Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

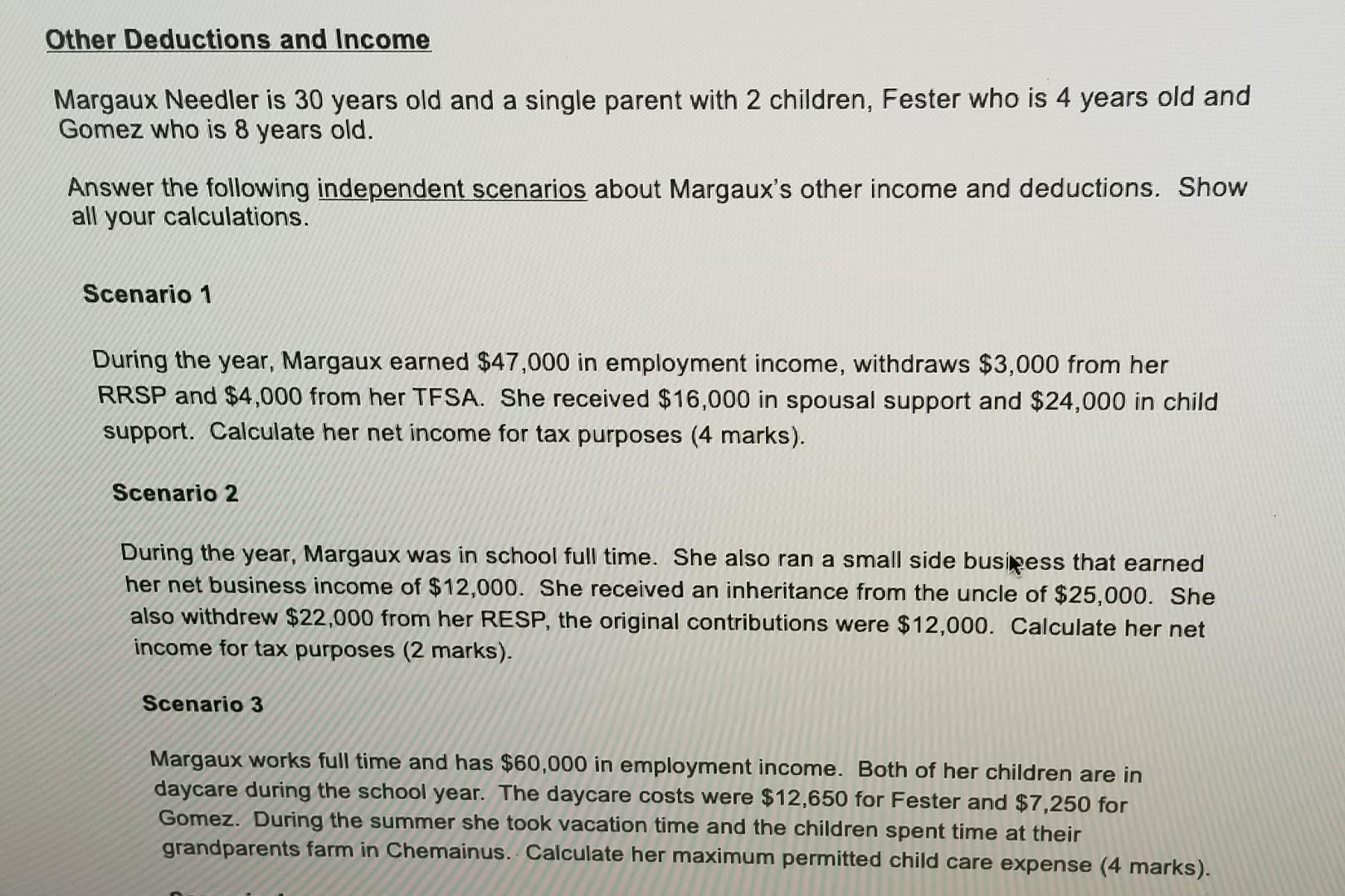

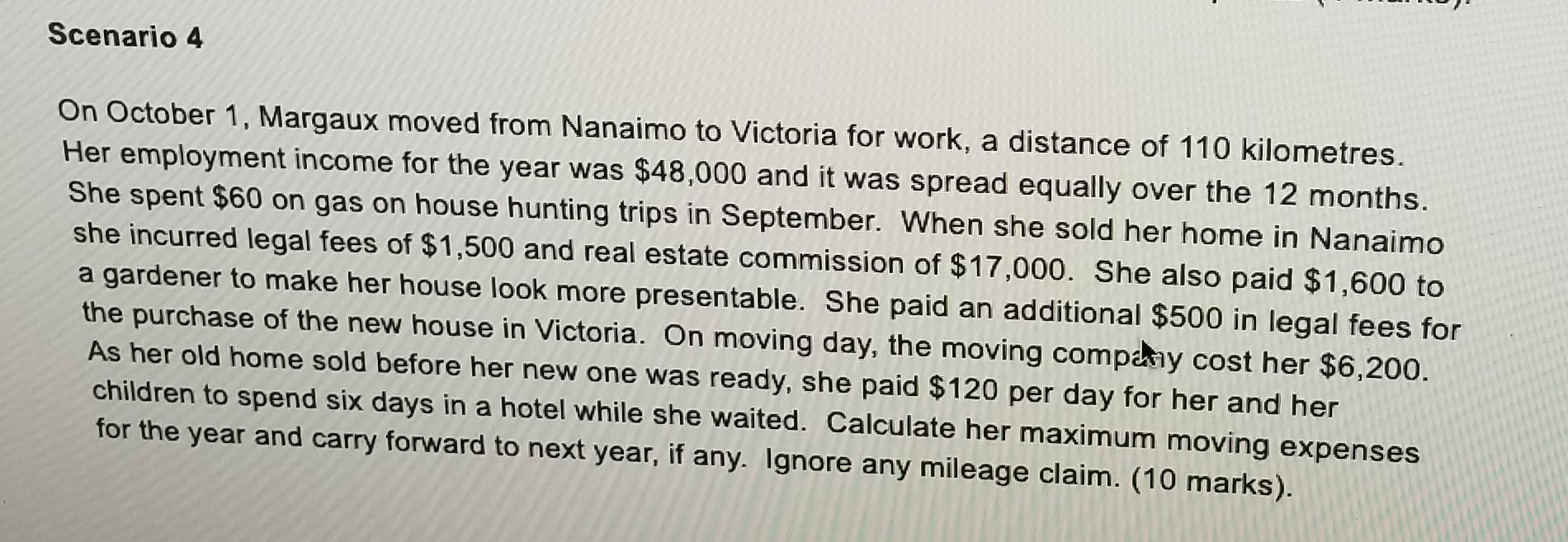

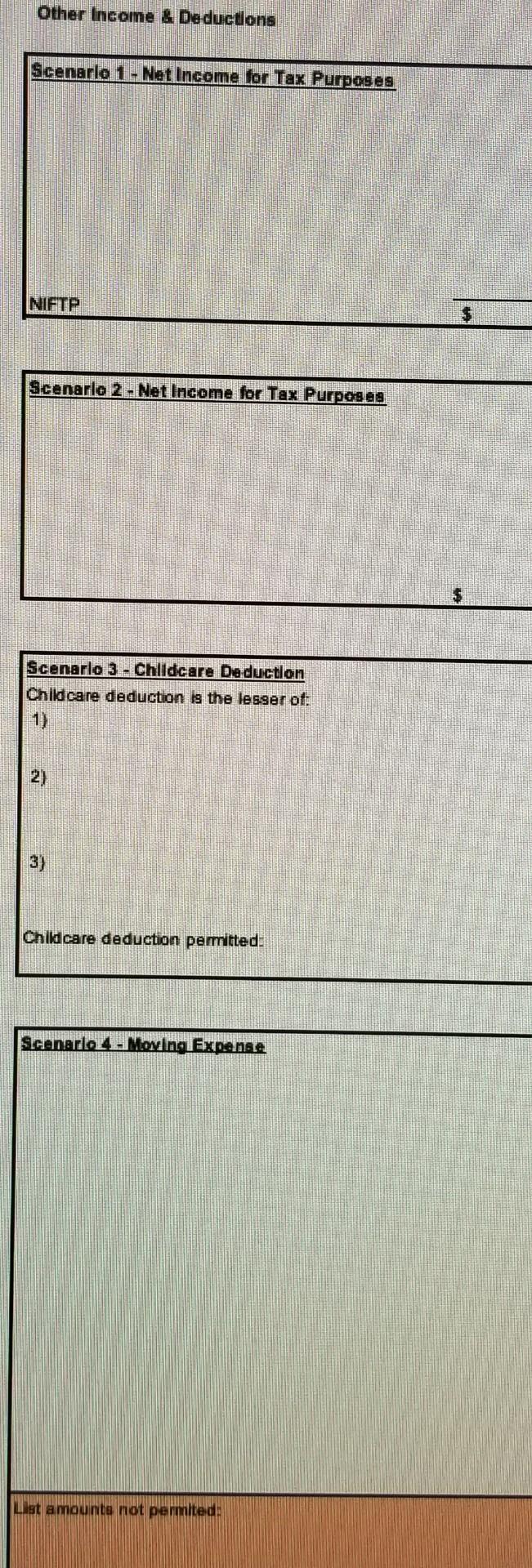

Other Deductions and Income Margaux Needler is 30 years old and a single parent with 2 children, Fester who is 4 years old and Gomez who is 8 years old. Answer the following independent scenarios about Margaux's other income and deductions. Show all your calculations. Scenario 1 During the year, Margaux earned $47,000 in employment income, withdraws $3,000 from her RRSP and $4,000 from her TFSA. She received $16,000 in spousal support and $24,000 in child support. Calculate her net income for tax purposes (4 marks). Scenario 2 During the year, Margaux was in school full time. She also ran a small side business that earned her net business income of $12,000. She received an inheritance from the uncle of $25,000. She also withdrew $22,000 from her RESP, the original contributions were $12,000. Calculate her net income for tax purposes (2 marks). Scenario 3 Margaux works full time and has $60,000 in employment income. Both of her children are in daycare during the school year. The daycare costs were $12,650 for Fester and $7,250 for Gomez. During the summer she took vacation time and the children spent time at their grandparents farm in Chemainus. Calculate her maximum permitted child care expense (4 marks). Scenario 4 On October 1, Margaux moved from Nanaimo to Victoria for work, a distance of 110 kilometres. Her employment income for the year was $48,000 and it was spread equally over the 12 months. She spent $60 on gas on house hunting trips in September. When she sold her home in Nanaimo she incurred legal fees of $1,500 and real estate commission of $17,000. She also paid $1,600 to a gardener to make her house look more presentable. She paid an additional $500 in legal fees for the purchase of the new house in Victoria. On moving day, the moving company cost her $6,200. As her old home sold before her new one was ready, she paid $120 per day for her and her children to spend six days in a hotel while she waited. Calculate her maximum moving expenses for the year and carry forward to next year, if any. Ignore any mileage claim. (10 marks). Other Income & Deductions Scenarle 1- Net Income for Tax Purposes NIFTP Scenarlo 2 - Net Income for Tax Purposes Scenarlo 3 - Childcare Deduction Childcare deduction is the lesser of: 1) 2) 3) Childcare deduction permitted. Scanarle 4 - Moving Expense List amounts not permited Other Deductions and Income Margaux Needler is 30 years old and a single parent with 2 children, Fester who is 4 years old and Gomez who is 8 years old. Answer the following independent scenarios about Margaux's other income and deductions. Show all your calculations. Scenario 1 During the year, Margaux earned $47,000 in employment income, withdraws $3,000 from her RRSP and $4,000 from her TFSA. She received $16,000 in spousal support and $24,000 in child support. Calculate her net income for tax purposes (4 marks). Scenario 2 During the year, Margaux was in school full time. She also ran a small side business that earned her net business income of $12,000. She received an inheritance from the uncle of $25,000. She also withdrew $22,000 from her RESP, the original contributions were $12,000. Calculate her net income for tax purposes (2 marks). Scenario 3 Margaux works full time and has $60,000 in employment income. Both of her children are in daycare during the school year. The daycare costs were $12,650 for Fester and $7,250 for Gomez. During the summer she took vacation time and the children spent time at their grandparents farm in Chemainus. Calculate her maximum permitted child care expense (4 marks). Scenario 4 On October 1, Margaux moved from Nanaimo to Victoria for work, a distance of 110 kilometres. Her employment income for the year was $48,000 and it was spread equally over the 12 months. She spent $60 on gas on house hunting trips in September. When she sold her home in Nanaimo she incurred legal fees of $1,500 and real estate commission of $17,000. She also paid $1,600 to a gardener to make her house look more presentable. She paid an additional $500 in legal fees for the purchase of the new house in Victoria. On moving day, the moving company cost her $6,200. As her old home sold before her new one was ready, she paid $120 per day for her and her children to spend six days in a hotel while she waited. Calculate her maximum moving expenses for the year and carry forward to next year, if any. Ignore any mileage claim. (10 marks). Other Income & Deductions Scenarle 1- Net Income for Tax Purposes NIFTP Scenarlo 2 - Net Income for Tax Purposes Scenarlo 3 - Childcare Deduction Childcare deduction is the lesser of: 1) 2) 3) Childcare deduction permitted. Scanarle 4 - Moving Expense List amounts not permitedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started