Question ask to be solved by spreadsheet

You are asked to determine in which currencies to borrow and lend based on information in the spreadsheet

9. How should BID analyse its effective borrowing costs? Under what circumstances should BID expect to prefer borrowing in one currency rather than the other? If it were issuing a note (i.e., borrowing a currency) now (at the end of the data update), what would you recommend it to do?

9. How should BID analyse its effective borrowing costs? Under what circumstances should BID expect to prefer borrowing in one currency rather than the other? If it were issuing a note (i.e., borrowing a currency) now (at the end of the data update), what would you recommend it to do?

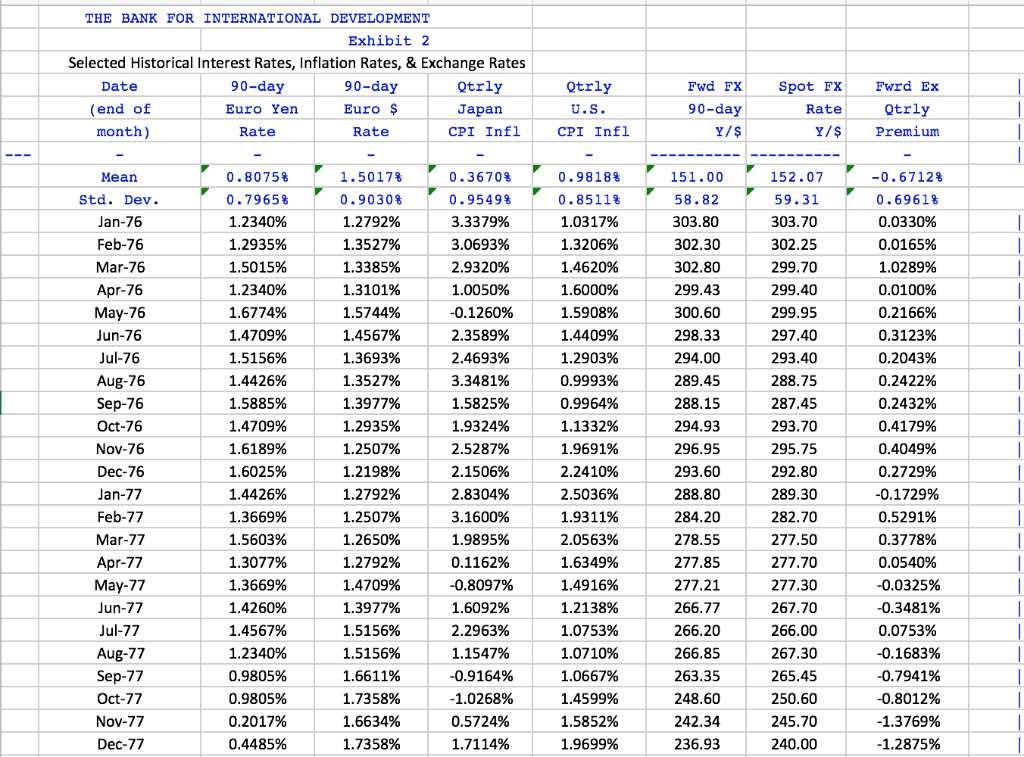

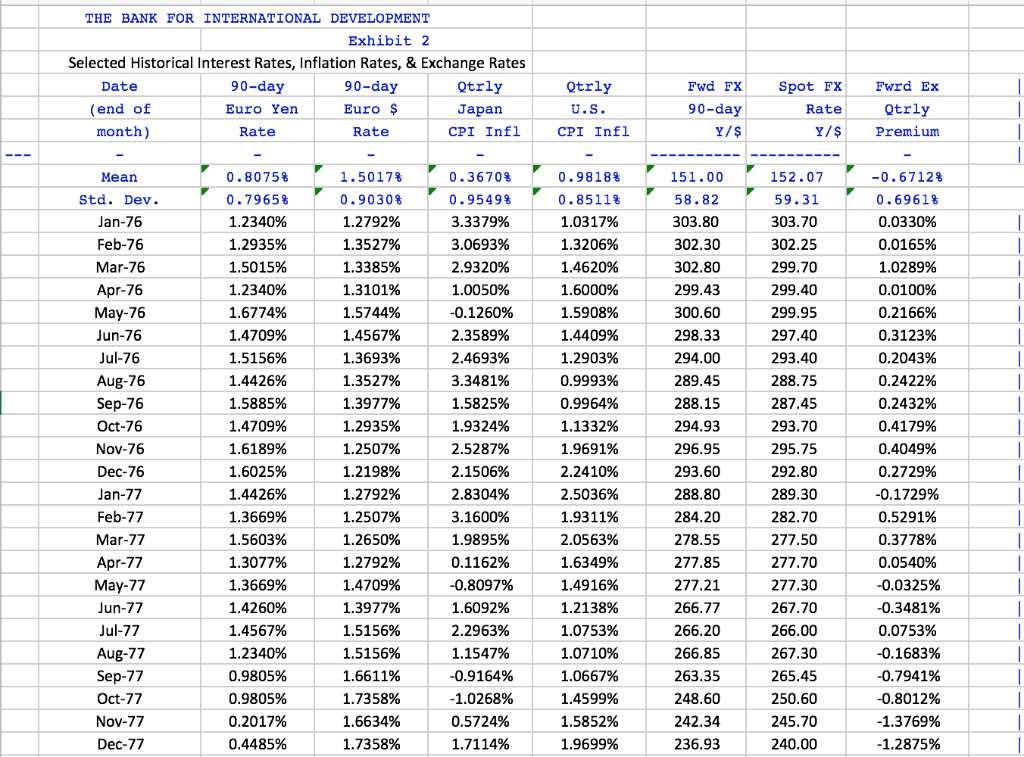

Spreadsheet data

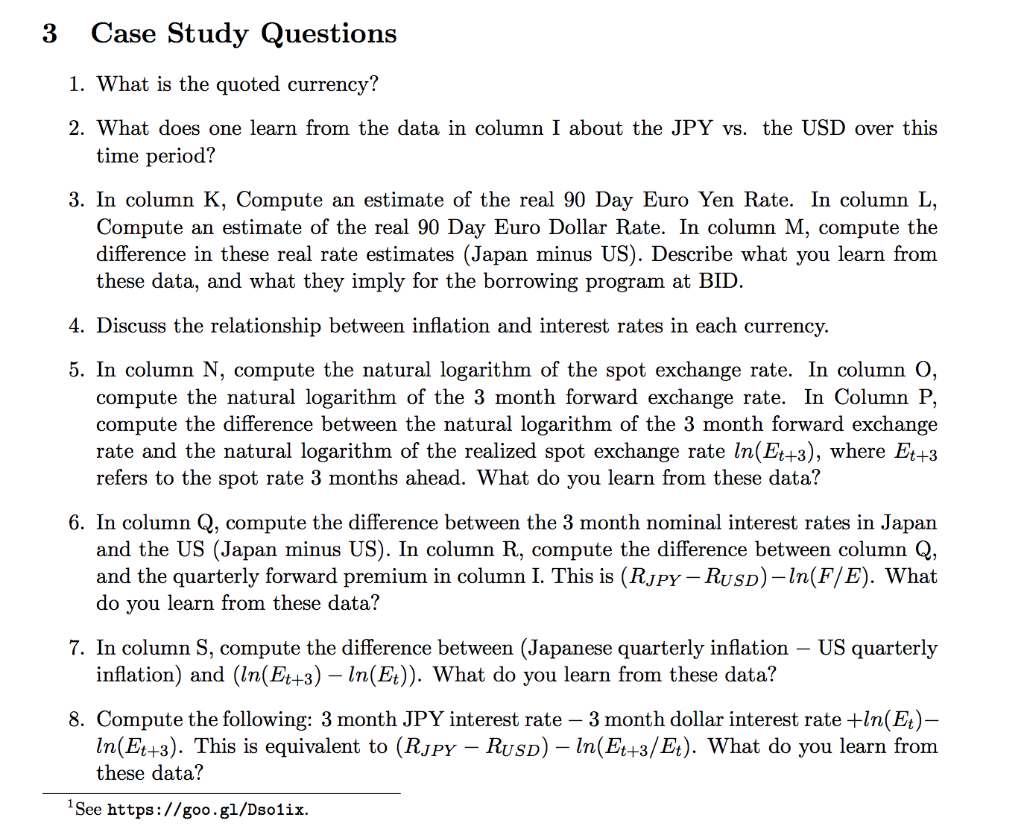

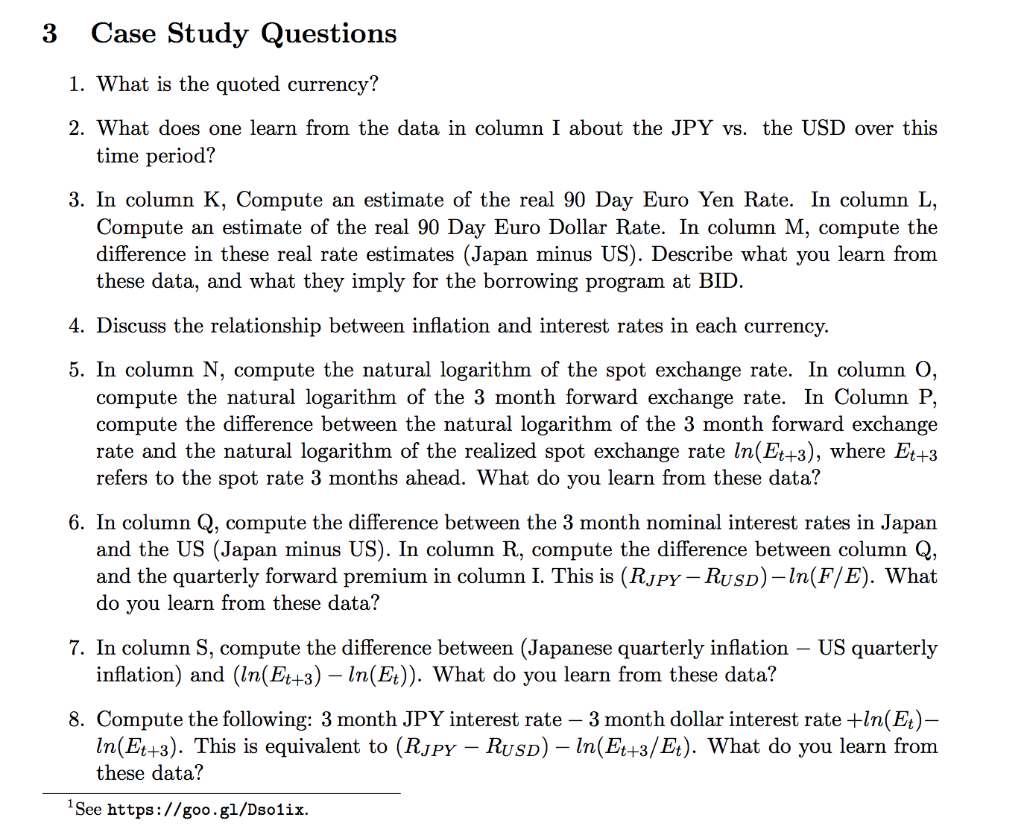

3 Case Study Questions 1. What is the quoted currency? 2. What does one learn from the data in column I about the JPY vs. the USD over this time period? 3. In column K, Compute an estimate of the real 90 Day Euro Yen Rate. In column L, Compute an estimate of the real 90 Day Euro Dollar Rate. In column M, compute the difference in these real rate estimates (Japan minus US). Describe what you learn from these data, and what they imply for the borrowing program at BID 4. Discuss the relationship between inflation and interest rates in each currency. 5. In column N, compute the natural logarithm of the spot exchange rate. In column O, compute the natural logarithm of the 3 month forward exchange rate. In Column IP compute the difference between the natural logarithm of the 3 month forward exchange rate and the natural logarithm of the realized spot exchange rate ln(Et+3), where Et+3 refers to the spot rate 3 months ahead. What do you learn from these data? 6. In column Q, compute the difference between the 3 month nominal interest rates in Japain and the US (Japan minus US). In column R, compute the difference between column Q, and the quarterly forward premium in column I. This is (Rjpy - RUSD)-ln(F/E). What do you learn from these data? 7. In column S, compute the difference between (Japanese quarterly inflation - US quarterly inflation) and (ln(Et+3) - In(Et)). What do you learn from these data? 8. Compute the following: 3 month JPY interest rate - 3 month dollar interest rate +n(Et)- In(Et+3). This is equivalent to (Rjpy - RUSD) - In(Et+3/Et). What do you learn from these data? See https://goo.gl/Dso1iix THE BANK FOR INTERNATIONAL DEVELOPMENT Exhibit 2 Selected Historical Interest Rates, Inflation Rates, & Exchange Rates Fwrd Ex Euro Yen Euro $ Japan CPI Infl CPI Infl Y/$ Premium 0.8075% 0.7965% 1.2340% 1.2935% 1.5015% 1.2340% 1.6774% 1.4709% 1.5156% 1.4426% 1.5885% 1.4709% 1.6189% 1.6025% 1.4426% 1.3669% 1.5603% 1.3077% 1.3669% 1.4260% 1.4567% 1.2340% 0.9805% 0.9805% 0.2017% 0.4485% , 1.5017% , 0.3670% 0.9818% 151.00 1.2792% 1.3527% 1.3385% 1.3101% 1.5744% 3.3379% 3.0693% 2.9320% 1.0317% 303.80 303.70 0.0330% 0.0165% 1.0289% 0.0100% 0.2166% 0.3123% 0.2043% 0.2422% 0.2432% 0.4179% 0.4049% 0.2729% -0.1729% 0.5291% 0.3778% 0.0540% -0.0325% -0.3481% 0.0753% -0.1683% -0.7941% -0.8012% -1.3769% -1.2875% 1.3206% 299.43 300.60 -0.1260% 2.3589% 2.4693% 3.3481% 1.5825% 1.9324% 2.5287% 2.1506% 2.8304% 3.1600% 1.9895% 0.1162% -0.8097% 1.6092% 2.2963% 1.1547% -0.9164% -1.0268% 1.5908% 299.95 1.3693% 1.3527% 1.3977% 1.2935% 1.2507% 1.2198% 1.2792% 1.2507% 1.2650% 1.2792% 1.4709% 1.3977% 1.2903% 0.9993% 0.99 64% 1.1332% 1.9691% 2.2410% 2.5036% 1.9311% 2.0563% 1.6349% 296.95 295.75 1.2138% 1.0753% 1.071096 1.0667% 1.4599% 1.5852% 1.9699% 266.77 267.70 266.20 1.5156% 1.661196 1.7358% 1.6634% 1.7358% 265.45 240.00 3 Case Study Questions 1. What is the quoted currency? 2. What does one learn from the data in column I about the JPY vs. the USD over this time period? 3. In column K, Compute an estimate of the real 90 Day Euro Yen Rate. In column L, Compute an estimate of the real 90 Day Euro Dollar Rate. In column M, compute the difference in these real rate estimates (Japan minus US). Describe what you learn from these data, and what they imply for the borrowing program at BID 4. Discuss the relationship between inflation and interest rates in each currency. 5. In column N, compute the natural logarithm of the spot exchange rate. In column O, compute the natural logarithm of the 3 month forward exchange rate. In Column IP compute the difference between the natural logarithm of the 3 month forward exchange rate and the natural logarithm of the realized spot exchange rate ln(Et+3), where Et+3 refers to the spot rate 3 months ahead. What do you learn from these data? 6. In column Q, compute the difference between the 3 month nominal interest rates in Japain and the US (Japan minus US). In column R, compute the difference between column Q, and the quarterly forward premium in column I. This is (Rjpy - RUSD)-ln(F/E). What do you learn from these data? 7. In column S, compute the difference between (Japanese quarterly inflation - US quarterly inflation) and (ln(Et+3) - In(Et)). What do you learn from these data? 8. Compute the following: 3 month JPY interest rate - 3 month dollar interest rate +n(Et)- In(Et+3). This is equivalent to (Rjpy - RUSD) - In(Et+3/Et). What do you learn from these data? See https://goo.gl/Dso1iix THE BANK FOR INTERNATIONAL DEVELOPMENT Exhibit 2 Selected Historical Interest Rates, Inflation Rates, & Exchange Rates Fwrd Ex Euro Yen Euro $ Japan CPI Infl CPI Infl Y/$ Premium 0.8075% 0.7965% 1.2340% 1.2935% 1.5015% 1.2340% 1.6774% 1.4709% 1.5156% 1.4426% 1.5885% 1.4709% 1.6189% 1.6025% 1.4426% 1.3669% 1.5603% 1.3077% 1.3669% 1.4260% 1.4567% 1.2340% 0.9805% 0.9805% 0.2017% 0.4485% , 1.5017% , 0.3670% 0.9818% 151.00 1.2792% 1.3527% 1.3385% 1.3101% 1.5744% 3.3379% 3.0693% 2.9320% 1.0317% 303.80 303.70 0.0330% 0.0165% 1.0289% 0.0100% 0.2166% 0.3123% 0.2043% 0.2422% 0.2432% 0.4179% 0.4049% 0.2729% -0.1729% 0.5291% 0.3778% 0.0540% -0.0325% -0.3481% 0.0753% -0.1683% -0.7941% -0.8012% -1.3769% -1.2875% 1.3206% 299.43 300.60 -0.1260% 2.3589% 2.4693% 3.3481% 1.5825% 1.9324% 2.5287% 2.1506% 2.8304% 3.1600% 1.9895% 0.1162% -0.8097% 1.6092% 2.2963% 1.1547% -0.9164% -1.0268% 1.5908% 299.95 1.3693% 1.3527% 1.3977% 1.2935% 1.2507% 1.2198% 1.2792% 1.2507% 1.2650% 1.2792% 1.4709% 1.3977% 1.2903% 0.9993% 0.99 64% 1.1332% 1.9691% 2.2410% 2.5036% 1.9311% 2.0563% 1.6349% 296.95 295.75 1.2138% 1.0753% 1.071096 1.0667% 1.4599% 1.5852% 1.9699% 266.77 267.70 266.20 1.5156% 1.661196 1.7358% 1.6634% 1.7358% 265.45 240.00

9. How should BID analyse its effective borrowing costs? Under what circumstances should BID expect to prefer borrowing in one currency rather than the other? If it were issuing a note (i.e., borrowing a currency) now (at the end of the data update), what would you recommend it to do?

9. How should BID analyse its effective borrowing costs? Under what circumstances should BID expect to prefer borrowing in one currency rather than the other? If it were issuing a note (i.e., borrowing a currency) now (at the end of the data update), what would you recommend it to do?