Answered step by step

Verified Expert Solution

Question

1 Approved Answer

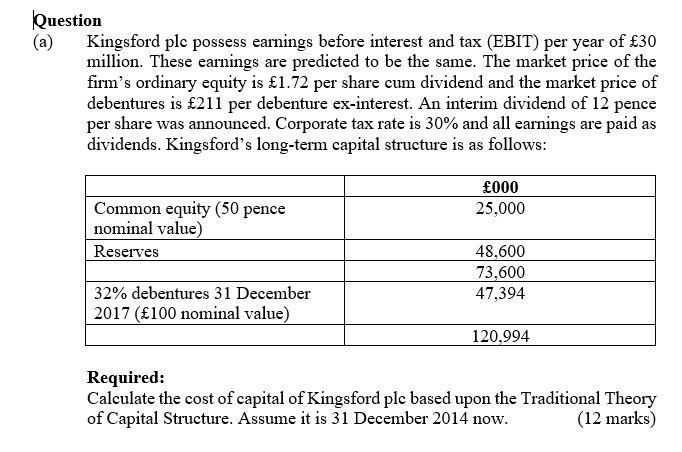

Question (a) Kingsford plc possess earnings before interest and tax (EBIT) per year of 30 million. These earnings are predicted to be the same. The

Question (a) Kingsford plc possess earnings before interest and tax (EBIT) per year of 30 million. These earnings are predicted to be the same. The market price of the firm's ordinary equity is 1.72 per share cum dividend and the market price of debentures is 211 per debenture ex-interest. An interim dividend of 12 pence per share was announced. Corporate tax rate is 30% and all earnings are paid as dividends. Kingsford's long-term capital structure is as follows: 000 25,000 Common equity (50 pence nominal value) Reserves 48,600 73,600 47,394 32% debentures 31 December 2017 (100 nominal value) 120,994 Required: Calculate the cost of capital of Kingsford plc based upon the Traditional Theory of Capital Structure. Assume it is 31 December 2014 now. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started