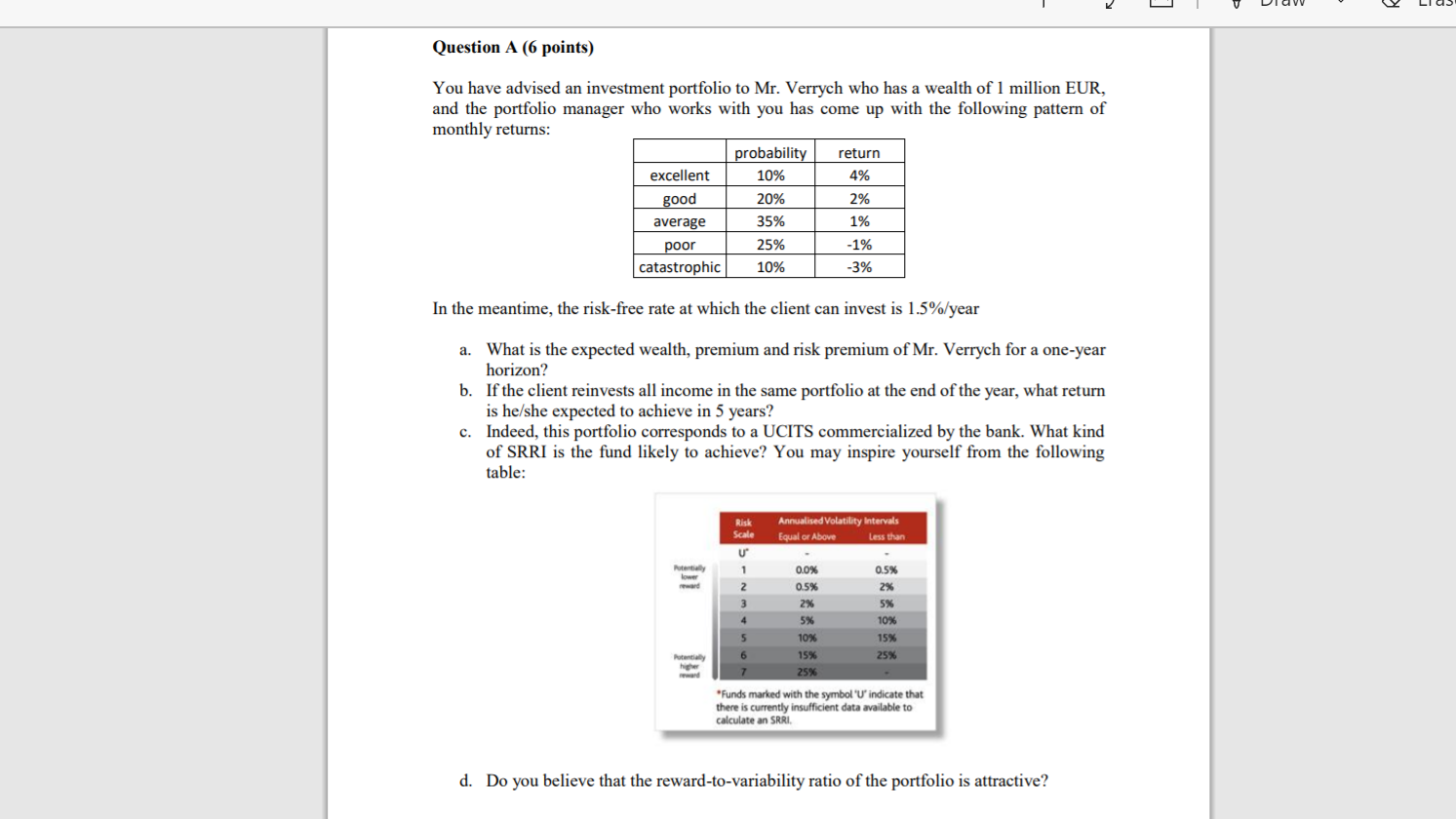

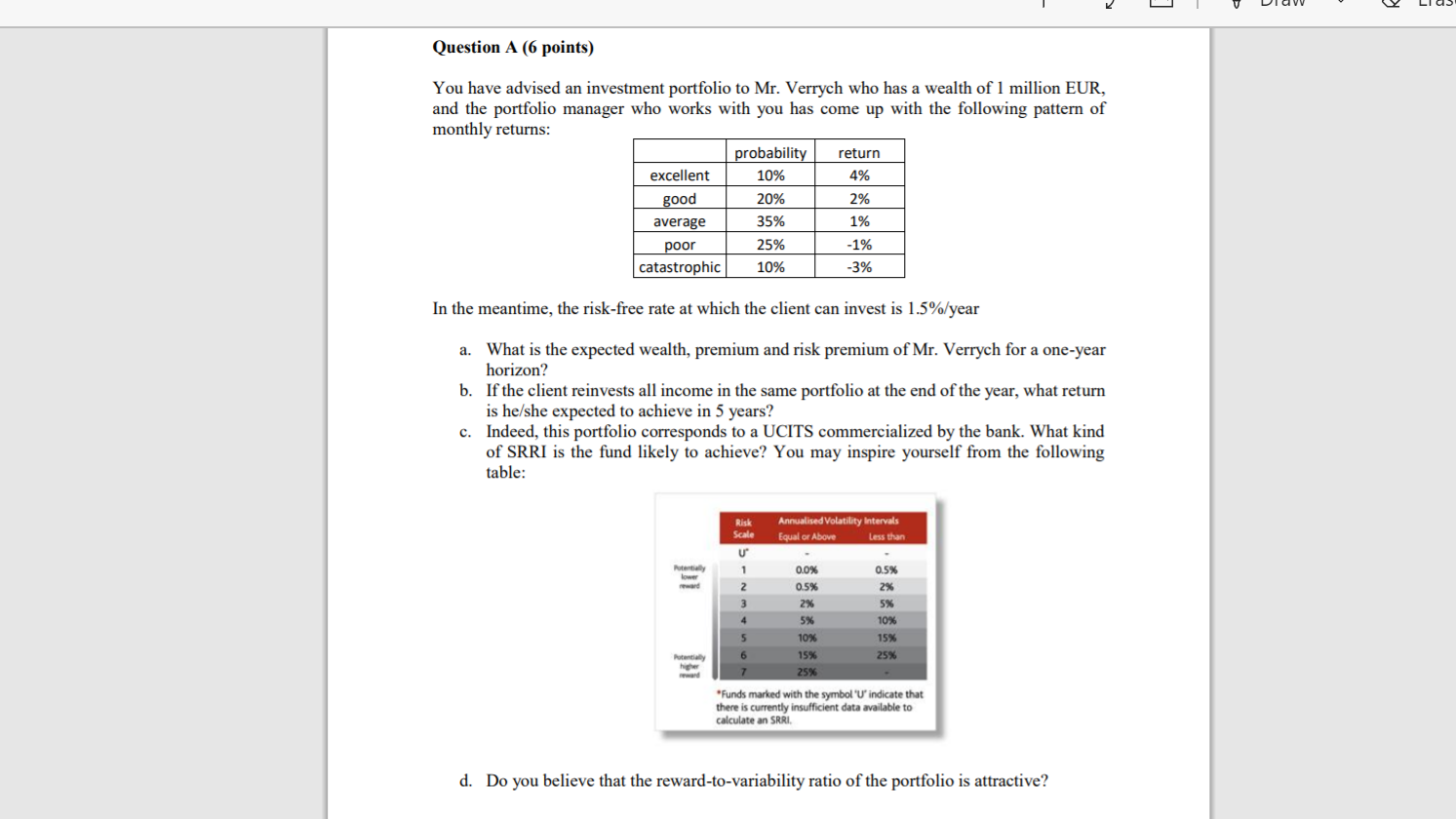

Question A (6 points) You have advised an investment portfolio to Mr. Verrych who has a wealth of 1 million EUR, and the portfolio manager who works with you has come up with the following pattern of monthly returns: probability return excellent 10% 4% good 20% 2% average 35% 1% poor 25% -1% catastrophic 10% -3% In the meantime, the risk-free rate at which the client can invest is 1.5%/year a. What is the expected wealth, premium and risk premium of Mr. Verrych for a one-year horizon? b. If the client reinvests all income in the same portfolio at the end of the year, what return is he/she expected to achieve in 5 years? c. Indeed, this portfolio corresponds to a UCITS commercialized by the bank. What kind of SRRI is the fund likely to achieve? You may inspire yourself from the following table: wa 2 3 Risk Annualised Volatility Intervals Scale Equal or Above Less than U 1 0.0% 0.5% 0.5% 2% 2% 5% 4 5% 10% 5 10% 15% 6 15% 25% 25% "Funds marked with the symbol 'U' indicate that there is currently insufficient data available to calculate an SRRI d. Do you believe that the reward-to-variability ratio of the portfolio is attractive? Question A (6 points) You have advised an investment portfolio to Mr. Verrych who has a wealth of 1 million EUR, and the portfolio manager who works with you has come up with the following pattern of monthly returns: probability return excellent 10% 4% good 20% 2% average 35% 1% poor 25% -1% catastrophic 10% -3% In the meantime, the risk-free rate at which the client can invest is 1.5%/year a. What is the expected wealth, premium and risk premium of Mr. Verrych for a one-year horizon? b. If the client reinvests all income in the same portfolio at the end of the year, what return is he/she expected to achieve in 5 years? c. Indeed, this portfolio corresponds to a UCITS commercialized by the bank. What kind of SRRI is the fund likely to achieve? You may inspire yourself from the following table: wa 2 3 Risk Annualised Volatility Intervals Scale Equal or Above Less than U 1 0.0% 0.5% 0.5% 2% 2% 5% 4 5% 10% 5 10% 15% 6 15% 25% 25% "Funds marked with the symbol 'U' indicate that there is currently insufficient data available to calculate an SRRI d. Do you believe that the reward-to-variability ratio of the portfolio is attractive