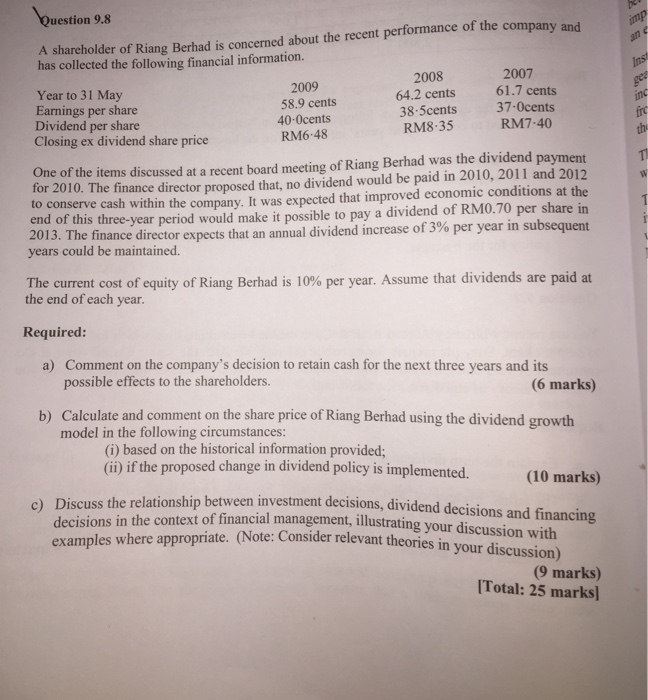

Question 9.8 imp Ins ger inc fire th A shareholder of Riang Berhad is concerned about the recent performance of the company and has collected the following financial information. 2007 Year to 31 May 2008 2009 64.2 cents 61.7 cents 58.9 cents Earnings per share Dividend per share 38-5cents 37-Ocents 40-Ocents Closing ex dividend share price RM6-48 RM8.35 RM7.40 One of the items discussed at a recent board meeting of Riang Berhad was the dividend payment for 2010. The finance director proposed that, no dividend would be paid in 2010, 2011 and 2012 to conserve cash within the company. It was expected that improved economic conditions at the end of this three-year period would make it possible to pay a dividend of RM0.70 per share in 2013. The finance director expects that an annual dividend increase of 3% per year in subsequent years could be maintained. TI w The current cost of equity of Riang Berhad is 10% per year. Assume that dividends are paid at the end of each year. Required: a) Comment on the company's decision to retain cash for the next three years and its possible effects to the shareholders. (6 marks) b) Calculate and comment on the share price of Riang Berhad using the dividend growth model in the following circumstances: (1) based on the historical information provided; (ii) if the proposed change in dividend policy is implemented. (10 marks) c) Discuss the relationship between investment decisions, dividend decisions and financing decisions in the context of financial management, illustrating your discussion with examples where appropriate. (Note: Consider relevant theories in your discussion) (9 marks) [Total: 25 marks] Question 9.8 imp Ins ger inc fire th A shareholder of Riang Berhad is concerned about the recent performance of the company and has collected the following financial information. 2007 Year to 31 May 2008 2009 64.2 cents 61.7 cents 58.9 cents Earnings per share Dividend per share 38-5cents 37-Ocents 40-Ocents Closing ex dividend share price RM6-48 RM8.35 RM7.40 One of the items discussed at a recent board meeting of Riang Berhad was the dividend payment for 2010. The finance director proposed that, no dividend would be paid in 2010, 2011 and 2012 to conserve cash within the company. It was expected that improved economic conditions at the end of this three-year period would make it possible to pay a dividend of RM0.70 per share in 2013. The finance director expects that an annual dividend increase of 3% per year in subsequent years could be maintained. TI w The current cost of equity of Riang Berhad is 10% per year. Assume that dividends are paid at the end of each year. Required: a) Comment on the company's decision to retain cash for the next three years and its possible effects to the shareholders. (6 marks) b) Calculate and comment on the share price of Riang Berhad using the dividend growth model in the following circumstances: (1) based on the historical information provided; (ii) if the proposed change in dividend policy is implemented. (10 marks) c) Discuss the relationship between investment decisions, dividend decisions and financing decisions in the context of financial management, illustrating your discussion with examples where appropriate. (Note: Consider relevant theories in your discussion) (9 marks) [Total: 25 marks]