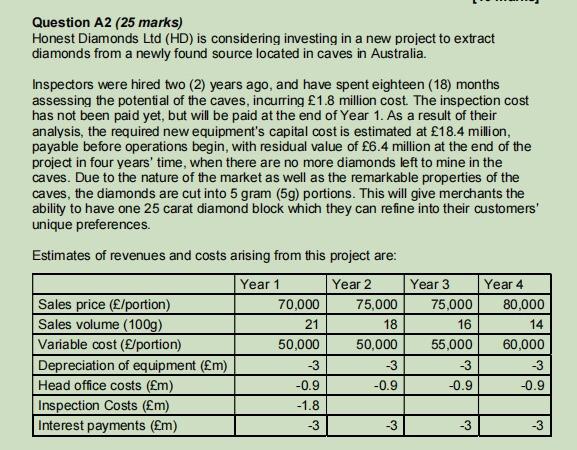

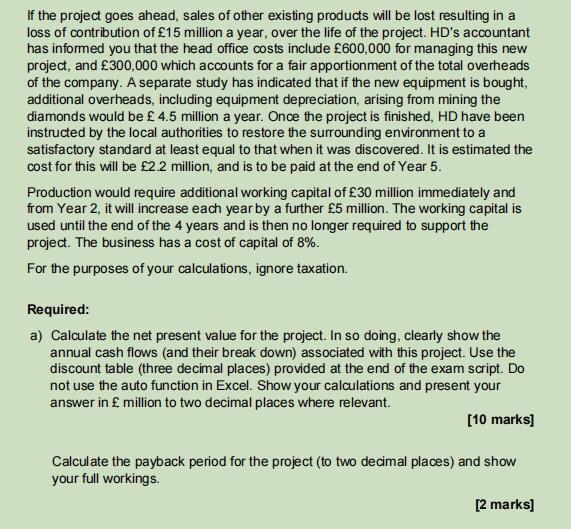

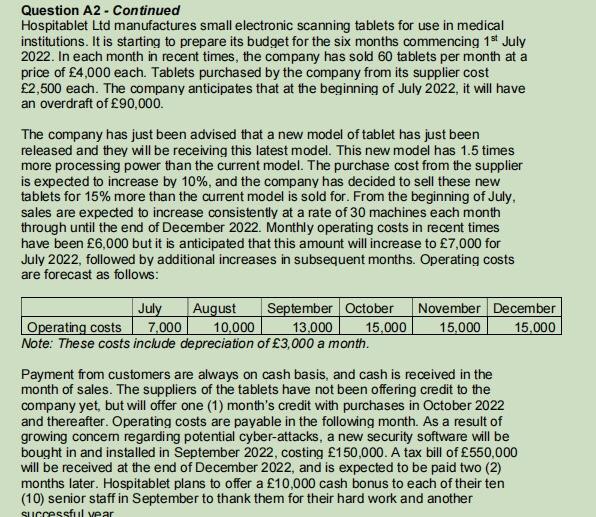

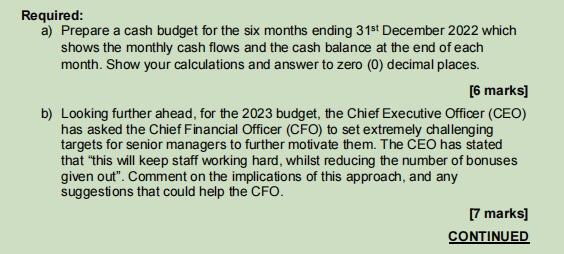

Question A2 (25 marks) Honest Diamonds Ltd (HD) is considering investing in a new project to extract diamonds from a newly found source located in caves in Australia. Inspectors were hired two (2) years ago, and have spent eighteen (18) months assessing the potential of the caves, incurring 1.8 million cost. The inspection cost has not been paid yet, but will be paid at the end of Year 1. As a result of their analysis, the required new equipment's capital cost is estimated at 18.4 million, payable before operations begin, with residual value of 6.4 million at the end of the project in four years' time, when there are no more diamonds left to mine in the caves. Due to the nature of the market as well as the remarkable properties of the caves, the diamonds are cut into 5 gram (5g) portions. This will give merchants the ability to have one 25 carat diamond block which they can refine into their customers' unique preferences. Estimates of revenues and costs arising from this project are: Year 1 Year 2 Year 3 Year 4 Sales price (/portion) 70,000 75,000 Sales volume (100g) 21 18 Variable cost (/portion) 50,000 50,000 Depreciation of equipment (m) -3 -3 -0.9 -0.9 Head office costs (m) Inspection Costs (m) -1.8 Interest payments (m) -3 -3 75,000 16 55,000 -3 -0.9 -3 80,000 14 60,000 -3 -0.9 -3 If the project goes ahead, sales of other existing products will be lost resulting in a loss of contribution of 15 million a year, over the life of the project. HD's accountant has informed you that the head office costs include 600,000 for managing this new project, and 300,000 which accounts for a fair apportionment of the total overheads of the company. A separate study has indicated that if the new equipment is bought, additional overheads, including equipment depreciation, arising from mining the diamonds would be 4.5 million a year. Once the project is finished, HD have been instructed by the local authorities to restore the surrounding environment to a satisfactory standard at least equal to that when it was discovered. It is estimated the cost for this will be 2.2 million, and is to be paid at the end of Year 5. Production would require additional working capital of 30 million immediately and from Year 2, it will increase each year by a further 5 million. The working capital is used until the end of the 4 years and is then no longer required to support the project. The business has a cost of capital of 8%. For the purposes of your calculations, ignore taxation. Required: a) Calculate the net present value for the project. In so doing, clearly show the annual cash flows (and their break down) associated with this project. Use the discount table (three decimal places) provided at the end of the exam script. Do not use the auto function in Excel. Show your calculations and present your answer in million to two decimal places where relevant. [10 marks] Calculate the payback period for the project (to two decimal places) and show your full workings. [2 marks] Question A2 - Continued Hospitablet Ltd manufactures small electronic scanning tablets for use in medical institutions. It is starting to prepare its budget for the six months commencing 1st July 2022. In each month in recent times, the company has sold 60 tablets per month at a price of 4,000 each. Tablets purchased by the company from its supplier cost 2,500 each. The company anticipates that at the beginning of July 2022, it will have an overdraft of 90,000. The company has just been advised that a new model of tablet has just been released and they will be receiving this latest model. This new model has 1.5 times more processing power than the current model. The purchase cost from the supplier is expected to increase by 10%, and the company has decided to sell these new tablets for 15% more than the current model is sold for. From the beginning of July. sales are expected to increase consistently at a rate of 30 machines each month through until the end of December 2022. Monthly operating costs in recent times have been 6,000 but it is anticipated that this amount will increase to 7,000 for July 2022, followed by additional increases in subsequent months. Operating costs are forecast as follows: July August September October November December 10,000 13.000 15,000 15,000 Operating costs 7,000 15,000 Note: These costs include depreciation of 3,000 a month. Payment from customers are always on cash basis, and cash is received in the month of sales. The suppliers of the tablets have not been offering credit to the company yet, but will offer one (1) month's credit with purchases in October 2022 and thereafter. Operating costs are payable in the following month. As a result of growing concern regarding potential cyber-attacks, a new security software will be bought in and installed in September 2022, costing 150,000. A tax bill of 550,000 will be received at the end of December 2022, and is expected to be paid two (2) months later. Hospitablet plans to offer a 10,000 cash bonus to each of their ten (10) senior staff in September to thank them for their hard work and another successful year Required: a) Prepare a cash budget for the six months ending 31st December 2022 which shows the monthly cash flows and the cash balance at the end of each month. Show your calculations and answer to zero (0) decimal places. [6 marks] b) Looking further ahead, for the 2023 budget, the Chief Executive Officer (CEO) has asked the Chief Financial Officer (CFO) to set extremely challenging targets for senior managers to further motivate them. The CEO has stated that "this will keep staff working hard, whilst reducing the number of bonuses given out". Comment on the implications of this approach, and any suggestions that could help the CFO. [7 marks] CONTINUED Question A2 (25 marks) Honest Diamonds Ltd (HD) is considering investing in a new project to extract diamonds from a newly found source located in caves in Australia. Inspectors were hired two (2) years ago, and have spent eighteen (18) months assessing the potential of the caves, incurring 1.8 million cost. The inspection cost has not been paid yet, but will be paid at the end of Year 1. As a result of their analysis, the required new equipment's capital cost is estimated at 18.4 million, payable before operations begin, with residual value of 6.4 million at the end of the project in four years' time, when there are no more diamonds left to mine in the caves. Due to the nature of the market as well as the remarkable properties of the caves, the diamonds are cut into 5 gram (5g) portions. This will give merchants the ability to have one 25 carat diamond block which they can refine into their customers' unique preferences. Estimates of revenues and costs arising from this project are: Year 1 Year 2 Year 3 Year 4 Sales price (/portion) 70,000 75,000 Sales volume (100g) 21 18 Variable cost (/portion) 50,000 50,000 Depreciation of equipment (m) -3 -3 -0.9 -0.9 Head office costs (m) Inspection Costs (m) -1.8 Interest payments (m) -3 -3 75,000 16 55,000 -3 -0.9 -3 80,000 14 60,000 -3 -0.9 -3 If the project goes ahead, sales of other existing products will be lost resulting in a loss of contribution of 15 million a year, over the life of the project. HD's accountant has informed you that the head office costs include 600,000 for managing this new project, and 300,000 which accounts for a fair apportionment of the total overheads of the company. A separate study has indicated that if the new equipment is bought, additional overheads, including equipment depreciation, arising from mining the diamonds would be 4.5 million a year. Once the project is finished, HD have been instructed by the local authorities to restore the surrounding environment to a satisfactory standard at least equal to that when it was discovered. It is estimated the cost for this will be 2.2 million, and is to be paid at the end of Year 5. Production would require additional working capital of 30 million immediately and from Year 2, it will increase each year by a further 5 million. The working capital is used until the end of the 4 years and is then no longer required to support the project. The business has a cost of capital of 8%. For the purposes of your calculations, ignore taxation. Required: a) Calculate the net present value for the project. In so doing, clearly show the annual cash flows (and their break down) associated with this project. Use the discount table (three decimal places) provided at the end of the exam script. Do not use the auto function in Excel. Show your calculations and present your answer in million to two decimal places where relevant. [10 marks] Calculate the payback period for the project (to two decimal places) and show your full workings. [2 marks] Question A2 - Continued Hospitablet Ltd manufactures small electronic scanning tablets for use in medical institutions. It is starting to prepare its budget for the six months commencing 1st July 2022. In each month in recent times, the company has sold 60 tablets per month at a price of 4,000 each. Tablets purchased by the company from its supplier cost 2,500 each. The company anticipates that at the beginning of July 2022, it will have an overdraft of 90,000. The company has just been advised that a new model of tablet has just been released and they will be receiving this latest model. This new model has 1.5 times more processing power than the current model. The purchase cost from the supplier is expected to increase by 10%, and the company has decided to sell these new tablets for 15% more than the current model is sold for. From the beginning of July. sales are expected to increase consistently at a rate of 30 machines each month through until the end of December 2022. Monthly operating costs in recent times have been 6,000 but it is anticipated that this amount will increase to 7,000 for July 2022, followed by additional increases in subsequent months. Operating costs are forecast as follows: July August September October November December 10,000 13.000 15,000 15,000 Operating costs 7,000 15,000 Note: These costs include depreciation of 3,000 a month. Payment from customers are always on cash basis, and cash is received in the month of sales. The suppliers of the tablets have not been offering credit to the company yet, but will offer one (1) month's credit with purchases in October 2022 and thereafter. Operating costs are payable in the following month. As a result of growing concern regarding potential cyber-attacks, a new security software will be bought in and installed in September 2022, costing 150,000. A tax bill of 550,000 will be received at the end of December 2022, and is expected to be paid two (2) months later. Hospitablet plans to offer a 10,000 cash bonus to each of their ten (10) senior staff in September to thank them for their hard work and another successful year Required: a) Prepare a cash budget for the six months ending 31st December 2022 which shows the monthly cash flows and the cash balance at the end of each month. Show your calculations and answer to zero (0) decimal places. [6 marks] b) Looking further ahead, for the 2023 budget, the Chief Executive Officer (CEO) has asked the Chief Financial Officer (CFO) to set extremely challenging targets for senior managers to further motivate them. The CEO has stated that "this will keep staff working hard, whilst reducing the number of bonuses given out". Comment on the implications of this approach, and any suggestions that could help the CFO. [7 marks] CONTINUED