Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 9 Which of the following statements is correct about mergers and acquisitions? I. Empirical evidence on deal announcement returns in the United States shows

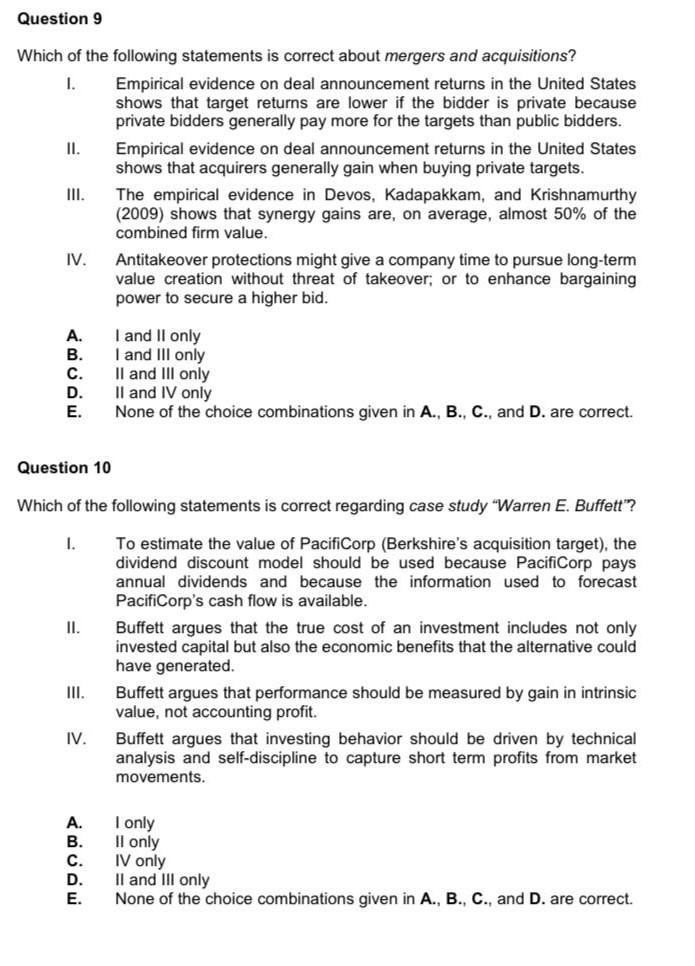

Question 9 Which of the following statements is correct about mergers and acquisitions? I. Empirical evidence on deal announcement returns in the United States shows that target returns are lower if the bidder is private because private bidders generally pay more for the targets than public bidders. II. Empirical evidence on deal announcement returns in the United States shows that acquirers generally gain when buying private targets. III. The empirical evidence in Devos, Kadapakkam, and Krishnamurthy (2009) shows that synergy gains are, on average, almost 50% of the combined firm value. IV. Antitakeover protections might give a company time to pursue long-term value creation without threat of takeover; or to enhance bargaining power to secure a higher bid. A. B. C. D. E. I and II only I and Ill only Il and Ill only II and IV only None of the choice combinations given in A., B., C., and D. are correct. Question 10 Which of the following statements is correct regarding case study "Warren E. Buffett? I. II. To estimate the value of PacifiCorp (Berkshire's acquisition target), the dividend discount model should be used because PacifiCorp pays annual dividends and because the information used to forecast PacifiCorp's cash flow is available. Buffett argues that the true cost of an investment includes not only invested capital but also the economic benefits that the alternative could have generated. Buffett argues that performance should be measured by gain in intrinsic value, not accounting profit. Buffett argues that investing behavior should be driven by technical analysis and self-discipline to capture short term profits from market movements. III. IV. A. B. I only Il only IV only II and III only None of the choice combinations given in A., B., C., and D. are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started