Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question A1 Premier Taxis (PT) is a taxi business in Bradford. PT is owned by two friends, Christine and Sally, who set up the

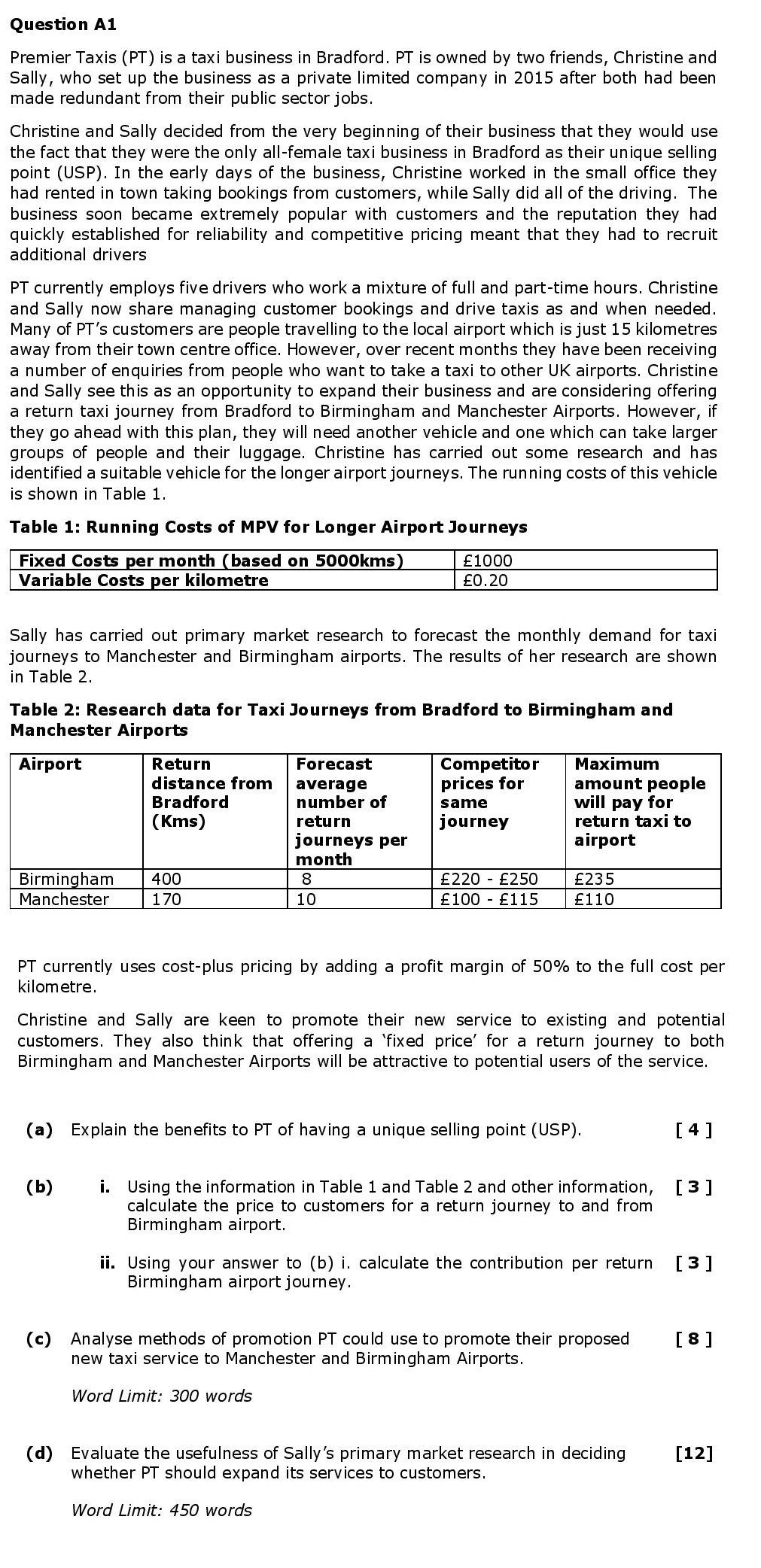

Question A1 Premier Taxis (PT) is a taxi business in Bradford. PT is owned by two friends, Christine and Sally, who set up the business as a private limited company in 2015 after both had been made redundant from their public sector jobs. Christine and Sally decided from the very beginning of their business that they would use the fact that they were the only all-female taxi business in Bradford as their unique selling point (USP). In the early days of the business, Christine worked in the small office they had rented in town taking bookings from customers, while Sally did all of the driving. The business soon became extremely popular with customers and the reputation they had quickly established for reliability and competitive pricing meant that they had to recruit additional drivers. PT currently employs five drivers who work a mixture of full and part-time hours. Christine and Sally now share managing customer bookings and drive taxis as and when needed. Many of PT's customers are people travelling to the local airport which is just 15 kilometres away from their town centre office. However, over recent months they have been receiving a number of enquiries from people who want to take a taxi to other UK airports. Christine and Sally see this as an opportunity to expand their business and are considering offering a return taxi journey from Bradford to Birmingham and Manchester Airports. However, if they go ahead with this plan, they will need another vehicle and one which can take larger groups of people and their luggage. Christine has carried out some research and has identified a suitable vehicle for the longer airport journeys. The running costs of this vehicle is shown in Table 1. Table 1: Running Costs of MPV for Longer Airport Journeys Fixed Costs per month (based on 5000kms) Variable Costs per kilometre 1000 0.20 Sally has carried out primary market research to forecast the monthly demand for taxi jou to Manchester and Birmingham airports. The results of her research are shown in Table 2. Table 2: Research data for Taxi Journeys from Bradford to Birmingham and Manchester Airports Airport Return distance from Bradford (Kms) Birmingham 400 Manchester 170 Forecast average number of return journeys per month (b) 8 10 Competitor prices for same journey PT currently uses cost-plus pricing by adding a profit kilometre. 220 250 100 115 Maximum amount people will pay for return taxi to airport 235 110 Christine and Sally are keen to promote their new service to existing and potential customers. They also think that offering a 'fixed price' for a return journey to both Birmingham and Manchester Airports will be attractive to potential users of the service. Word Limit: 450 words of 50% to the full cost per (a) Explain the benefits to PT of having a unique selling point (USP). i. Using the information in Table 1 and Table 2 and other information, [3] calculate the price to customers for a return journey to and from Birmingham airport. ii. Using your answer to (b) i. calculate the contribution per return [3] Birmingham airport journey. (c) Analyse methods of promotion PT could use to promote their proposed new taxi service to Manchester and Birmingham Airports. Word Limit: 300 words [4] (d) Evaluate the usefulness of Sally's primary market research in deciding whether PT should expand its services to customers. [8] [12]

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A1 a The benefits of having a unique selling point USP for Premier Taxis PT are numerous Firstly it allows the business to stand out from the competition in the local market as they are the only allfe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started