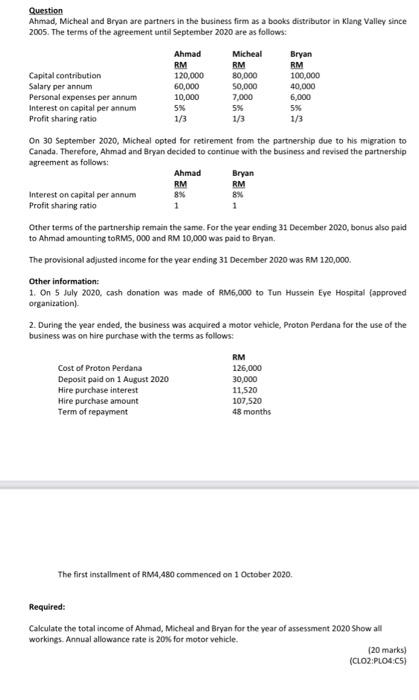

Question Ahmad, Micheal and Bryan are partners in the business firm as a books distributor in Klang Valley since 2005. The terms of the agreement until September 2020 are as follows: 6,000 5% RM Ahmad Micheal Bryan RM RM RM Capital contribution 120,000 80,000 100,000 Salary per annum 60,000 50,000 40,000 Personal expenses per annum 10,000 7,000 Interest on capital per annum 5% 5% Profit sharing ratio 1/3 1/3 1/3 On 30 September 2020, Micheal opted for retirement from the partnership due to his migration to Canada. Therefore, Ahmad and Bryan decided to continue with the business and revised the partnership agreement as follows: Ahmad Bryan RM Interest on capital per annum 8% 8% Profit sharing ratio 1 Other terms of the partnership remain the same. For the year ending 31 December 2020, bonus also paid to Ahmad amounting to RM5,000 and RM 10,000 was paid to Bryan The provisional adjusted income for the year ending 31 December 2020 was RM 120,000 Other information: 1. On 5 July 2020, cash donation was made of RM6,000 to Tun Hussein Eye Hospital (approved organization) 2. During the year ended the business was acquired a motor vehicle, Proton Perdana for the use of the business was on hire purchase with the terms as follows: Cost of Proton Perdana Deposit paid on 1 August 2020 Hire purchase interest Hire purchase amount Term of repayment RM 126,000 30,000 11,520 107,520 48 months The first installment of RM4,480 commenced on 1 October 2020 Required: Calculate the total income of Ahmad, Micheal and Bryan for the year of assessment 2020 Show all workings. Annual allowance rate is 20% for motor vehicle. (20 marks) (CLO2:PLO4C5) Question Ahmad, Micheal and Bryan are partners in the business firm as a books distributor in Klang Valley since 2005. The terms of the agreement until September 2020 are as follows: 6,000 5% RM Ahmad Micheal Bryan RM RM RM Capital contribution 120,000 80,000 100,000 Salary per annum 60,000 50,000 40,000 Personal expenses per annum 10,000 7,000 Interest on capital per annum 5% 5% Profit sharing ratio 1/3 1/3 1/3 On 30 September 2020, Micheal opted for retirement from the partnership due to his migration to Canada. Therefore, Ahmad and Bryan decided to continue with the business and revised the partnership agreement as follows: Ahmad Bryan RM Interest on capital per annum 8% 8% Profit sharing ratio 1 Other terms of the partnership remain the same. For the year ending 31 December 2020, bonus also paid to Ahmad amounting to RM5,000 and RM 10,000 was paid to Bryan The provisional adjusted income for the year ending 31 December 2020 was RM 120,000 Other information: 1. On 5 July 2020, cash donation was made of RM6,000 to Tun Hussein Eye Hospital (approved organization) 2. During the year ended the business was acquired a motor vehicle, Proton Perdana for the use of the business was on hire purchase with the terms as follows: Cost of Proton Perdana Deposit paid on 1 August 2020 Hire purchase interest Hire purchase amount Term of repayment RM 126,000 30,000 11,520 107,520 48 months The first installment of RM4,480 commenced on 1 October 2020 Required: Calculate the total income of Ahmad, Micheal and Bryan for the year of assessment 2020 Show all workings. Annual allowance rate is 20% for motor vehicle. (20 marks) (CLO2:PLO4C5)