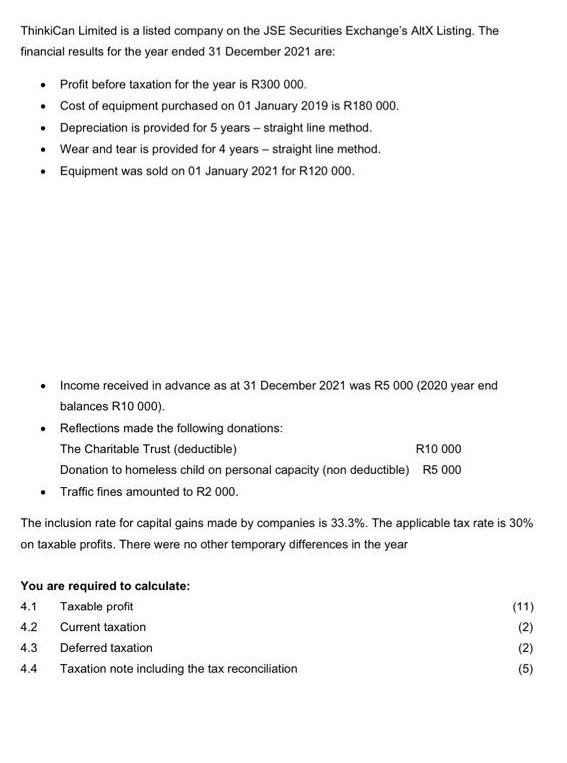

ThinkiCan Limited is a listed company on the JSE Securities Exchange's AltX Listing. The financial results for the year ended 31 December 2021 are:

ThinkiCan Limited is a listed company on the JSE Securities Exchange's AltX Listing. The financial results for the year ended 31 December 2021 are: Profit before taxation for the year is R300 000. Cost of equipment purchased on 01 January 2019 is R180 000. Depreciation is provided for 5 years - straight line method. Wear and tear is provided for 4 years - straight line method. Equipment was sold on 01 January 2021 for R120 000. . Income received in advance as at 31 December 2021 was R5 000 (2020 year end balances R10 000). Reflections made the following donations: The Charitable Trust (deductible) R10 000 Donation to homeless child on personal capacity (non deductible) R5 000 Traffic fines amounted to R2 000. The inclusion rate for capital gains made by companies is 33.3%. The applicable tax rate is 30% on taxable profits. There were no other temporary differences in the year You are required to calculate: 4.1 Taxable profit 4.2 Current taxation 4.3 Deferred taxation 4.4 Taxation note including the tax reconciliation (11) (2) (5)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Profit before tax 300000 Profit on sale of asset 12000 Total Gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started