Question a and b

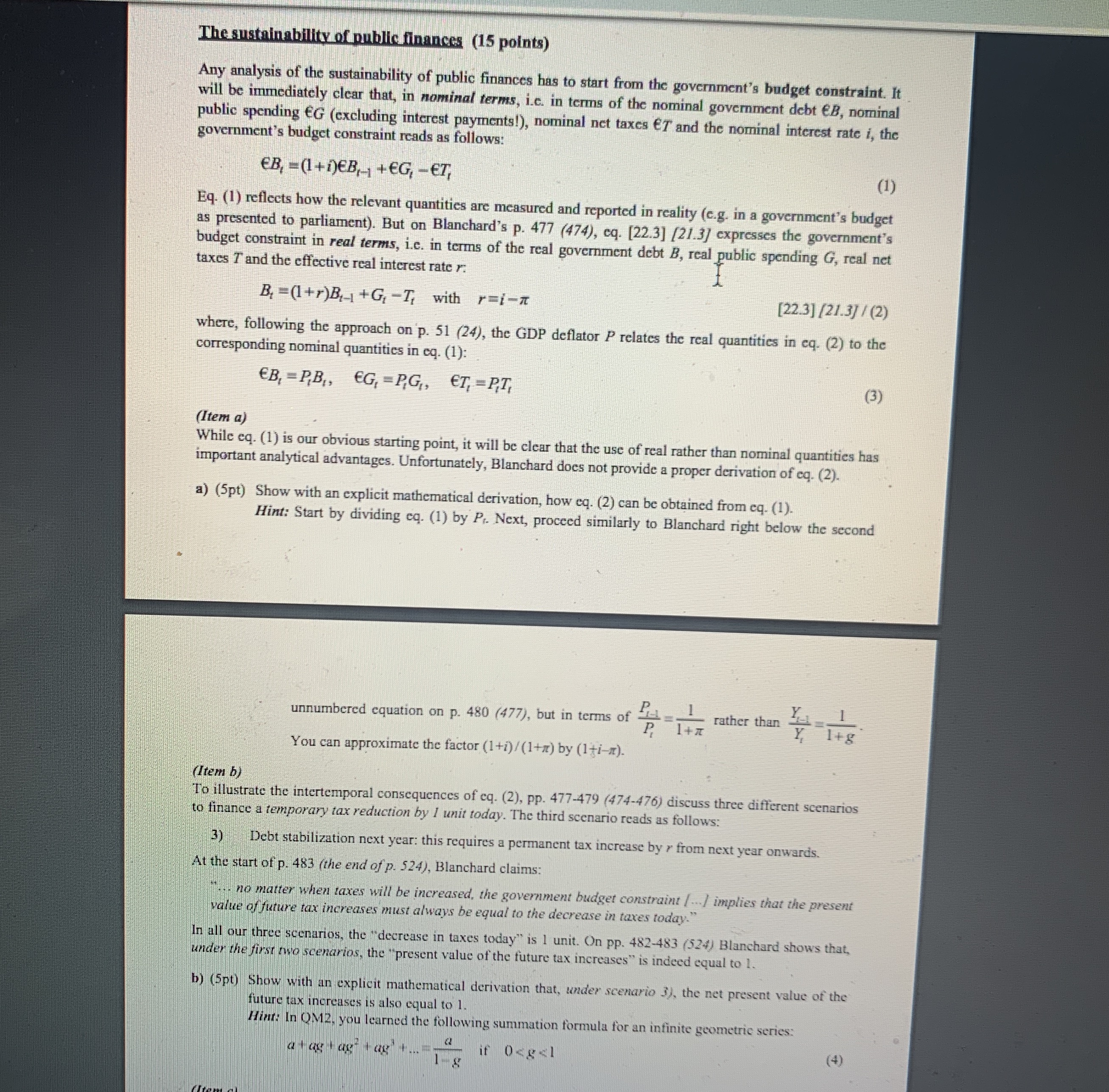

The sustainability of public finances (15 points) Any analysis of the sustainability of public finances has to start from the government's budget constraint. It will be immediately clear that, in nominal terms, i.e. in terms of the nominal government debt EB, nominal public spending EG (excluding interest payments!), nominal net taxes ET and the nominal interest rate i, the government's budget constraint reads as follows: EB, - (1+1EB,_1 +EG, -ET, (1) Eq. (1) reflects how the relevant quantities are measured and reported in reality (c.g. in a government's budget as presented to parliament). But on Blanchard's p. 477 (474), eq. [22.3] [21.3) expresses the government's budget constraint in real terms, i.c. in terms of the real government debt B, real public spending G, real net taxes T and the effective real interest rate r. B, = (1 +r)Bi-1 +G, -T, with r=i-n [22.3] (21.3] / (2) where, following the approach on p. 51 (24), the GDP deflator P relates the real quantities in cq. (2) to the corresponding nominal quantities in eq. (1): EB, = P,B,, EG, = P,G,, ET, = P,I, (3) (Item a) While eq. (1) is our obvious starting point, it will be clear that the use of real rather than nominal quantities has important analytical advantages. Unfortunately, Blanchard does not provide a proper derivation of eq. (2). a) (5pt) Show with an explicit mathematical derivation, how eq. (2) can be obtained from eq. (1). Hint: Start by dividing eq. (1) by P. Next, proceed similarly to Blanchard right below the second unnumbered equation on p. 480 (477), but in terms of 1+7 rather than You can approximate the factor (1+i) / (1+x) by (1ti-x). (Item b) To illustrate the intertemporal consequences of cq. (2), pp. 477-479 (474-476) discuss three different scenarios to finance a temporary tax reduction by I unit today. The third scenario reads as follows: 3) Debt stabilization next year: this requires a permanent tax increase by r from next year onwards. At the start of p. 483 (the end of p. 524), Blanchard claims: -.. no matter when taxes will be increased, the government budget constraint [ ] implies that the present value of future tax increases must always be equal to the decrease in taxes today. In all our three scenarios, the "decrease in taxes today" is 1 unit. On pp. 482-483 (524) Blanchard shows that, under the first hyo scenarios, the "present value of the future tax increases" is indeed equal to 1. b) (5pt) Show with an explicit mathematical derivation that, under scenario 3), the net present value of the future tax increases is also equal to 1. Hiar: In OM2, you learned the following summation formula for an infinite geometric series: if Osgel ( 4)