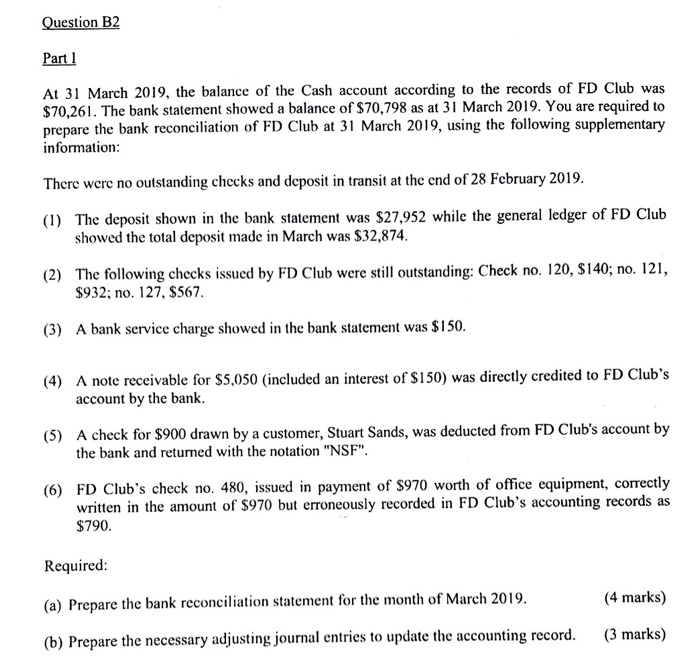

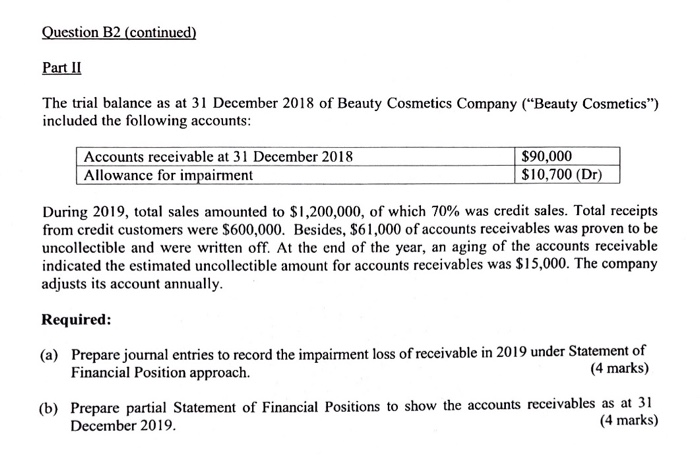

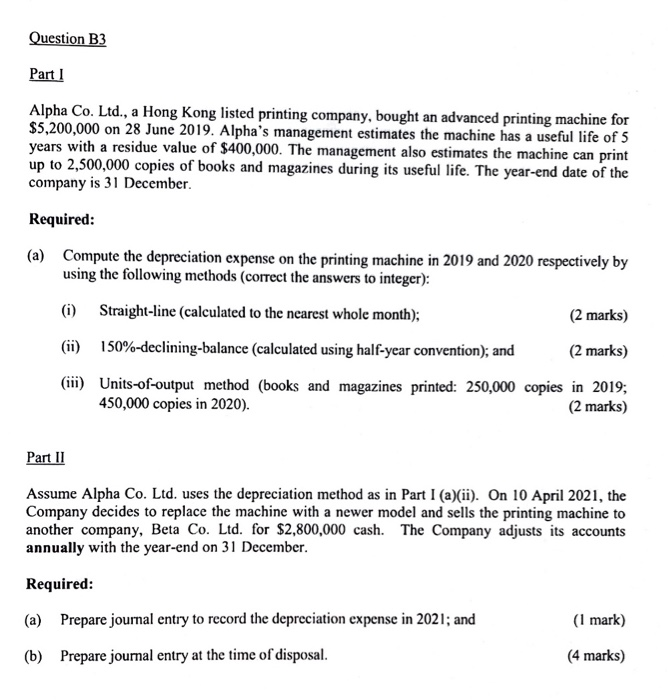

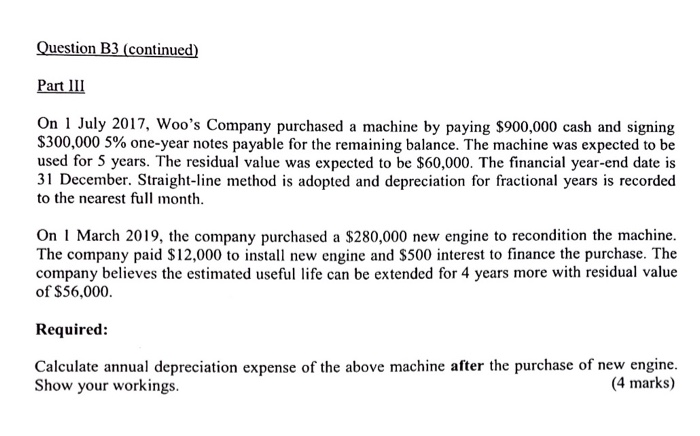

Question B2 Part 1 At 31 March 2019, the balance of the Cash account according to the records of FD Club was $70,261. The bank statement showed a balance of $70,798 as at 31 March 2019. You are required to prepare the bank reconciliation of FD Club at 31 March 2019, using the following supplementary information: There were no outstanding checks and deposit in transit at the end of 28 February 2019. (1) The deposit shown in the bank statement was $27.952 while the general ledger of FD Club showed the total deposit made in March was $32,874. (2) The following checks issued by FD Club were still outstanding: Check no. 120, $140; no. 121, $932; no. 127. $567. (3) A bank service charge showed in the bank statement was $150. (4) A note receivable for $5,050 (included an interest of $150) was directly credited to FD Club's account by the bank. (5) A check for $900 drawn by a customer, Stuart Sands, was deducted from FD Club's account by the bank and returned with the notation "NSF". (6) FD Club's check no. 480, issued in payment of $970 worth of office equipment, correctly written in the amount of $970 but erroneously recorded in FD Club's accounting records as $790. Required: (a) Prepare the bank reconciliation statement for the month of March 2019. (4 marks) (b) Prepare the necessary adjusting journal entries to update the accounting record. (3 marks) Question B2 (continued) Part II The trial balance as at 31 December 2018 of Beauty Cosmetics Company ("Beauty Cosmetics") included the following accounts: Accounts receivable at 31 December 2018 Allowance for impairment $90,000 $10,700 (Dr) During 2019, total sales amounted to $1,200,000, of which 70% was credit sales. Total receipts from credit customers were $600,000. Besides, $61,000 of accounts receivables was proven to be uncollectible and were written off. At the end of the year, an aging of the accounts receivable indicated the estimated uncollectible amount for accounts receivables was $15,000. The company adjusts its account annually. Required: (a) Prepare journal entries to record the impairment loss of receivable in 2019 under Statement of Financial Position approach. (4 marks) (b) Prepare partial Statement of Financial Positions to show the accounts receivables as at 31 December 2019. (4 marks) Question B3 Part I Alpha Co. Ltd., a Hong Kong listed printing company, bought an advanced printing machine for $5,200,000 on 28 June 2019. Alpha's management estimates the machine has a useful life of 5 years with a residue value of $400,000. The management also estimates the machine can print up to 2,500,000 copies of books and magazines during its useful life. The year-end date of the company is 31 December Required: (a) Compute the depreciation expense on the printing machine in 2019 and 2020 respectively by using the following methods (correct the answers to integer): (i) Straight-line (calculated to the nearest whole month); (2 marks) (ii) 150%-declining-balance (calculated using half-year convention); and (2 marks) (iii) Units-of-output method (books and magazines printed: 250,000 copies in 2019; 450,000 copies in 2020). (2 marks) Part II Assume Alpha Co. Ltd, uses the depreciation method as in Part I (a)(ii). On 10 April 2021, the Company decides to replace the machine with a newer model and sells the printing machine to another company, Beta Co. Ltd. for $2,800,000 cash. The Company adjusts its accounts annually with the year-end on 31 December. Required: (a) Prepare journal entry to record the depreciation expense in 2021; and (1 mark) (b) Prepare journal entry at the time of disposal. (4 marks) Question B3 (continued) Part III On 1 July 2017, Woo's Company purchased a machine by paying $900,000 cash and signing $300,000 5% one-year notes payable for the remaining balance. The machine was expected to be used for 5 years. The residual value was expected to be $60,000. The financial year-end date is 31 December. Straight-line method is adopted and depreciation for fractional years is recorded to the nearest full month. On 1 March 2019, the company purchased a $280,000 new engine to recondition the machine. The company paid $12,000 to install new engine and $500 interest to finance the purchase. The company believes the estimated useful life can be extended for 4 years more with residual value of $56,000. Required: Calculate annual depreciation expense of the above machine after the purchase of new engine. Show your workings. (4 marks)