Question b2:Compute the amount of gross profit to be recognized for each year assuming that completed contract method is used.

Question b2:Compute the amount of gross profit to be recognized for each year assuming that completed contract method is used.

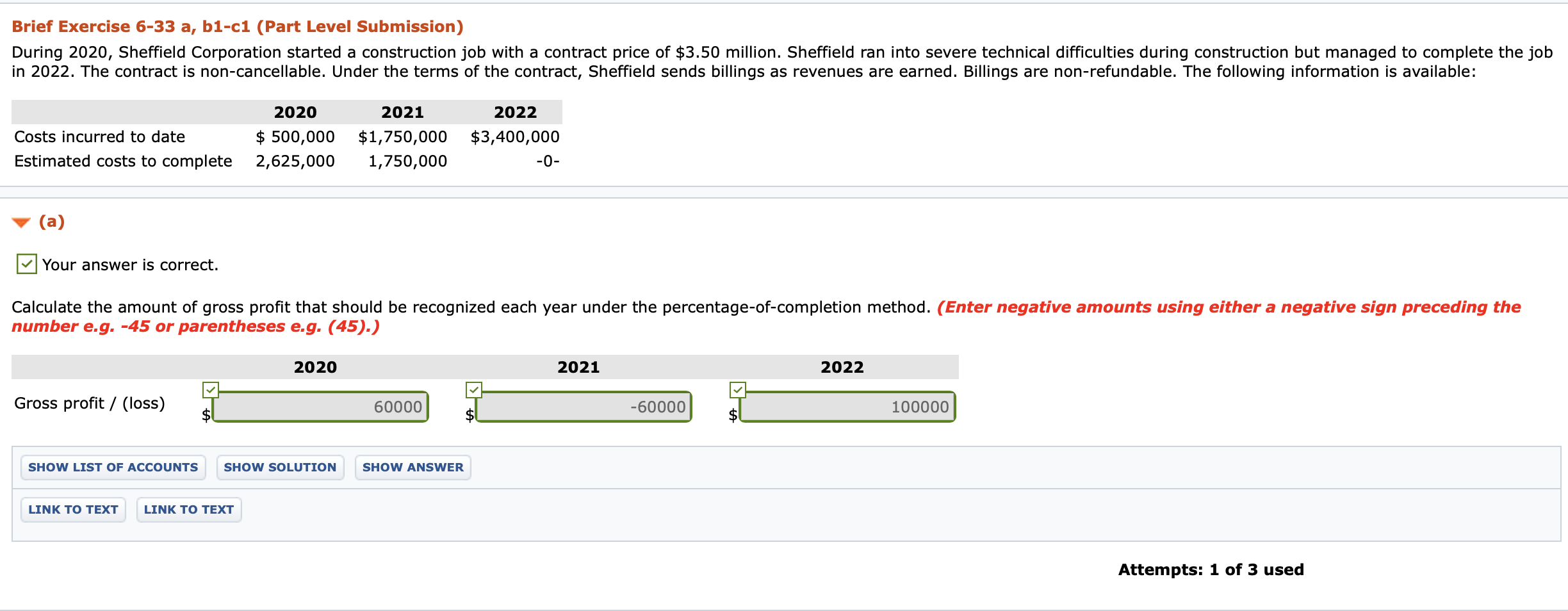

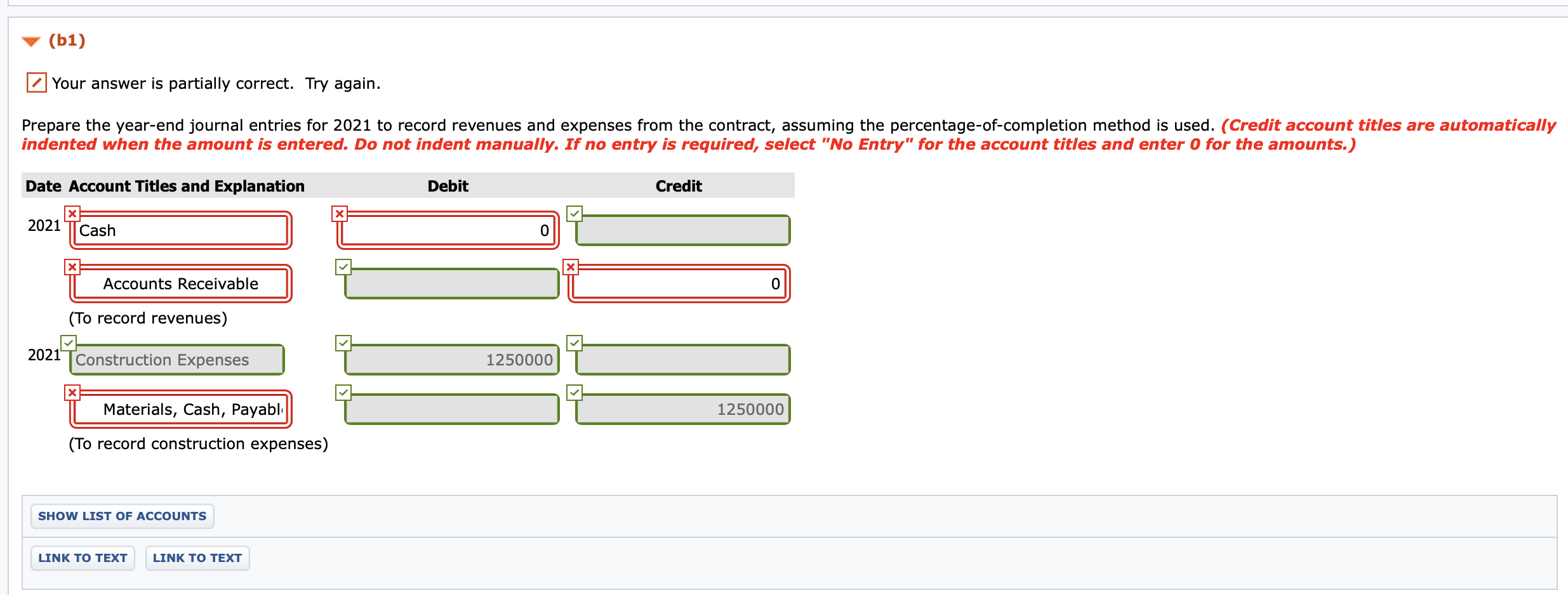

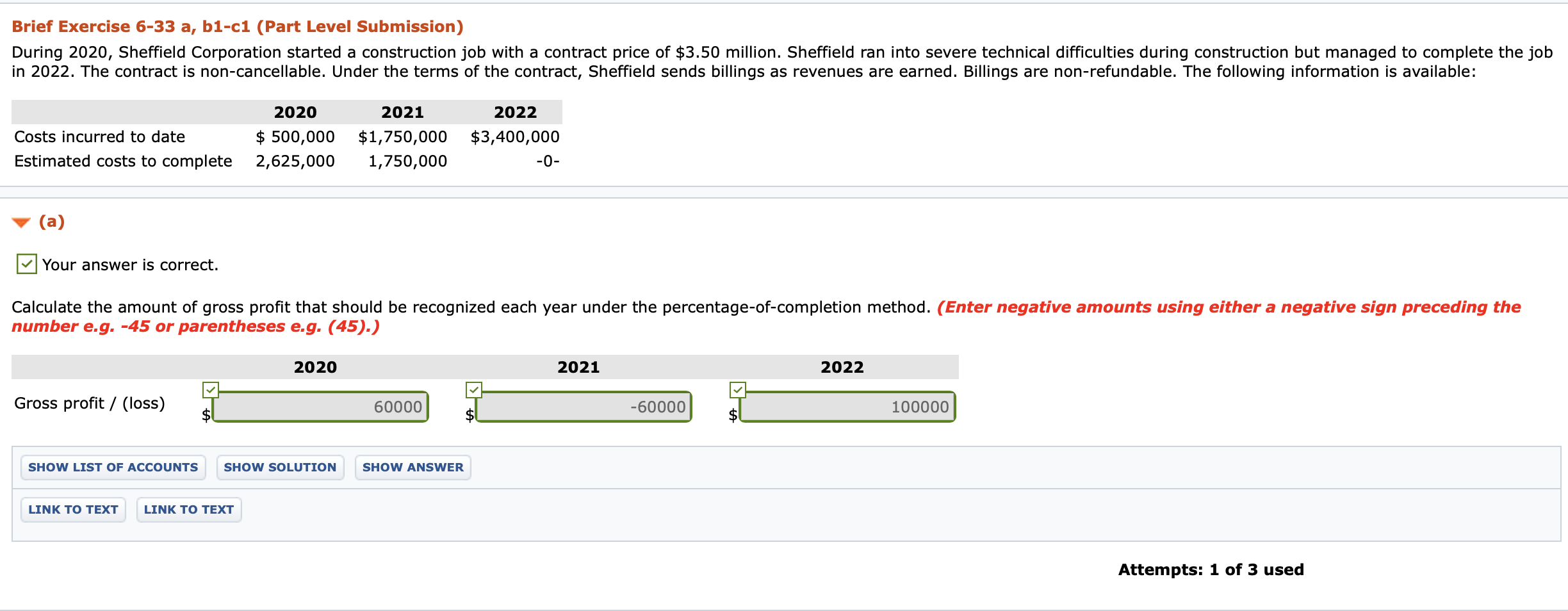

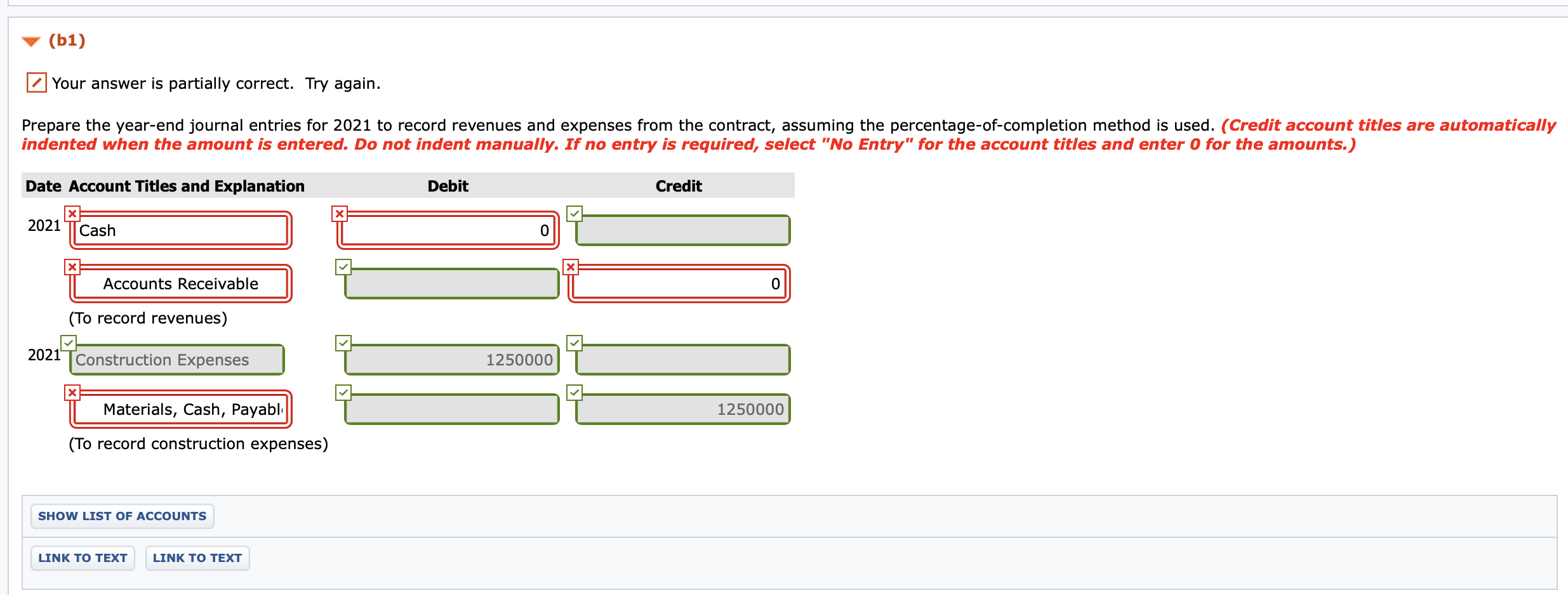

Brief Exercise 6-33 a, b1-ci (Part Level Submission) During 2020, Sheffield Corporation started a construction job with a contract price of $3.50 million. Sheffield ran into severe technical difficulties during construction but managed to complete the job in 2022. The contract is non-cancellable. Under the terms of the contract, Sheffield sends billings as revenues are earned. Billings are non-refundable. The following information is available: 2020 $ 500,000 2,625,000 Costs incurred to date Estimated costs to complete 2021 $1,750,000 1,750,000 2022 $3,400,000 -0- (a) Your answer is correct. Calculate the amount of gross profit that should be recognized each year under the percentage-of-completion method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2020 2021 2022 Gross profit / (loss) 60000 -60000 100000 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT LINK TO TEXT Attempts: 1 of 3 used (61) Your answer is partially correct. Try again. Prepare the year-end journal entries for 2021 to record revenues and expenses from the contract, assuming the percentage-of-completion method is used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit 2021 | Cash Accounts Receivable (To record revenues) 2021 TConstruction Expenses 1250000 Materials, Cash, Payabli 1250000 (To record construction expenses) SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Brief Exercise 6-33 a, b1-ci (Part Level Submission) During 2020, Sheffield Corporation started a construction job with a contract price of $3.50 million. Sheffield ran into severe technical difficulties during construction but managed to complete the job in 2022. The contract is non-cancellable. Under the terms of the contract, Sheffield sends billings as revenues are earned. Billings are non-refundable. The following information is available: 2020 $ 500,000 2,625,000 Costs incurred to date Estimated costs to complete 2021 $1,750,000 1,750,000 2022 $3,400,000 -0- (a) Your answer is correct. Calculate the amount of gross profit that should be recognized each year under the percentage-of-completion method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2020 2021 2022 Gross profit / (loss) 60000 -60000 100000 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT LINK TO TEXT Attempts: 1 of 3 used (61) Your answer is partially correct. Try again. Prepare the year-end journal entries for 2021 to record revenues and expenses from the contract, assuming the percentage-of-completion method is used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit 2021 | Cash Accounts Receivable (To record revenues) 2021 TConstruction Expenses 1250000 Materials, Cash, Payabli 1250000 (To record construction expenses) SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT

Question b2:Compute the amount of gross profit to be recognized for each year assuming that completed contract method is used.

Question b2:Compute the amount of gross profit to be recognized for each year assuming that completed contract method is used.