Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question A Bert and Ernie ( Party Planners ) Bert and Ernie have a partnership and are equal partners running a business as party planners

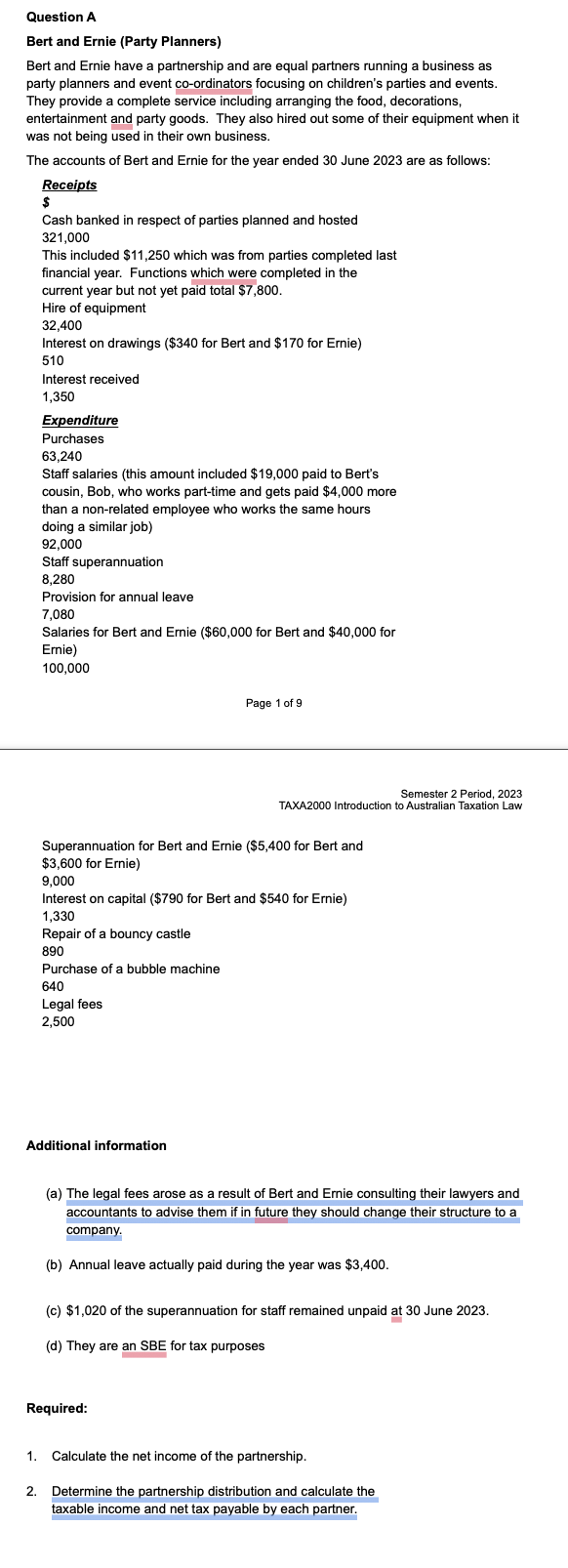

Question A

Bert and Ernie Party Planners

Bert and Ernie have a partnership and are equal partners running a business as

party planners and event coordinators focusing on children's parties and events.

They provide a complete service including arranging the food, decorations,

entertainment and party goods. They also hired out some of their equipment when it

was not being used in their own business.

The accounts of Bert and Ernie for the year ended June are as follows:

Receipts

$

Cash banked in respect of parties planned and hosted

This included $ which was from parties completed last

financial year. Functions which were completed in the

current year but not yet paid total $

Hire of equipment

Interest on drawings $ for Bert and $ for Ernie

Interest received

Expenditure

Purchases

Staff salaries this amount included $ paid to Bert's

cousin, Bob, who works parttime and gets paid $ more

than a nonrelated employee who works the same hours

doing a similar job

Staff superannuation

Provision for annual leave

Salaries for Bert and Ernie for Bert and $ for

Ernie

Page of

Superannuation for Bert and Ernie for Bert and

$ for Ernie

Interest on capital $ for Bert and $ for Ernie

Repair of a bouncy castle

Purchase of a bubble machine

Legal fees

Additional information

a The legal fees arose as a result of Bert and Ernie consulting their lawyers and

accountants to advise them if in future they should change their structure to a

company.

b Annual leave actually paid during the year was $

c $ of the superannuation for staff remained unpaid at June

d They are an SBE for tax purposes

Required:

Calculate the net income of the partnership.

Determine the partnership distribution and calculate the

taxable income and net tax payable by each partner.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started