Question

Question 90 J Ltd. purchased machinery from K Ltd. on 30.09.2013. The price was 370.44 lakhs after charging 8% Sales-tax and giving a trade

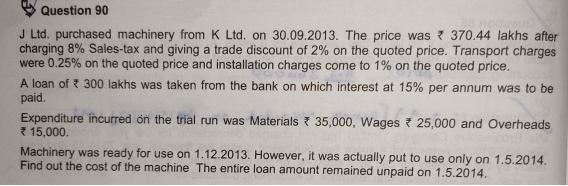

Question 90 J Ltd. purchased machinery from K Ltd. on 30.09.2013. The price was 370.44 lakhs after charging 8% Sales-tax and giving a trade discount of 2% on the quoted price. Transport charges were 0.25% on the quoted price and installation charges come to 1% on the quoted price. A loan of 300 lakhs was taken from the bank on which interest at 15% per annum was to be paid. Expenditure incurred on the trial run was Materials 35,000, Wages 25,000 and Overheads * 15,000. Machinery was ready for use on 1.12.2013. However, it was actually put to use only on 1.5.2014. Find out the cost of the machine The entire loan amount remained unpaid on 1.5.2014.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App