Answered step by step

Verified Expert Solution

Question

1 Approved Answer

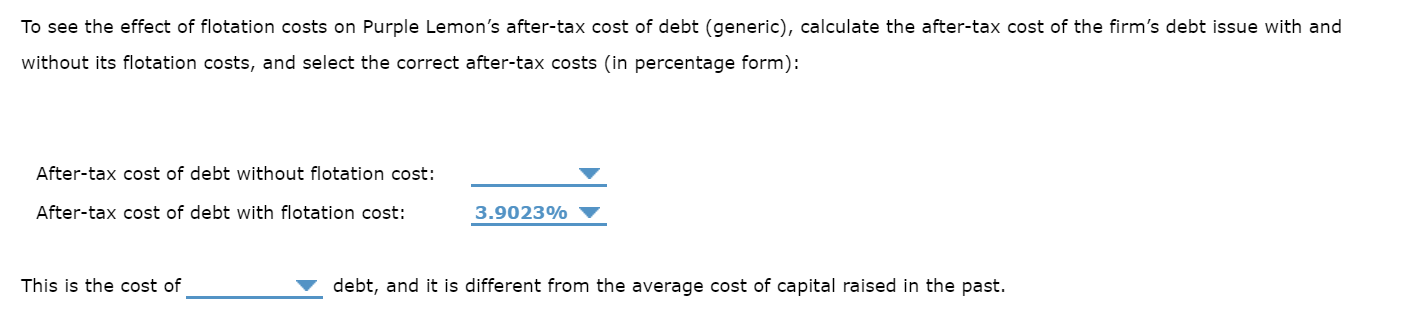

Question Answer Choices: Question 1: added to, subtracted from Question 2: 3.6575%, 3.0800%, 3.2725%, 3.8500% Question 3: 3.6575%, 4.2350%, 3.4650%, 3.9023% Question 4: historical, marginal

Question Answer Choices:

Question Answer Choices:

Question 1: added to, subtracted from

Question 2: 3.6575%, 3.0800%, 3.2725%, 3.8500%

Question 3: 3.6575%, 4.2350%, 3.4650%, 3.9023%

Question 4: historical, marginal

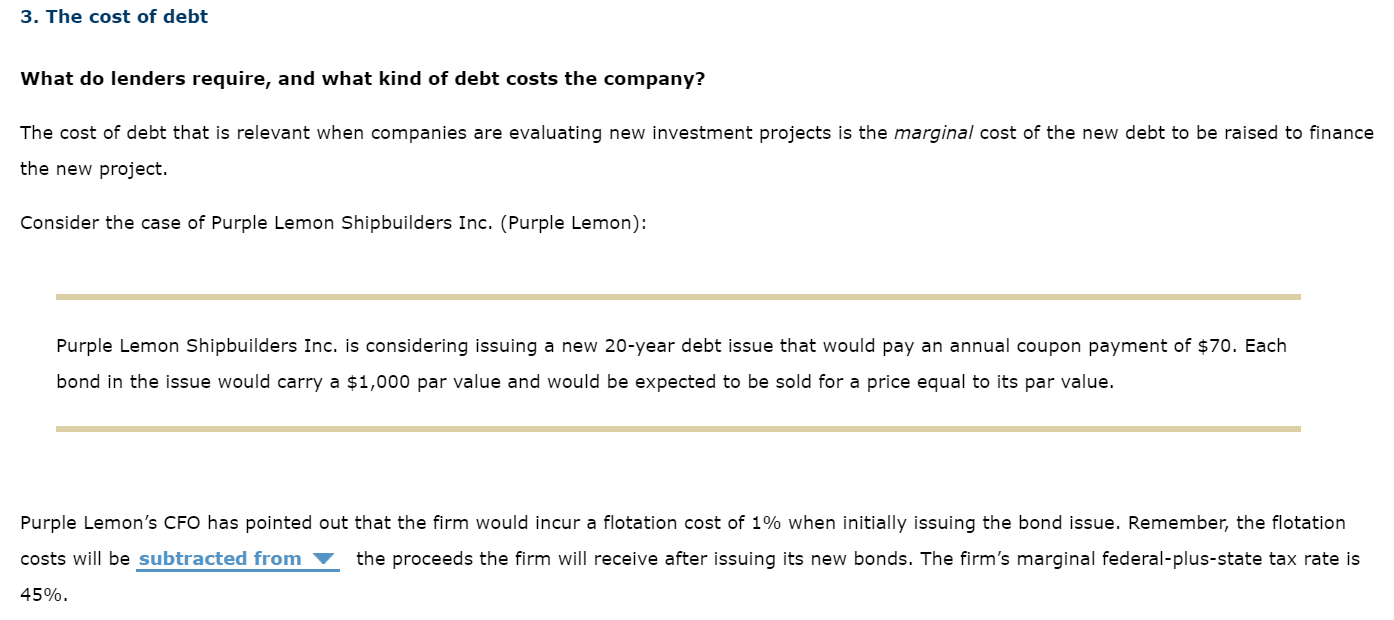

What do lenders require, and what kind of debt costs the company? The cost of debt that is relevant when companies are evaluating new investment projects is the marginal cost of the new to be the the new project. Consider the case of Purple Lemon Shipbuilders Inc. (Purple Lemon): Purple Lemon Shipbuilders Inc. is considering issuing a new 20 -year debt issue that would pay an annent $70. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value. Purple Lemon's CFO has pointed out that the firm would incur a flotation cost of 1% when initially issuing the bond issue. Remember, the flotation costs will be the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 45% To see the effect of flotation costs on Purple Lemon's after-tax cost of debt (generic), calculate the after-tax cost of the firm's debt issue with and without its flotation costs, and select the correct after-tax costs (in percentage form)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started