Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 9 Shopping for Life Insurance Suppose Kevin has determined that a 10-year, $150,000 term tife Insurance policy would best sult his needs. Tina Trustworthy,

question 9

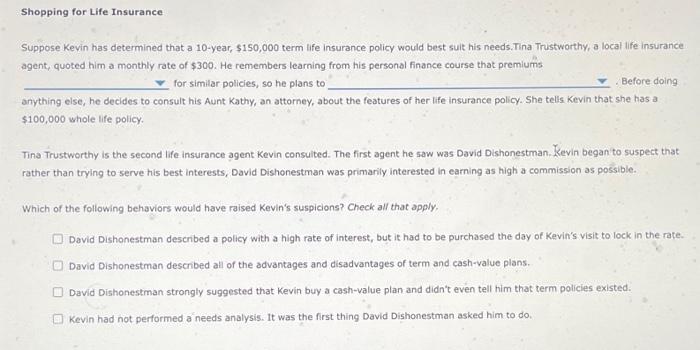

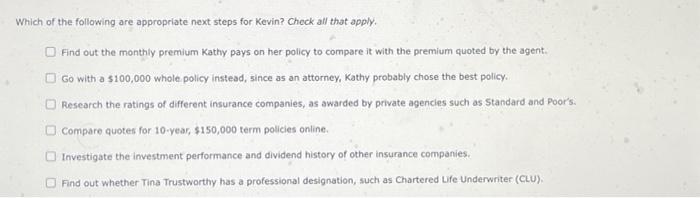

Shopping for Life Insurance Suppose Kevin has determined that a 10-year, $150,000 term tife Insurance policy would best sult his needs. Tina Trustworthy, a local life Insurance agent, quoted him a monthly rate of $300. He remembers learning from his personal finance course that premiums for similar policies, so he plans to Before doing anything else, he decides to consult his Aunt Kathy, an attorney, about the features of her life insurance policy. She tells Kevin that she has a $100,000 whole life policy Tina Trustworthy is the second life insurance agent Kevin consulted. The first agent he saw was David Dishonestman, Kevin began to suspect that rather than trying to serve his best interests, David Dishonestman was primarily interested in earning as high a commission as possible. Which of the following behaviors would have raised Kevin's suspicions? Check all that apply, David Dishonestman described a policy with a high rate of interest, but it had to be purchased the day of Kevin's visit to lock in the rate. David Dishonestman described all of the advantages and disadvantages of term and cash-value plans. David Dishonestman strongly suggested that Kevin buy a cash-value plan and didn't even tell him that term policies existed. Kevin had not performed a needs analysis. It was the first thing David Dishonestman asked him to do. Which of the following are appropriate next steps for Kevin? Check all that apply. Find out the monthly premium Kathy pays on her policy to compare it with the premium quoted by the agent. Go with a $100,000 whole policy instead, since as an attorney, Kathy probably chose the best policy Research the ratings of different insurance companies, as awarded by private agencies such as Standard and Poor's. Compare quotes for 10-year, $150,000 term policies online Investigate the investment performance and dividend history of other insurance companies Find out whether Tina Trustworthy has a professional designation, such as Chartered Life Underwriter (CL)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started