Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question about floating rate bond Firstly, when calculating bond price, why the numerator is using rate directly * year(APR) but dicounting, the denominator using EPR?

Question about floating rate bond

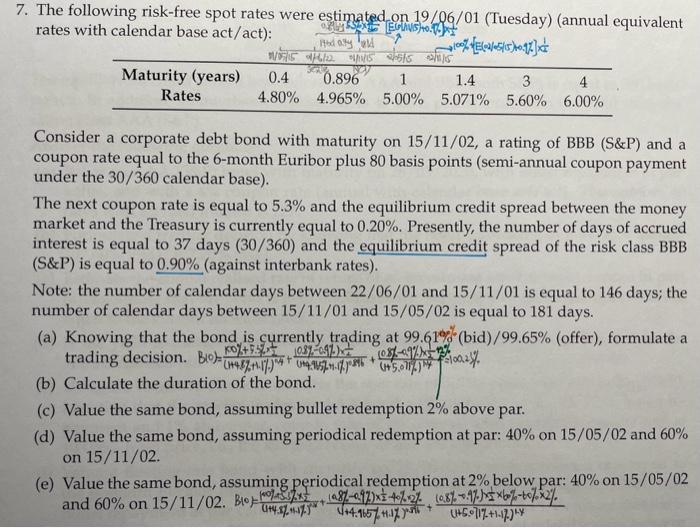

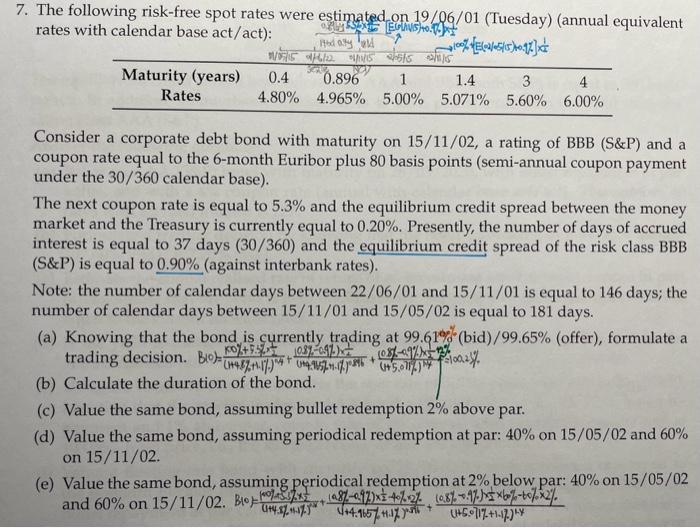

7. The following risk-free spot rates were estimated on 19/06/01 (Tuesday) (annual equivalent rates with calendar base act/act): Consider a corporate debt bond with maturity on 15/11/02, a rating of BBB (S\&P) and a coupon rate equal to the 6 -month Euribor plus 80 basis points (semi-annual coupon payment under the 30/360 calendar base). The next coupon rate is equal to 5.3% and the equilibrium credit spread between the money market and the Treasury is currently equal to 0.20%. Presently, the number of days of accrued interest is equal to 37 days (30/360) and the equilibrium credit spread of the risk class BBB (S&P) is equal to 0.90% (against interbank rates). Note: the number of calendar days between 22/06/01 and 15/11/01 is equal to 146 days; the number of calendar days between 15/11/01 and 15/05/02 is equal to 181 days. (a) Knowing that the bond is currently trading at 99.61%% (bid) /99.65% (offer), formulate a (c) Value the same bond, assuming bullet redemption 2% above par. (d) Value the same bond, assuming periodical redemption at par: 40% on 15/05/02 and 60% on 15/11/02. (e) Value the same bond, assuming periodical redemption at 2% below par: 40% on 15/05/02 Firstly, when calculating bond price, why the numerator is using rate directly * year(APR) but dicounting, the denominator using EPR?

Then pleassse explain in detail the following question in figure, I really confused about each question, for example, why there is 1.1% in the denominator; why in c) we just need to +2% and in d) we *60% in the end; and also the logic in d)

Thank you sooo much!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started