Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

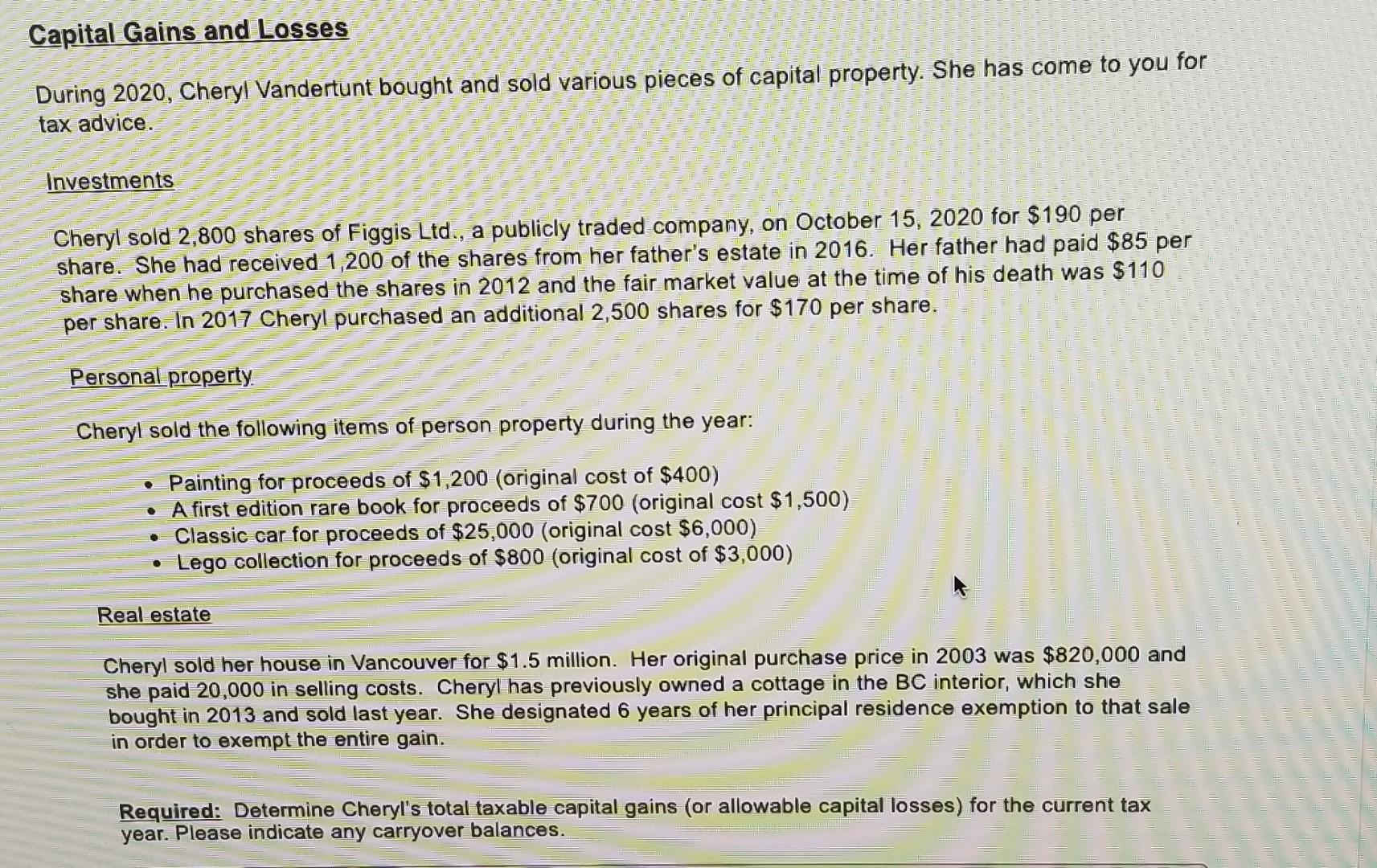

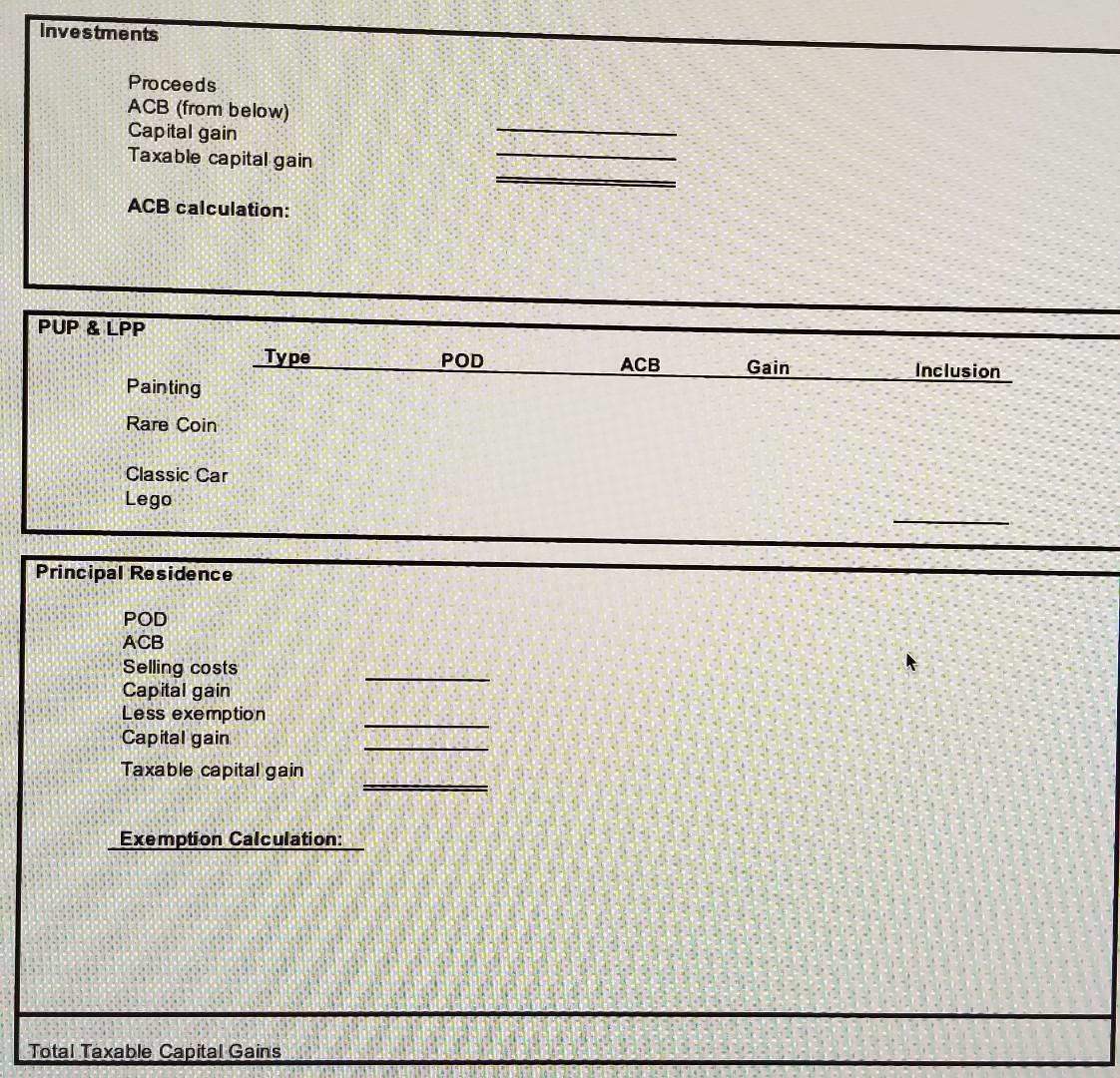

Capital Gains and Losses During 2020, Cheryl Vandertunt bought and sold various pieces of capital property. She has come to you for tax advice. Investments Cheryl sold 2,800 shares of Figgis Ltd., a publicly traded company, on October 15, 2020 for $190 per share. She had received 1,200 of the shares from her father's estate in 2016. Her father had paid $85 per share when he purchased the shares in 2012 and the fair market value at the time of his death was $110 per share. In 2017 Cheryl purchased an additional 2,500 shares for $170 per share. Personal property. Cheryl sold the following items of person property during the year: Painting for proceeds of $1,200 (original cost of $400) A first edition rare book for proceeds of $700 (original cost $1,500) Classic car for proceeds of $25,000 (original cost $6,000) Lego collection for proceeds of $800 (original cost of $3,000) Real estate Cheryl sold her house in Vancouver for $1.5 million. Her original purchase price in 2003 was $820,000 and she paid 20,000 in selling costs. Cheryl has previously owned a cottage in the BC interior, which she bought in 2013 and sold last year. She designated 6 years of her principal residence exemption to that sale in order to exempt the entire gain. Required: Determine Cheryl's total taxable capital gains (or allowable capital losses) for the current tax year. Please indicate any carryover balances. Investments Proceeds ACB (from below) Capital gain Taxable capital gain ACB calculation: PUP & LPP Type POD ACB Gain Inclusion Painting Rare Coin Classic Car Lego Principal Residence POD ACB Selling costs Capital gain Less exemption Capital gain Taxable capital gain Exemption Calculation: Total Taxable Capital GainsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started