Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

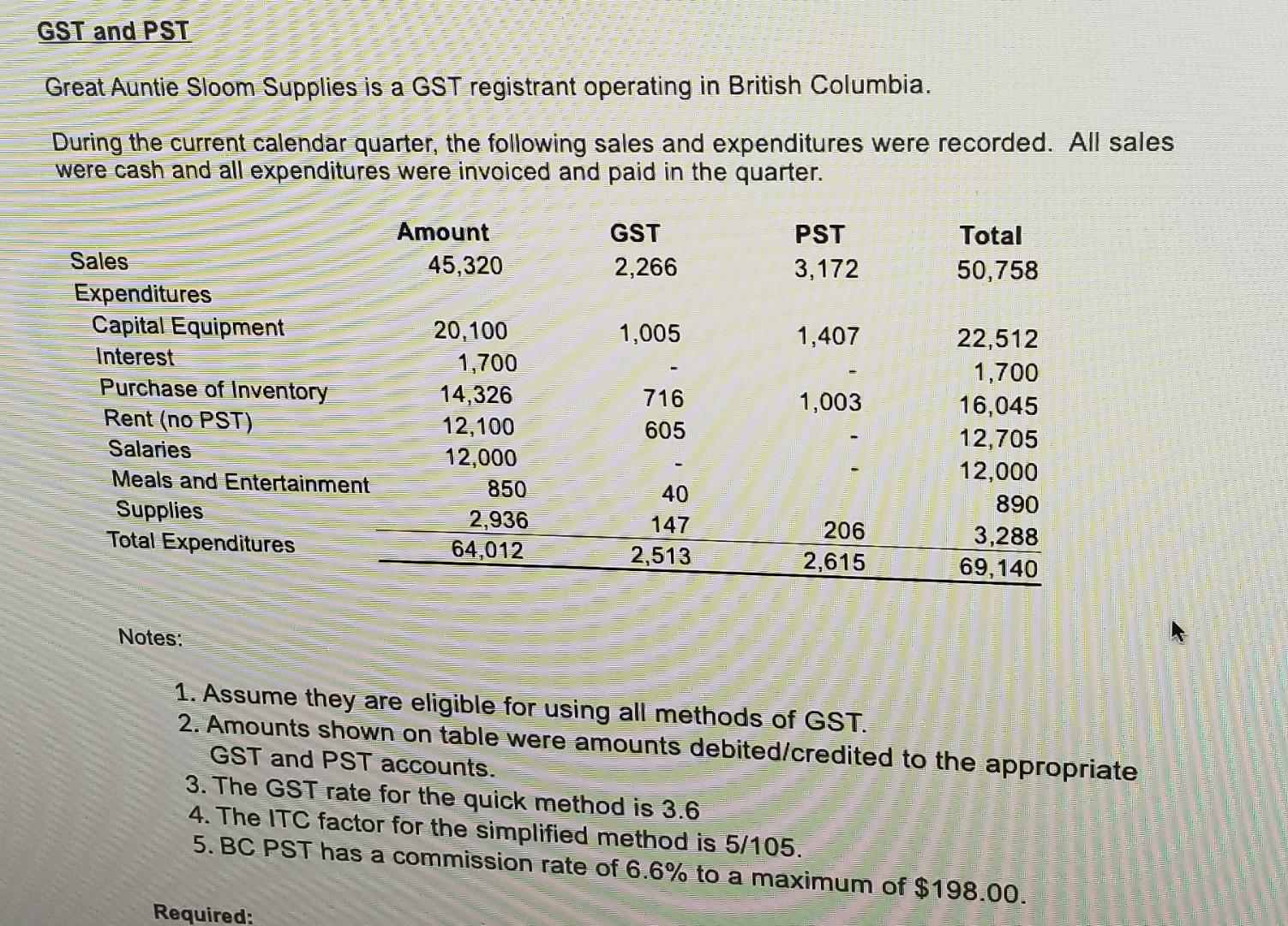

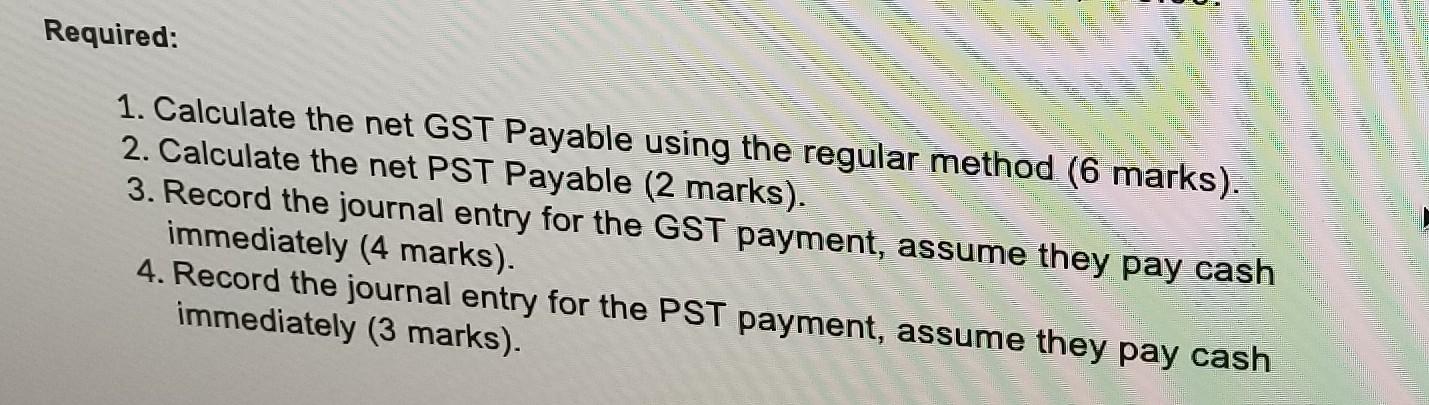

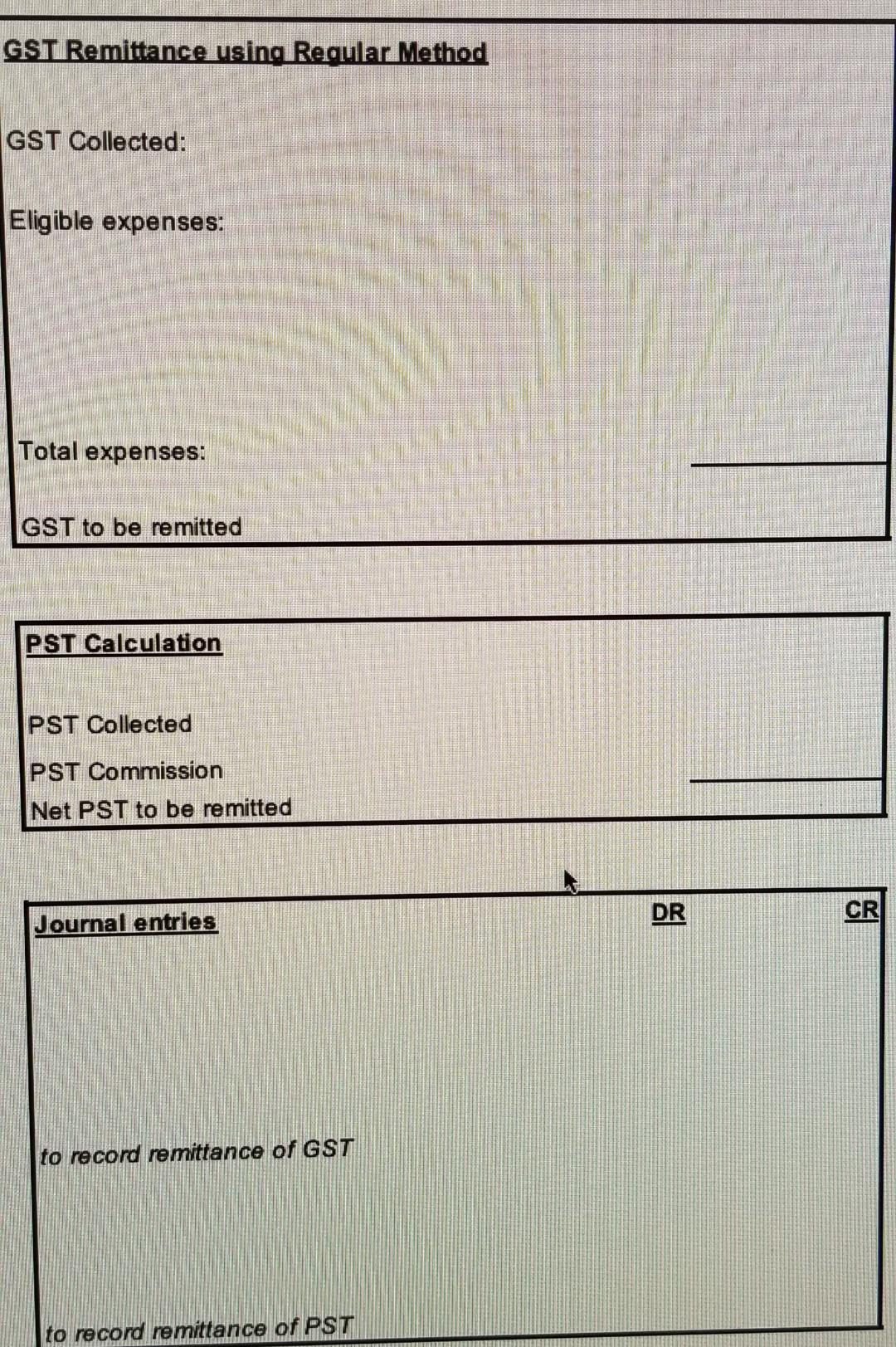

GST and PST Great Auntie Sloom Supplies is a GST registrant operating in British Columbia. During the current calendar quarter, the following sales and expenditures were recorded. All sales were cash and all expenditures were invoiced and paid in the quarter. Amount 45,320 GST 2,266 PST 3,172 Total 50,758 1,005 1,407 Sales Expenditures Capital Equipment Interest Purchase of Inventory Rent (no PST) Salaries Meals and Entertainment Supplies Total Expenditures 1,003 20,100 1,700 14,326 12,100 12,000 850 2,936 64,012 716 605 22,512 1,700 16,045 12,705 12,000 890 3,288 69,140 40 147 2,513 206 2,615 Notes: 1. Assume they are eligible for using all methods of GST. 2. Amounts shown on table were amounts debited/credited to the appropriate GST and PST accounts. 3. The GST rate for the quick method is 3.6 4. The ITC factor for the simplified method is 5/105. 5.BC PST has a commission rate of 6.6% to a maximum of $198.00. Required: HAM Required: 1. Calculate the net GST Payable using the regular method (6 marks). 2. Calculate the net PST Payable (2 marks). 3. Record the journal entry for the GST payment, assume they pay cash immediately (4 marks). 4. Record the journal entry for the PST payment, assume they pay cash immediately (3 marks). GST Remittance using Regular Method GST Collected: Eligible expenses: Total expenses: GST to be remitted PST Calculation PST Collected PST Commission Net PST to be remitted DR CR Journal entries to record remittance of GST to record remittance of PSTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started