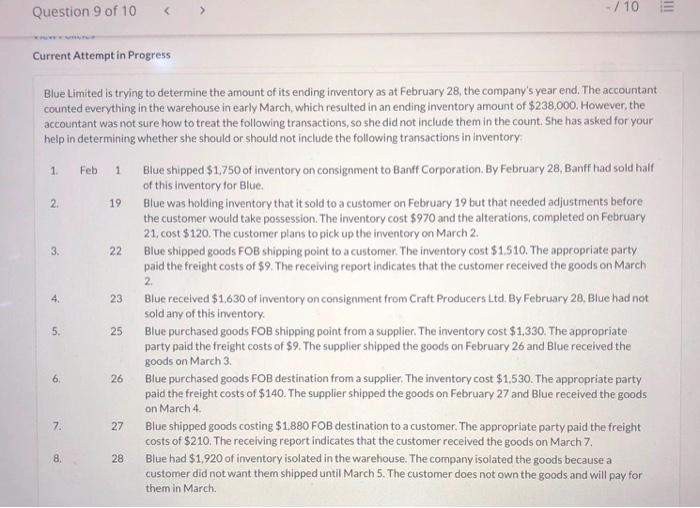

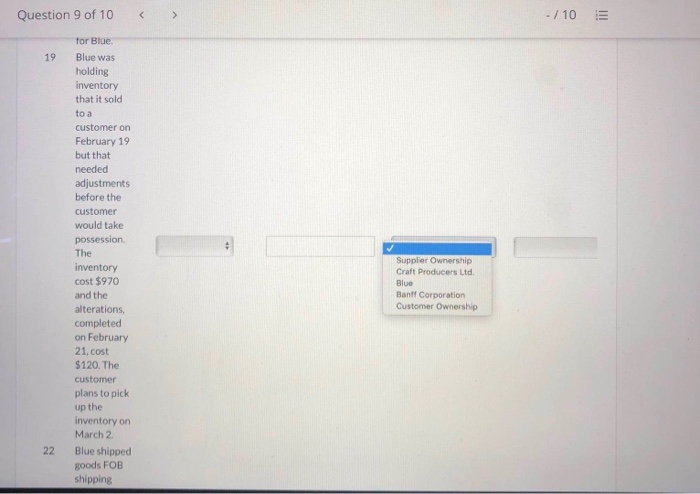

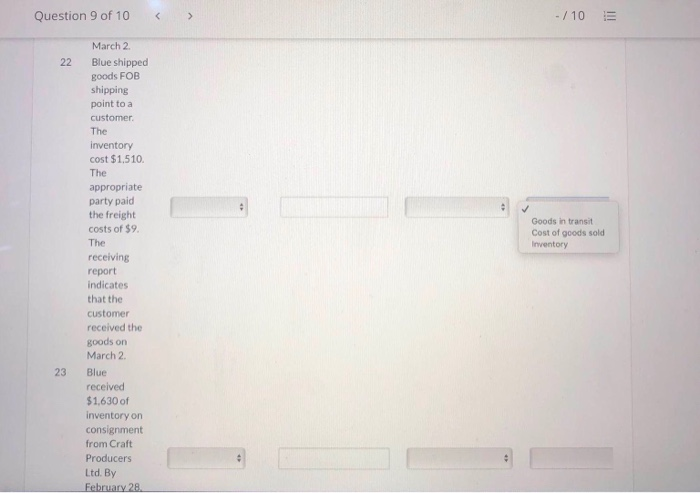

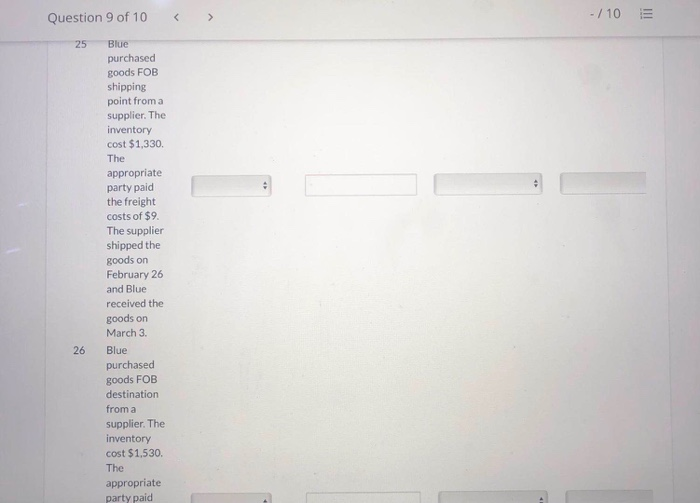

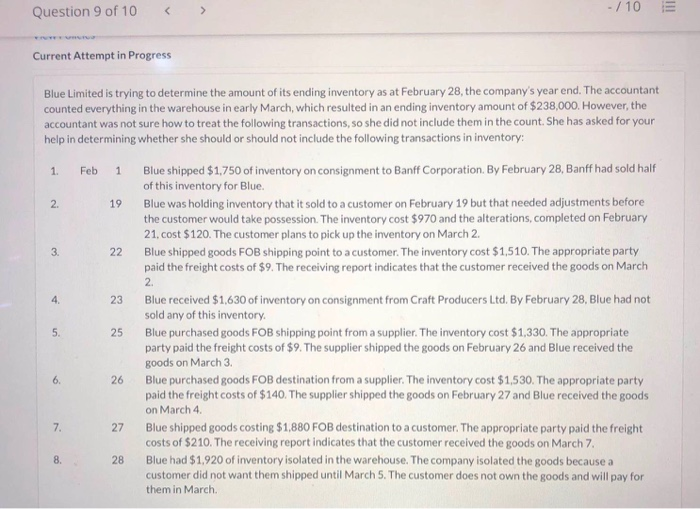

Question 9 of 10 - / 10 ili Current Attempt in Progress 1. Feb 1 2. 3. Blue Limited is trying to determine the amount of its ending inventory as at February 28, the company's year end. The accountant counted everything in the warehouse in early March, which resulted in an ending inventory amount of $238,000. However, the accountant was not sure how to treat the following transactions, so she did not include them in the count. She has asked for your help in determining whether she should or should not include the following transactions in inventory: Blue shipped $1,750 of inventory on consignment to Banff Corporation. By February 28, Banff had sold half of this inventory for Blue. 19 Blue was holding inventory that it sold to a customer on February 19 but that needed adjustments before the customer would take possession. The inventory cost $970 and the alterations, completed on February 21, cost $120. The customer plans to pick up the inventory on March 2. 22 Blue shipped goods FOB shipping point to a customer. The inventory cost $1,510. The appropriate party paid the freight costs of $9. The receiving report indicates that the customer received the goods on March 2. Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28, Blue had not sold any of this inventory Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330. The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. Blue purchased goods FOB destination from a supplier. The inventory cost $1,530. The appropriate party paid the freight costs of $140. The supplier shipped the goods on February 27 and Blue received the goods on March 4. 27 Blue shipped goods costing $1,880 FOB destination to a customer. The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7. Blue had $1,920 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until March 5. The customer does not own the goods and will pay for them in March 4. 23 5. 25 6. 26 7. 8. 28 Question 9 of 10 - / 10 E 19 for Blue. Blue was holding inventory that it sold to a customer on February 19 but that needed adjustments before the customer would take possession The inventory cost $970 and the alterations, completed on February 21, cost $120. The customer plans to pick Supplier Ownership Craft Producers Ltd. Blue Banff Corporation Customer Ownership up the 22 inventory on March 2 Blue shipped goods FOB shipping Question 9 of 10 - / 10 E 22 Goods in transit Cost of goods sold Inventory March 2 Blue shipped goods FOB shipping point to a customer The inventory cost $1.510. The appropriate party paid the freight costs of $9. The receiving report indicates that the customer received the goods on March 2 Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28 23 Question 9 of 10 - / 10 25 Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330 The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. Blue purchased goods FOB destination from a supplier. The inventory cost $1.530. The appropriate party paid 26 Question 9 of 10 - / 10 ili 27 Blue shipped goods costing $1,880 FOB destination to a customer The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7 Blue had $1,920 of Inventory isolated in the warehouse The company isolated the goods because a 28 Question 9 of 10 > - / 10 III Current Attempt in Progress 1 1 3 Blue Limited is trying to determine the amount of its ending inventory as at February 28, the company's year end. The accountant counted everything in the warehouse in early March, which resulted in an ending inventory amount of $238,000. However, the accountant was not sure how to treat the following transactions, so she did not include them in the count. She has asked for your help in determining whether she should or should not include the following transactions in inventory: Feb Blue shipped $1,750 of inventory on consignment to Banff Corporation. By February 28, Banff had sold half of this inventory for Blue 2. 19 Blue was holding inventory that it sold to a customer on February 19 but that needed adjustments before the customer would take possession. The inventory cost $970 and the alterations, completed on February 21, cost $120. The customer plans to pick up the inventory on March 2. 22 Blue shipped goods FOB shipping point to a customer. The inventory cost $1,510. The appropriate party paid the freight costs of $9. The receiving report indicates that the customer received the goods on March 2 23 Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28, Blue had not sold any of this inventory. Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330. The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. 6. Blue purchased goods FOB destination from a supplier. The inventory cost $1,530. The appropriate party paid the freight costs of $140. The supplier shipped the goods on February 27 and Blue received the goods on March 4 7. Blue shipped goods costing $1,880 FOB destination to a customer. The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7. 28 Blue had $1.920 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until March 5. The customer does not own the goods and will pay for them in March 4 5. 25 26 27 8. Question 9 of 10 > - / 10 ili 22 March 2 Blue shipped goods FOB shipping point to a customer The inventory cost $1,510 The Goods in transit Cost of goods sold Inventory appropriate party paid the freight costs of $9 The receiving report indicates that the customer received the goods on March 2 Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28 23 Question 9 of 10 - / 10 25 Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330 The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. Blue purchased goods FOB destination from a supplier. The inventory cost $1.530. The appropriate party paid 26 Question 9 of 10 - / 10 ili 27 Blue shipped goods costing $1,880 FOB destination to a customer The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7 Blue had $1,920 of Inventory isolated in the warehouse The company isolated the goods because a 28 Question 9 of 10 - / 10 ili Current Attempt in Progress 1. Feb 1 2. 3. Blue Limited is trying to determine the amount of its ending inventory as at February 28, the company's year end. The accountant counted everything in the warehouse in early March, which resulted in an ending inventory amount of $238,000. However, the accountant was not sure how to treat the following transactions, so she did not include them in the count. She has asked for your help in determining whether she should or should not include the following transactions in inventory: Blue shipped $1,750 of inventory on consignment to Banff Corporation. By February 28, Banff had sold half of this inventory for Blue. 19 Blue was holding inventory that it sold to a customer on February 19 but that needed adjustments before the customer would take possession. The inventory cost $970 and the alterations, completed on February 21, cost $120. The customer plans to pick up the inventory on March 2. 22 Blue shipped goods FOB shipping point to a customer. The inventory cost $1,510. The appropriate party paid the freight costs of $9. The receiving report indicates that the customer received the goods on March 2. Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28, Blue had not sold any of this inventory Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330. The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. Blue purchased goods FOB destination from a supplier. The inventory cost $1,530. The appropriate party paid the freight costs of $140. The supplier shipped the goods on February 27 and Blue received the goods on March 4. 27 Blue shipped goods costing $1,880 FOB destination to a customer. The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7. Blue had $1,920 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until March 5. The customer does not own the goods and will pay for them in March 4. 23 5. 25 6. 26 7. 8. 28 Question 9 of 10 - / 10 E 19 for Blue. Blue was holding inventory that it sold to a customer on February 19 but that needed adjustments before the customer would take possession The inventory cost $970 and the alterations, completed on February 21, cost $120. The customer plans to pick Supplier Ownership Craft Producers Ltd. Blue Banff Corporation Customer Ownership up the 22 inventory on March 2 Blue shipped goods FOB shipping Question 9 of 10 - / 10 E 22 Goods in transit Cost of goods sold Inventory March 2 Blue shipped goods FOB shipping point to a customer The inventory cost $1.510. The appropriate party paid the freight costs of $9. The receiving report indicates that the customer received the goods on March 2 Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28 23 Question 9 of 10 - / 10 25 Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330 The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. Blue purchased goods FOB destination from a supplier. The inventory cost $1.530. The appropriate party paid 26 Question 9 of 10 - / 10 ili 27 Blue shipped goods costing $1,880 FOB destination to a customer The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7 Blue had $1,920 of Inventory isolated in the warehouse The company isolated the goods because a 28 Question 9 of 10 > - / 10 III Current Attempt in Progress 1 1 3 Blue Limited is trying to determine the amount of its ending inventory as at February 28, the company's year end. The accountant counted everything in the warehouse in early March, which resulted in an ending inventory amount of $238,000. However, the accountant was not sure how to treat the following transactions, so she did not include them in the count. She has asked for your help in determining whether she should or should not include the following transactions in inventory: Feb Blue shipped $1,750 of inventory on consignment to Banff Corporation. By February 28, Banff had sold half of this inventory for Blue 2. 19 Blue was holding inventory that it sold to a customer on February 19 but that needed adjustments before the customer would take possession. The inventory cost $970 and the alterations, completed on February 21, cost $120. The customer plans to pick up the inventory on March 2. 22 Blue shipped goods FOB shipping point to a customer. The inventory cost $1,510. The appropriate party paid the freight costs of $9. The receiving report indicates that the customer received the goods on March 2 23 Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28, Blue had not sold any of this inventory. Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330. The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. 6. Blue purchased goods FOB destination from a supplier. The inventory cost $1,530. The appropriate party paid the freight costs of $140. The supplier shipped the goods on February 27 and Blue received the goods on March 4 7. Blue shipped goods costing $1,880 FOB destination to a customer. The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7. 28 Blue had $1.920 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until March 5. The customer does not own the goods and will pay for them in March 4 5. 25 26 27 8. Question 9 of 10 > - / 10 ili 22 March 2 Blue shipped goods FOB shipping point to a customer The inventory cost $1,510 The Goods in transit Cost of goods sold Inventory appropriate party paid the freight costs of $9 The receiving report indicates that the customer received the goods on March 2 Blue received $1,630 of inventory on consignment from Craft Producers Ltd. By February 28 23 Question 9 of 10 - / 10 25 Blue purchased goods FOB shipping point from a supplier. The inventory cost $1,330 The appropriate party paid the freight costs of $9. The supplier shipped the goods on February 26 and Blue received the goods on March 3. Blue purchased goods FOB destination from a supplier. The inventory cost $1.530. The appropriate party paid 26 Question 9 of 10 - / 10 ili 27 Blue shipped goods costing $1,880 FOB destination to a customer The appropriate party paid the freight costs of $210. The receiving report indicates that the customer received the goods on March 7 Blue had $1,920 of Inventory isolated in the warehouse The company isolated the goods because a 28