Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Assess the cash flows that can be used to value the entire firm (i.e., equity plus debt portion) and the cash flows that can

Question:

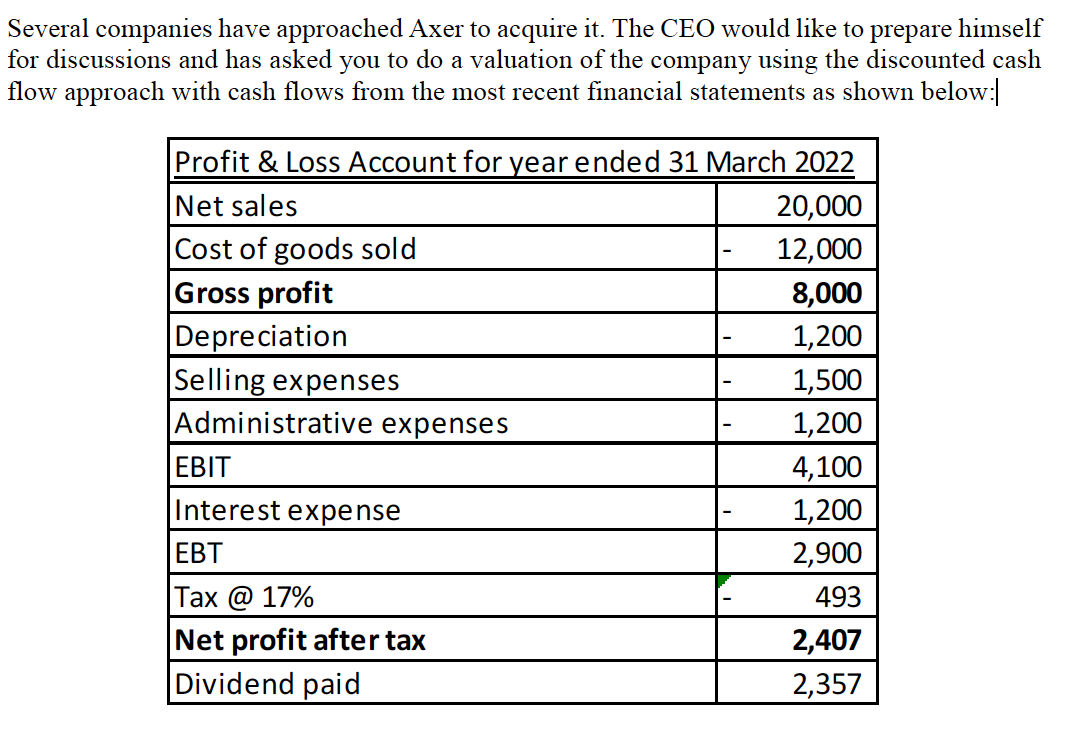

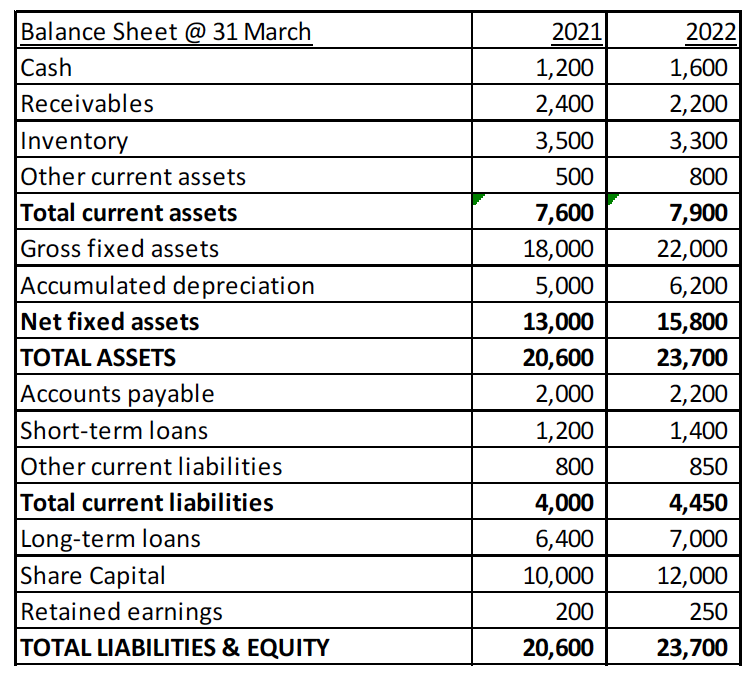

Assess the cash flows that can be used to value the entire firm (i.e., equity plus debt portion) and the cash flows that can be used to value the equity portion of the firm.

Several companies have approached Axer to acquire it. The CEO would like to prepare himself for discussions and has asked you to do a valuation of the company using the discounted cash flow approach with cash flows from the most recent financial statements as shown below: \begin{tabular}{|l|r|r|} \hline Balance Sheet @ 31 March & 2021 & 2022 \\ \hline Cash & 1,200 & 1,600 \\ \hline Receivables & 2,400 & 2,200 \\ \hline Inventory & 3,500 & 3,300 \\ \hline Other current assets & 500 & 800 \\ \hline Total current assets & 7,600 & 7,900 \\ \hline Gross fixed assets & 18,000 & 22,000 \\ \hline Accumulated depreciation & 5,000 & 6,200 \\ \hline Net fixed assets & 13,000 & 15,800 \\ \hline TOTAL ASSETS & 20,600 & 23,700 \\ \hline Accounts payable & 2,000 & 2,200 \\ \hline Short-term loans & 1,200 & 1,400 \\ \hline Other current liabilities & 800 & 850 \\ \hline Total current liabilities & 4,000 & 4,450 \\ \hline Long-term loans & 6,400 & 7,000 \\ \hline Share Capital & 10,000 & 12,000 \\ \hline Retained earnings & 200 & 250 \\ \hline TOTAL LIABILITIES \& EQUITY & 20,600 & 23,700 \\ \hline \end{tabular} Several companies have approached Axer to acquire it. The CEO would like to prepare himself for discussions and has asked you to do a valuation of the company using the discounted cash flow approach with cash flows from the most recent financial statements as shown below: \begin{tabular}{|l|r|r|} \hline Balance Sheet @ 31 March & 2021 & 2022 \\ \hline Cash & 1,200 & 1,600 \\ \hline Receivables & 2,400 & 2,200 \\ \hline Inventory & 3,500 & 3,300 \\ \hline Other current assets & 500 & 800 \\ \hline Total current assets & 7,600 & 7,900 \\ \hline Gross fixed assets & 18,000 & 22,000 \\ \hline Accumulated depreciation & 5,000 & 6,200 \\ \hline Net fixed assets & 13,000 & 15,800 \\ \hline TOTAL ASSETS & 20,600 & 23,700 \\ \hline Accounts payable & 2,000 & 2,200 \\ \hline Short-term loans & 1,200 & 1,400 \\ \hline Other current liabilities & 800 & 850 \\ \hline Total current liabilities & 4,000 & 4,450 \\ \hline Long-term loans & 6,400 & 7,000 \\ \hline Share Capital & 10,000 & 12,000 \\ \hline Retained earnings & 200 & 250 \\ \hline TOTAL LIABILITIES \& EQUITY & 20,600 & 23,700 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started