Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question (a) Daniel, an Irishman, was offered a two-year contract by Horwath IT Solutions Bhd (HISB) as a human resources regional director effective from

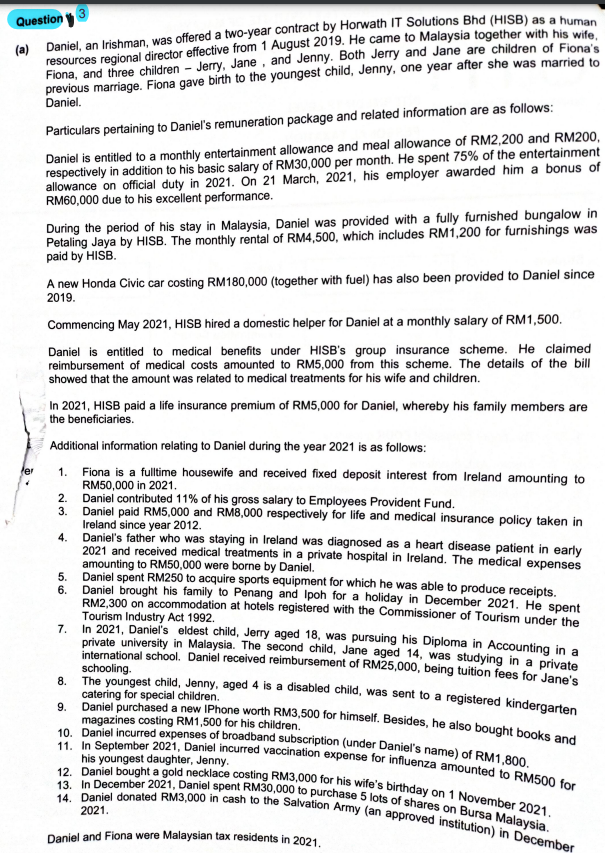

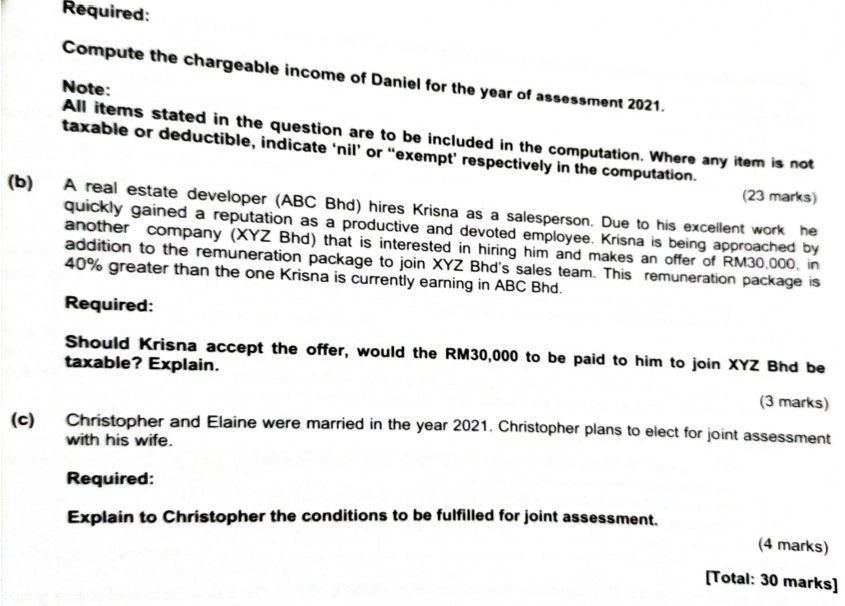

Question (a) Daniel, an Irishman, was offered a two-year contract by Horwath IT Solutions Bhd (HISB) as a human resources regional director effective from 1 August 2019. He came to Malaysia together with his wife, Fiona, and three children - Jerry, Jane, and Jenny. Both Jerry and Jane are children of Fiona's previous marriage. Fiona gave birth to the youngest child, Jenny, one year after she was married to Daniel. Particulars pertaining to Daniel's remuneration package and related information are as follows: Daniel is entitled to a monthly entertainment allowance and meal allowance of RM2,200 and RM200, respectively in addition to his basic salary of RM30,000 per month. He spent 75% of the entertainment allowance on official duty in 2021. On 21 March, 2021, his employer awarded him a bonus of RM60,000 due to his excellent performance. During the period of his stay in Malaysia, Daniel was provided with a fully furnished bungalow in Petaling Jaya by HISB. The monthly rental of RM4,500, which includes RM1,200 for furnishings was paid by HISB. A new Honda Civic car costing RM180,000 (together with fuel) has also been provided to Daniel since 2019. Commencing May 2021, HISB hired a domestic helper for Daniel at a monthly salary of RM1,500. Daniel is entitled to medical benefits under HISB's group insurance scheme. He claimed reimbursement of medical costs amounted to RM5,000 from this scheme. The details of the bill showed that the amount was related to medical treatments for his wife and children. In 2021, HISB paid a life insurance premium of RM5,000 for Daniel, whereby his family members are the beneficiaries. Additional information relating to Daniel during the year 2021 is as follows: 1. Fiona is a fulltime housewife and received fixed deposit interest from Ireland amounting to RM50,000 in 2021. 23 2. 3. 4. 5. 56 Daniel contributed 11% of his gross salary to Employees Provident Fund. Daniel paid RM5,000 and RM8,000 respectively for life and medical insurance policy taken in Ireland since year 2012. Daniel's father who was staying in Ireland was diagnosed as a heart disease patient in early 2021 and received medical treatments in a private hospital in Ireland. The medical expenses amounting to RM50,000 were borne by Daniel. Daniel spent RM250 to acquire sports equipment for which he was able to produce receipts. Daniel brought his family to Penang and Ipoh for a holiday in December 2021. He spent RM2,300 on accommodation at hotels registered with the Commissioner of Tourism under the Tourism Industry Act 1992. 7. In 2021, Daniel's eldest child, Jerry aged 18, was pursuing his Diploma in Accounting in a private university in Malaysia. The second child, Jane aged 14, was studying in a private international school. Daniel received reimbursement of RM25,000, being tuition fees for Jane's 8. 9. schooling. The youngest child, Jenny, aged 4 is a disabled child, was sent to a registered kindergarten catering for special children. Daniel purchased a new iPhone worth RM3,500 for himself. Besides, he also bought books and magazines costing RM1,500 for his children. his youngest daughter, Jenny. 10. Daniel incurred expenses of broadband subscription (under Daniel's name) of RM1,800. 11. In September 2021, Daniel incurred vaccination expense for influenza amounted to RM500 for 12. Daniel bought a gold necklace costing RM3,000 for his wife's birthday on 1 November 2021. 13. In December 2021, Daniel spent RM30,000 to purchase 5 lots of shares on Bursa Malaysia. 14. Daniel donated RM3,000 in cash to the Salvation Army (an approved institution) in December 2021. Daniel and Fiona were Malaysian tax residents in 2021. (b) (c) Required: Compute the chargeable income of Daniel for the year of assessment 2021. Note: All items stated in the question are to be included in the computation. Where any item is not taxable or deductible, indicate 'nil' or "exempt' respectively in the computation. A real estate developer (ABC Bhd) hires Krisna as a salesperson. Due to his excellent work he (23 marks) quickly gained a reputation as a productive and devoted employee. Krisna is being approached by another company (XYZ Bhd) that is interested in hiring him and makes an offer of RM30,000, in addition to the remuneration package to join XYZ Bhd's sales team. This remuneration package is 40% greater than the one Krisna is currently earning in ABC Bhd. Required: Should Krisna accept the offer, would the RM30,000 to be paid to him to join XYZ Bhd be taxable? Explain. (3 marks) Christopher and Elaine were married in the year 2021. Christopher plans to elect for joint assessment with his wife. Required: Explain to Christopher the conditions to be fulfilled for joint assessment. (4 marks) [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Computation of Daniels chargeable income for YA 2021 Income Basic salary RM30000 x 12 months RM360...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started