Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer Sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer Sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

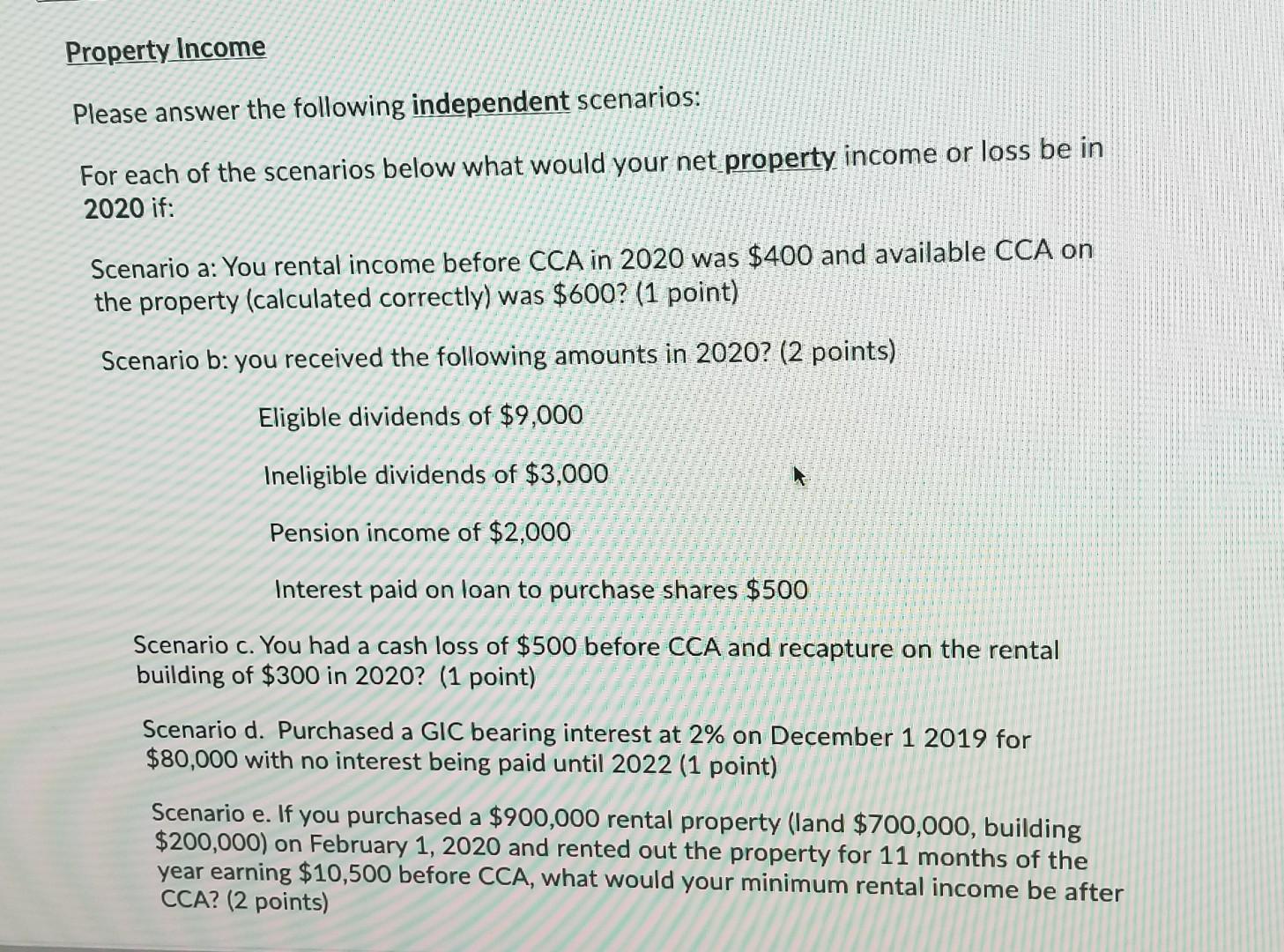

Property Income Please answer the following independent scenarios: For each of the scenarios below what would your net property income or loss be in 2020 if: Scenario a: You rental income before CCA in 2020 was $400 and available CCA on the property (calculated correctly) was $600? (1 point) Scenario b: you received the following amounts in 2020? (2 points) Eligible dividends of $9,000 Ineligible dividends of $3,000 Pension income of $2,000 Interest paid on loan to purchase shares $500 Scenario c. You had a cash loss of $500 before CCA and recapture on the rental building of $300 in 2020? (1 point) Scenario d. Purchased a GIC bearing interest at 2% on December 1 2019 for $80,000 with no interest being paid until 2022 (1 point) Scenario e. If you purchased a $900,000 rental property (land $700,000, building $200,000) on February 1, 2020 and rented out the property for 11 months of the year earning $10,500 before CCA, what would your minimum rental income be after CCA? (2 points) d) Property Income Please answer the following independent scenarios: For each of the scenarios below what would your net property income or loss be in 2020 if: Scenario a: You rental income before CCA in 2020 was $400 and available CCA on the property (calculated correctly) was $600? (1 point) Scenario b: you received the following amounts in 2020? (2 points) Eligible dividends of $9,000 Ineligible dividends of $3,000 Pension income of $2,000 Interest paid on loan to purchase shares $500 Scenario c. You had a cash loss of $500 before CCA and recapture on the rental building of $300 in 2020? (1 point) Scenario d. Purchased a GIC bearing interest at 2% on December 1 2019 for $80,000 with no interest being paid until 2022 (1 point) Scenario e. If you purchased a $900,000 rental property (land $700,000, building $200,000) on February 1, 2020 and rented out the property for 11 months of the year earning $10,500 before CCA, what would your minimum rental income be after CCA? (2 points) d)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started