Answered step by step

Verified Expert Solution

Question

1 Approved Answer

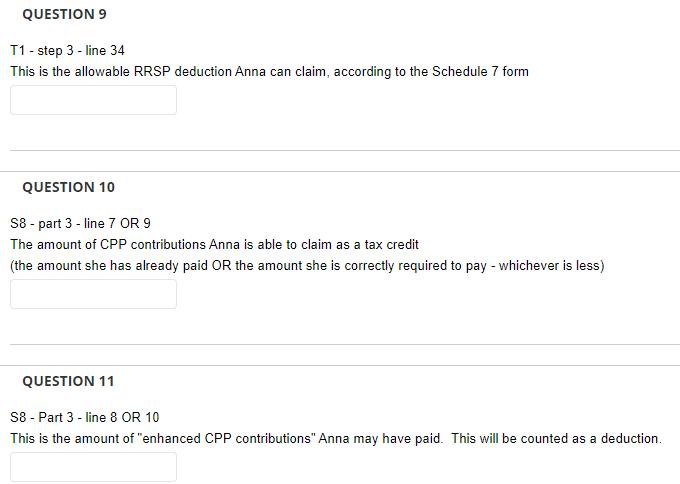

QUESTION 9 T1 - step 3 - line 34 This is the allowable RRSP deduction Anna can claim, according to the Schedule 7 form

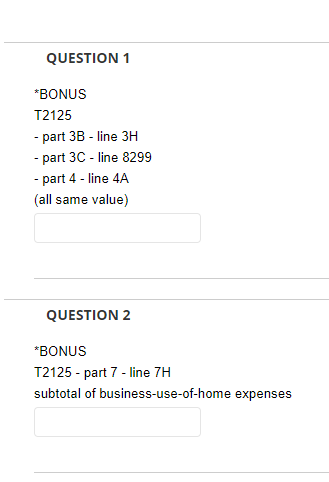

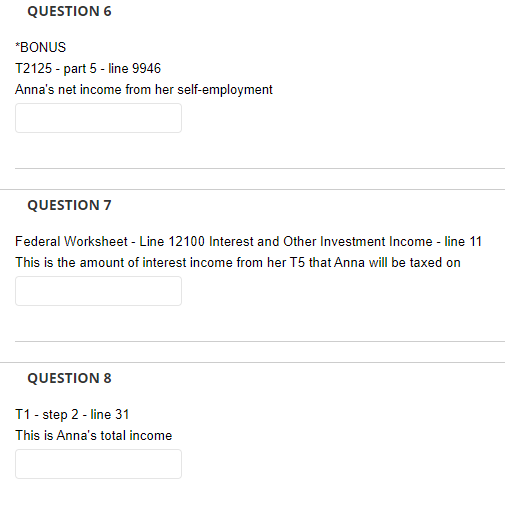

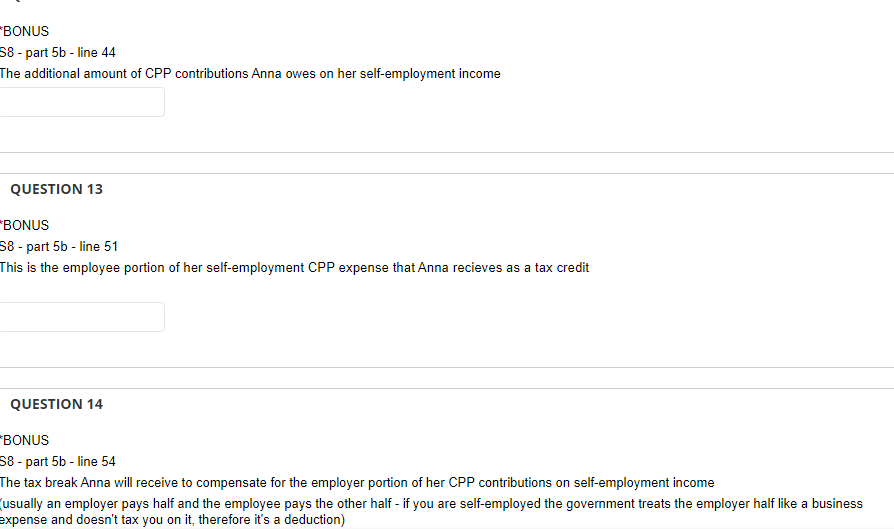

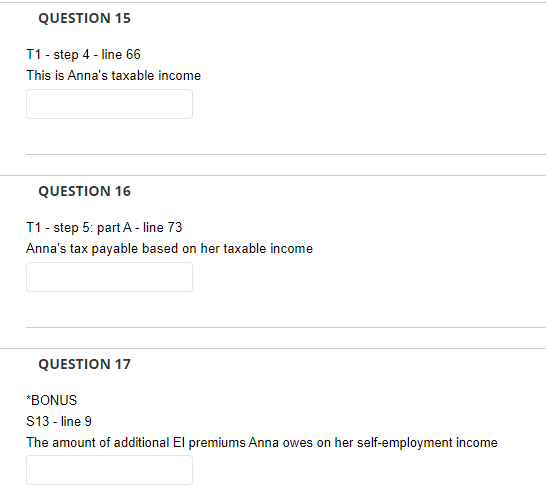

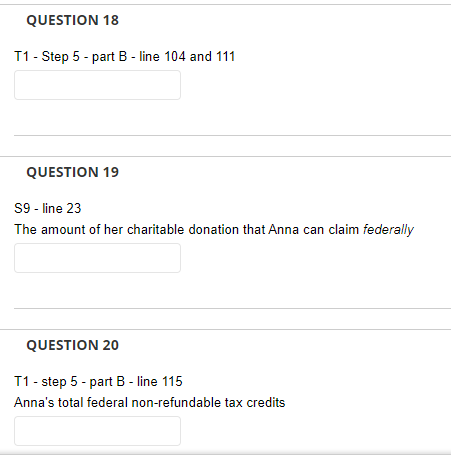

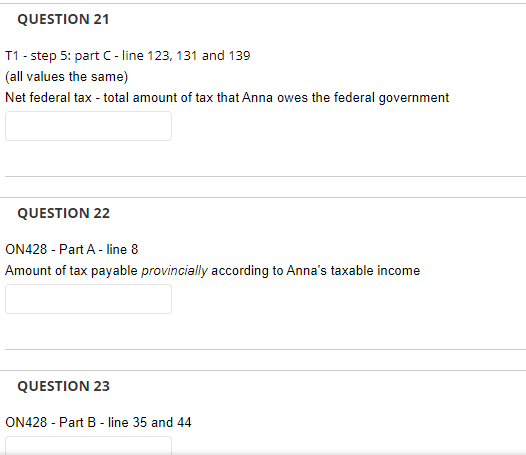

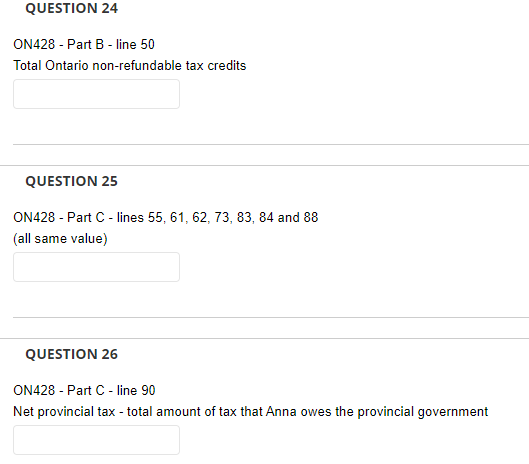

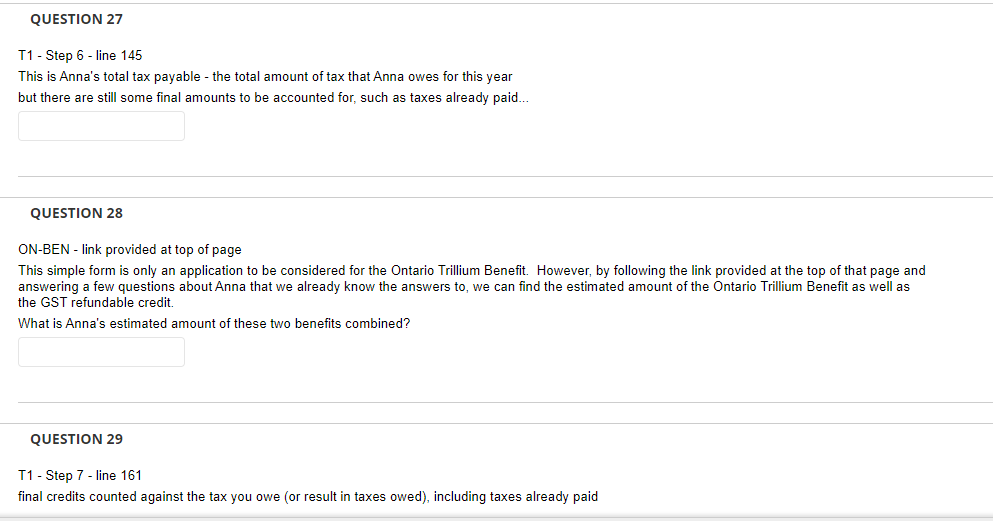

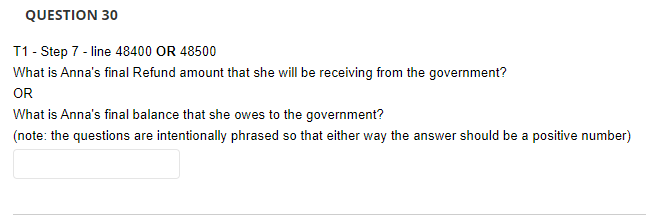

QUESTION 9 T1 - step 3 - line 34 This is the allowable RRSP deduction Anna can claim, according to the Schedule 7 form QUESTION 10 S8 - part 3 - line 7 OR 9 The amount of CPP contributions Anna is able to claim as a tax credit (the amount she has already paid OR the amount she is correctly required to pay - whichever is less) QUESTION 11 S8 - Part 3 - line 8 OR 10 This is the amount of "enhanced CPP contributions" Anna may have paid. This will be counted as a deduction. QUESTION 1 *BONUS T2125 - part 3B - line 3H - part 3C - line 8299 - part 4 - line 4A (all same value) QUESTION 2 *BONUS T2125 - part 7 - line 7H subtotal of business-use-of-home expenses QUESTION 6 *BONUS T2125 - part 5 - line 9946 Anna's net income from her self-employment QUESTION 7 Federal Worksheet - Line 12100 Interest and Other Investment Income - line 11 This is the amount of interest income from her T5 that Anna will be taxed on QUESTION 8 T1 - step 2 - line 31 This is Anna's total income BONUS S8 - part 5b - line 44 The additional amount of CPP contributions Anna owes on her self-employment income QUESTION 13 BONUS S8 - part 5b - line 51 This is the employee portion of her self-employment CPP expense that Anna recieves as a tax credit QUESTION 14 BONUS 58 - part 5b - line 54 The tax break Anna will receive to compensate for the employer portion of her CPP contributions on self-employment income (usually an employer pays half and the employee pays the other half - if you are self-employed the government treats the employer half like a business expense and doesn't tax you on it, therefore it's a deduction) QUESTION 15 T1 - step 4 - line 66 This is Anna's taxable income QUESTION 16 T1 - step 5: part A - line 73 Anna's tax payable based on her taxable income QUESTION 17 *BONUS S13 - line 9 The amount of additional El premiums Anna owes on her self-employment income QUESTION 18 T1 - Step 5 - part B - line 104 and 111 QUESTION 19 S9 - line 23 The amount of her charitable donation that Anna can claim federally QUESTION 20 T1 - step 5 - part B - line 115 Anna's total federal non-refundable tax credits QUESTION 21 T1 - step 5: part C-line 123, 131 and 139 (all values the same) Net federal tax - total amount of tax that Anna owes the federal government QUESTION 22 ON428 - Part A - line 8 Amount of tax payable provincially according to Anna's taxable income QUESTION 23 ON428 - Part B - line 35 and 44 QUESTION 24 ON428 - Part B - line 50 Total Ontario non-refundable tax credits QUESTION 25 ON428 - Part C-lines 55, 61, 62, 73, 83, 84 and 88 (all same value) QUESTION 26 ON428 - Part C - line 90 Net provincial tax - total amount of tax that Anna owes the provincial government QUESTION 27 T1 - Step 6 - line 145 This is Anna's total tax payable - the total amount of tax that Anna owes for this year but there are still some final amounts to be accounted for, such as taxes already paid... QUESTION 28 ON-BEN - link provided at top of page This simple form is only an application to be considered for the Ontario Trillium Benefit. However, by following the link provided at the top of that page and answering a few questions about Anna that we already know the answers to, we can find the estimated amount of the Ontario Trillium Benefit as well as the GST refundable credit. What is Anna's estimated amount of these two benefits combined? QUESTION 29 T1 - Step 7 - line 161 final credits counted against the tax you owe (or result in taxes owed), including taxes already paid QUESTION 30 T1 - Step 7 - line 48400 OR 48500 What is Anna's final Refund amount that she will be receiving from the government? OR What is Anna's final balance that she owes to the government? (note: the questions are intentionally phrased so that either way the answer should be a positive number)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION QUESTION 9 The allowable RRSP deduction Anna can claim according to the Schedule 7 form is 1500 2000 x 75 QUESTION 10 The amount of CPP contributions Anna is able to claim as a tax credit is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started