Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question A4 (12 marks) Comfort Dance Corporation (CDC) is a major distributor of dance shoes. All sales are on terms 2/10, n/30. CDC uses

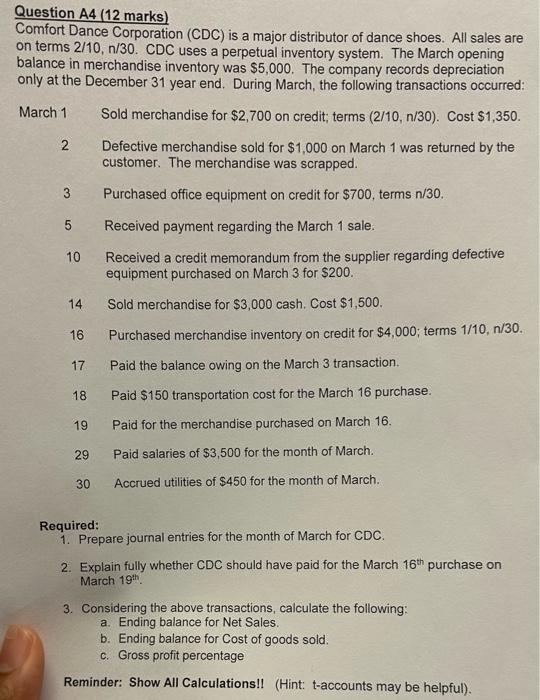

Question A4 (12 marks) Comfort Dance Corporation (CDC) is a major distributor of dance shoes. All sales are on terms 2/10, n/30. CDC uses a perpetual inventory system. The March opening balance in merchandise inventory was $5,000. The company records depreciation only at the December 31 year end. During March, the following transactions occurred: March 1 2 Sold merchandise for $2,700 on credit; terms (2/10, n/30). Cost $1,350. Defective merchandise sold for $1,000 on March 1 was returned by the customer. The merchandise was scrapped. 3 Purchased office equipment on credit for $700, terms n/30. Received payment regarding the March 1 sale. 10 Received a credit memorandum from the supplier regarding defective equipment purchased on March 3 for $200. Sold merchandise for $3,000 cash. Cost $1,500. Purchased merchandise inventory on credit for $4,000; terms 1/10, n/30. Paid the balance owing on the March 3 transaction. Paid $150 transportation cost for the March 16 purchase. 14 16 17 18 19 Paid for the merchandise purchased on March 16. 29 30 Paid salaries of $3,500 for the month of March. Accrued utilities of $450 for the month of March. Required: 1. Prepare journal entries for the month of March for CDC. 2. Explain fully whether CDC should have paid for the March 16th purchase on March 19th 3. Considering the above transactions, calculate the following: a. Ending balance for Net Sales. b. Ending balance for Cost of goods sold. c. Gross profit percentage Reminder: Show All Calculations!! (Hint: t-accounts may be helpful).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Below is the journal entries for the month of March March 1 Sale on credit Debit Accounts Receivable 2700 Credit Sales 2700 Debit Cost of Goods Sold 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started