Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question A and B please The owner of Green Takeaway, a local business, has approached you for advice in choosing one of the two mutually

Question A and B please

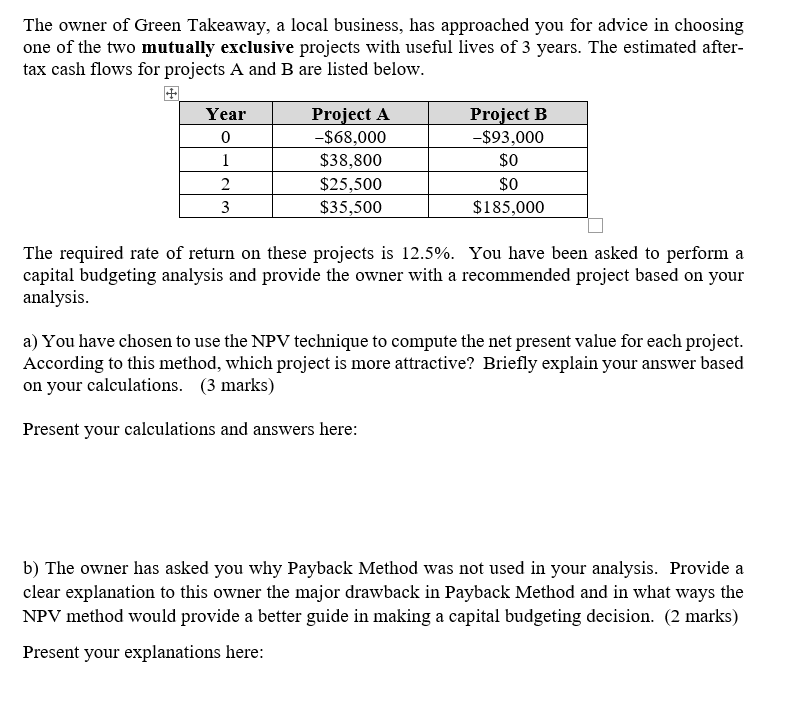

The owner of Green Takeaway, a local business, has approached you for advice in choosing one of the two mutually exclusive projects with useful lives of 3 years. The estimated after- tax cash flows for projects A and B are listed below. 1 Year 0 Proiect A Project A -$68,000 $38,800 $25,500 $35,500 Project B -$93,000 $0 $0 $185,000 The required rate of return on these projects is 12.5%. You have been asked to perform a capital budgeting analysis and provide the owner with a recommended project based on your analysis. a) You have chosen to use the NPV technique to compute the net present value for each project. According to this method, which project is more attractive? Briefly explain your answer based on your calculations. (3 marks) Present your calculations and answers here: b) The owner has asked you why Payback Method was not used in your analysis. Provide a clear explanation to this owner the major drawback in Payback Method and in what ways the NPV method would provide a better guide in making a capital budgeting decision. (2 marks) Present your explanations hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started