Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION: A mutual fund has 500 million-peso worth of stock, 50 million pesos worth of bonds, and 10 million pesos in cash. The fund's total

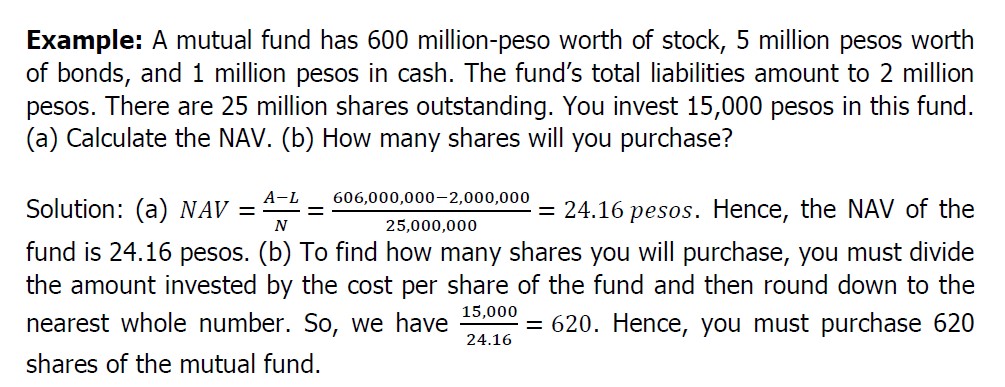

QUESTION: A mutual fund has 500 million-peso worth of stock, 50 million pesos worth of bonds, and 10 million pesos in cash. The fund's total liabilities amount to 10 million pesos. There are 50 million shares outstanding. You invest 150,000 pesos in this fund. (a) Calculate the NAV. (b) How many shares will you purchase?

***Note: When solving the question, please be guided by the sample problem attached.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started