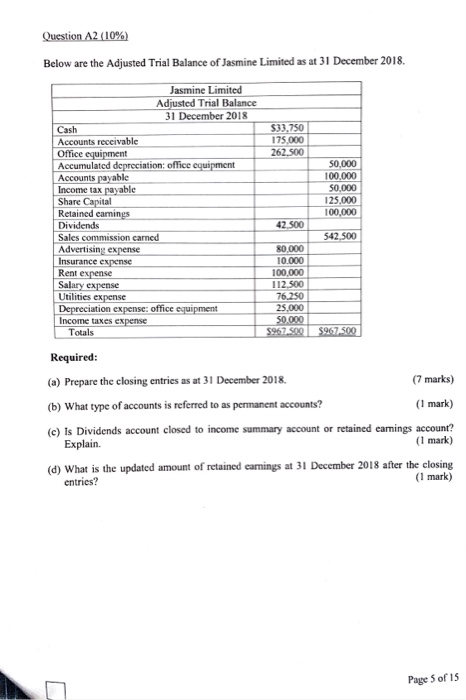

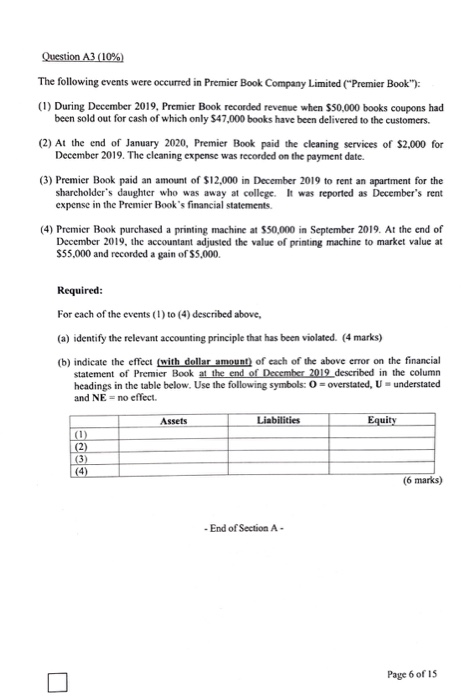

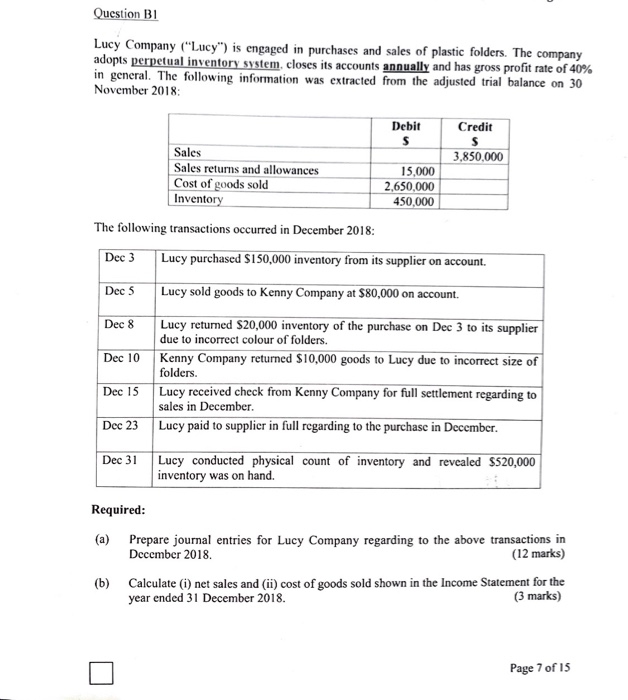

Question A2 (10%) Below are the Adjusted Trial Balance of Jasmine Limited as at 31 December 2018. $33.750 262.500 Jasmine Limited Adjusted Trial Balance 31 December 2018 Cash Accounts receivable Office equipment 1 Accumulated depreciation office cquipment Accounts payable Income tax payable Share Capital Retained earnings Dividends Sales commission carned Advertising expense Insurance expense Rent expense Salary expense Utilities expense Depreciation expense: office equipment Income taxes expense Totals 50,000 100.000 50,000 125.000 100,000 42 500 542.500 80,000 10.000 100.000 112.500 76.250 25.000 50.000 5967.500 $967.500 Required: (a) Prepare the closing entries as at 31 December 2018 (7 marks) (b) What type of accounts is referred to as permanent accounts? (1 mark) (c) Is Dividends account closed to income summary account or retained earnings account? Explain. (1 mark) (d) What is the updated amount of retained earnings at 31 December 2018 after the closing entries? (1 mark) Page 5 of 15 Question A3 (10%) The following events were occurred in Premier Book Company Limited ("Premier Book"): (1) During December 2019, Premier Book recorded revenue when $50,000 books coupons had been sold out for cash of which only $47.000 books have been delivered to the customers. (2) At the end of January 2020, Premier Book paid the cleaning services of $2,000 for December 2019. The cleaning expense was recorded on the payment date. (3) Premier Book paid an amount of $12,000 in December 2019 to rent an apartment for the shareholder's daughter who was away at college. It was reported as December's rent expense in the Premier Book's financial statements (4) Premier Book purchased a printing machine at $50,000 in September 2019. At the end of December 2019, the accountant adjusted the value of printing machine to market value at $55.000 and recorded a gain of $5.000. Required: For each of the events (1) to (4) described above, (a) identify the relevant accounting principle that has been violated. (4 marks) (b) indicate the effect (with dollar amount of each of the above error on the financial statement of Premier Book at the end of December 2012 described in the column headings in the table below. Use the following symbols: 0 - overstated, U understated and NE no effect. Assets Liabilities Equity elle (6 marks) - End of Section A- Page 6 of 15 Question B1 Lucy Company (Lucy) is engaged in purchases and sales of plastic folders. The company adopts perpetual inventory system, closes its accounts annually and has gross profit rate of 40% in general. The following information was extracted from the adjusted trial balance on 30 November 2018 Debit Credit 3,850,000 Sales Sales returns and allowances Cost of goods sold Inventory 15,000 2,650,000 450.000 The following transactions occurred in December 2018: Dec 3 Lucy purchased S150,000 inventory from its supplier on account. Dec 5 Lucy sold goods to Kenny Company at $80,000 on account. Dec 8 Dec 10 Lucy returned $20,000 inventory of the purchase on Dec 3 to its supplier due to incorrect colour of folders. Kenny Company returned $10,000 goods to Lucy due to incorrect size of folders. Lucy received check from Kenny Company for full settlement regarding to sales in December. Lucy paid to supplier in full regarding to the purchase in December. Dec 15 Dec 23 Dec 31 Lucy conducted physical count of inventory and revealed $520,000 Lucy cond inventory was on hand. Required: (a) Prepare journal entries for Lucy Company regarding to the above transactions in December 2018 (12 marks) (b) Calculate (i) net sales and (ii) cost of goods sold shown in the Income Statement for the year ended 31 December 2018. (3 marks) Page 7 of 15