Answered step by step

Verified Expert Solution

Question

1 Approved Answer

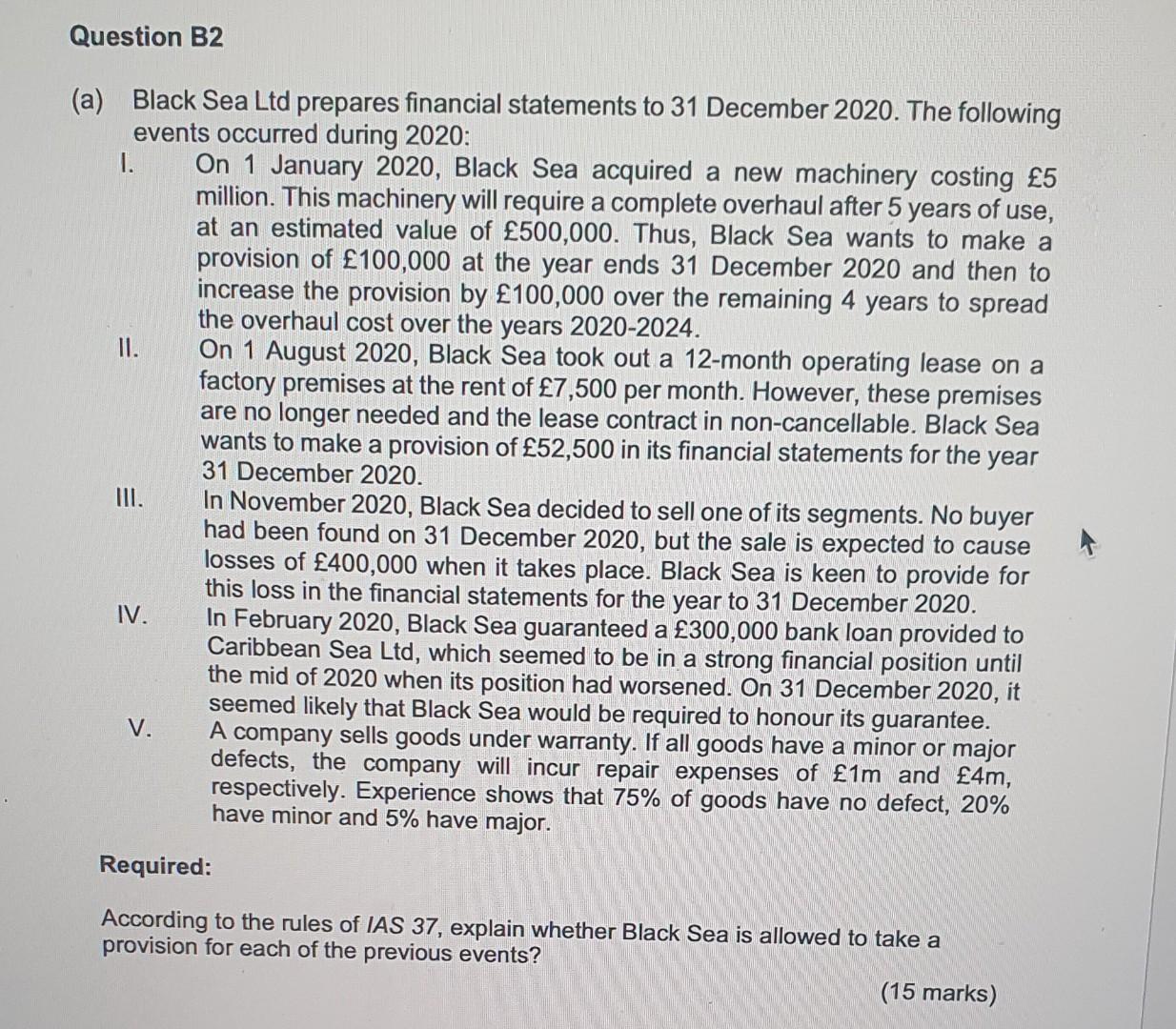

Question B2 (a) Black Sea Ltd prepares financial statements to 31 December 2020. The following events occurred during 2020: I. II. III. IV. V.

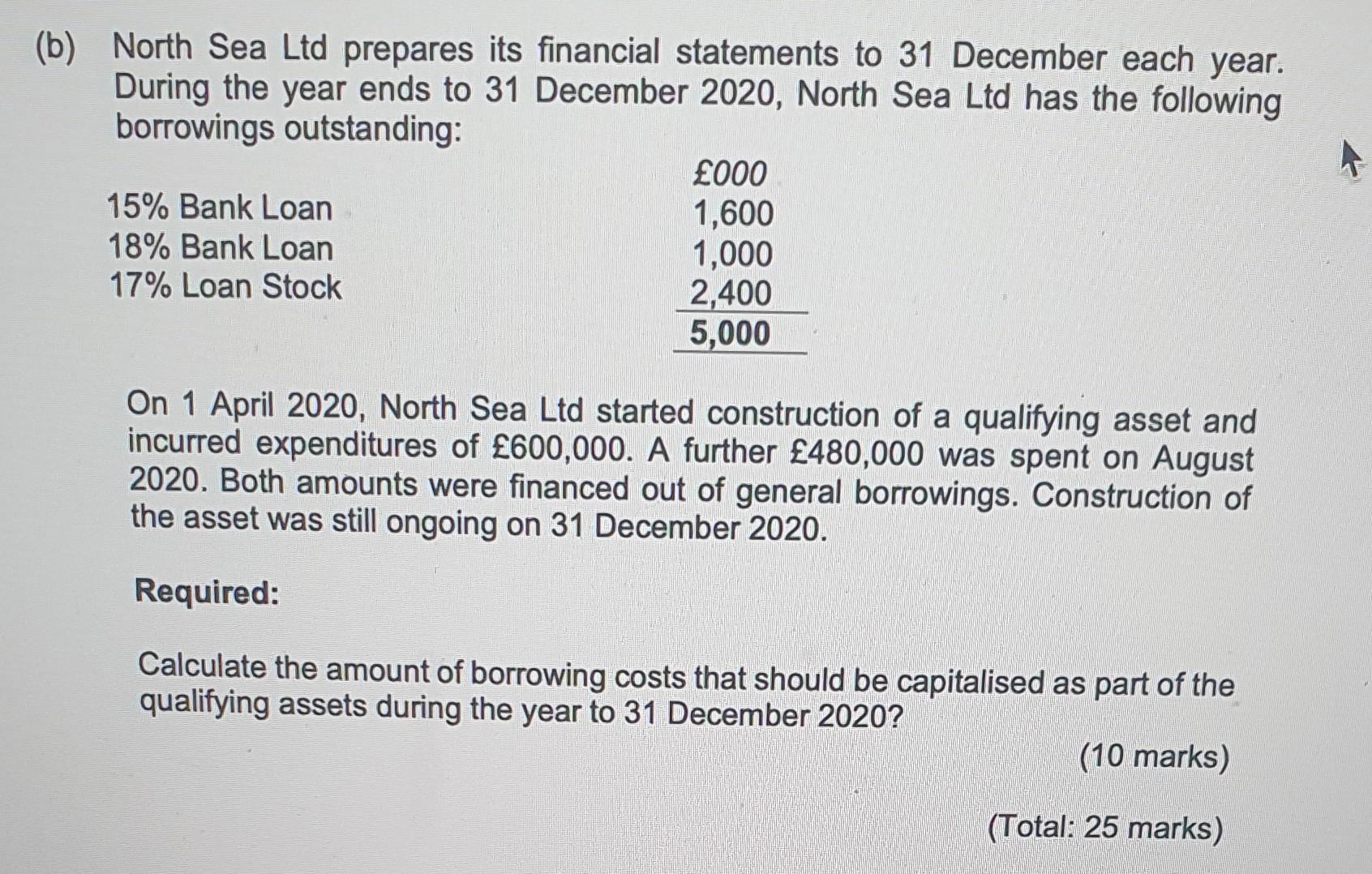

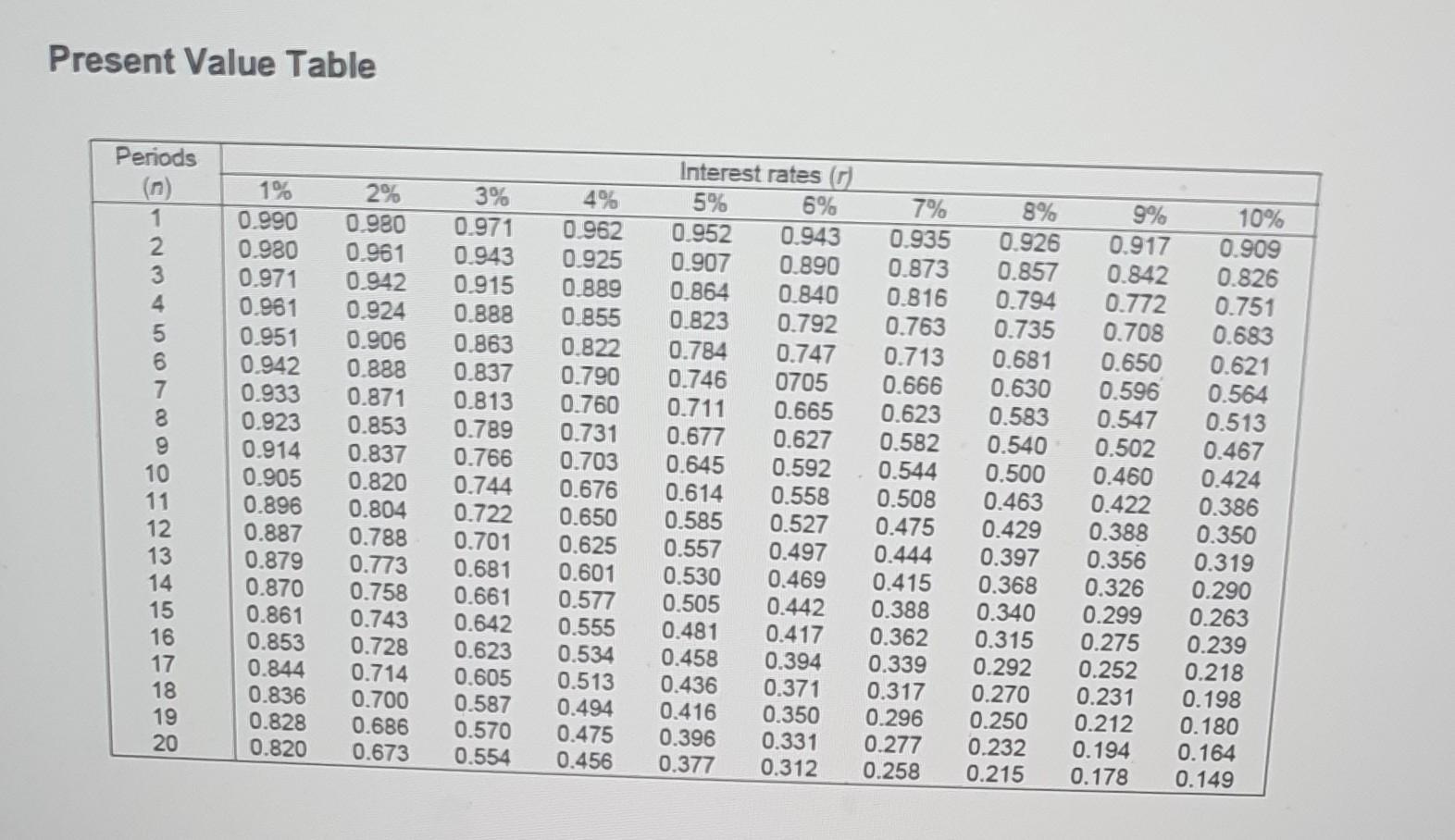

Question B2 (a) Black Sea Ltd prepares financial statements to 31 December 2020. The following events occurred during 2020: I. II. III. IV. V. On 1 January 2020, Black Sea acquired a new machinery costing 5 million. This machinery will require a complete overhaul after 5 years of use, at an estimated value of 500,000. Thus, Black Sea wants to make a provision of 100,000 at the year ends 31 December 2020 and then to increase the provision by 100,000 over the remaining 4 years to spread the overhaul cost over the years 2020-2024. On 1 August 2020, Black Sea took out a 12-month operating lease on a factory premises at the rent of 7,500 per month. However, these premises are no longer needed and the lease contract in non-cancellable. Black Sea wants to make a provision of 52,500 in its financial statements for the year 31 December 2020. In November 2020, Black Sea decided to sell one of its segments. No buyer had been found on 31 December 2020, but the sale is expected to cause losses of 400,000 when it takes place. Black Sea is keen to provide for this loss in the financial statements for the year to 31 December 2020. In February 2020, Black Sea guaranteed a 300,000 bank loan provided to Caribbean Sea Ltd, which seemed to be in a strong financial position until the mid of 2020 when its position had worsened. On 31 December 2020, it seemed likely that Black Sea would be required to honour its guarantee. A company sells goods under warranty. If all goods have a minor or major defects, the company will incur repair expenses of 1m and 4m, respectively. Experience shows that 75% of goods have no defect, 20% have minor and 5% have major. Required: According to the rules of IAS 37, explain whether Black Sea is allowed to take a provision for each of the previous events? (15 marks) (b) North Sea Ltd prepares its financial statements to 31 December each year. During the year ends to 31 December 2020, North Sea Ltd has the following borrowings outstanding: 15% Bank Loan 18% Bank Loan 17% Loan Stock 000 1,600 1,000 2,400 5,000 On 1 April 2020, North Sea Ltd started construction of a qualifying asset and incurred expenditures of 600,000. A further 480,000 was spent on August 2020. Both amounts were financed out of general borrowings. Construction of the asset was still ongoing on 31 December 2020. Required: Calculate the amount of borrowing costs that should be capitalised as part of the qualifying assets during the year to 31 December 2020? (10 marks) (Total: 25 marks) A Present Value Table Periods 1 2 22 3 4 5 6 7 8 9 10 11 12 13 14 45 15 16 17 18 19 20 Interest rates (1) 1% 4% 5% 6% 7% 8% 9% 0.990 0.962 0.952 0.943 0.935 0.926 0.917 0.980 0.925 0.907 0.890 0.873 0.857 0.842 0.971 0.889 0.864 0.840 0.816 0.794 0.772 0.961 0.924 0.951 0.906 0.855 0.823 0.763 0.735 0.708 0.713 0.681 0.650 0.942 0.888 0.666 0.630 0.596 0.888 0.792 0.863 0.822 0.784 0.747 0.837 0.790 0.746 0705 0.933 0.871 0.813 0.760 0.711 0.665 0.923 0.853 0.789 0.731 0.677 0.627 0.766 0.623 0.583 0.547 0.582 0.540 0.502 0.914 0.837 0.703 0.645 0.592 0.544 0.500 0.460 0.905 0.744 0.676 0.614 0.820 0.896 0.804 0.722 0.558 0.508 0.463 0.422 0.650 0.585 0.527 0.475 0.429 0.388 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.530 0.469 0.415 0.368 0.326 0.879 0.870 0.861 0.505 0.442 0.388 0.340 0.299 0.773 0.681 0.601 0.758 0.661 0.577 0.743 0.642 0.555 0.853 0.728 0.623 0.534 0.844 0.714 0.605 0.513 0.587 0.494 0.481 0.417 0.362 0.315 0.275 0.458 0.394 0.339 0.292 0.252 0.436 0.371 0.317 0.270 0.231 0.836 0.700 0.416 0.350 0.296 0.250 0.212 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 2% 3% 0.980 0.971 0.961 0.943 0.942 0.915 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

IAS 37 provides the criteria for provisions that must be met for a provision to be recognized Accord...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started