Answered step by step

Verified Expert Solution

Question

1 Approved Answer

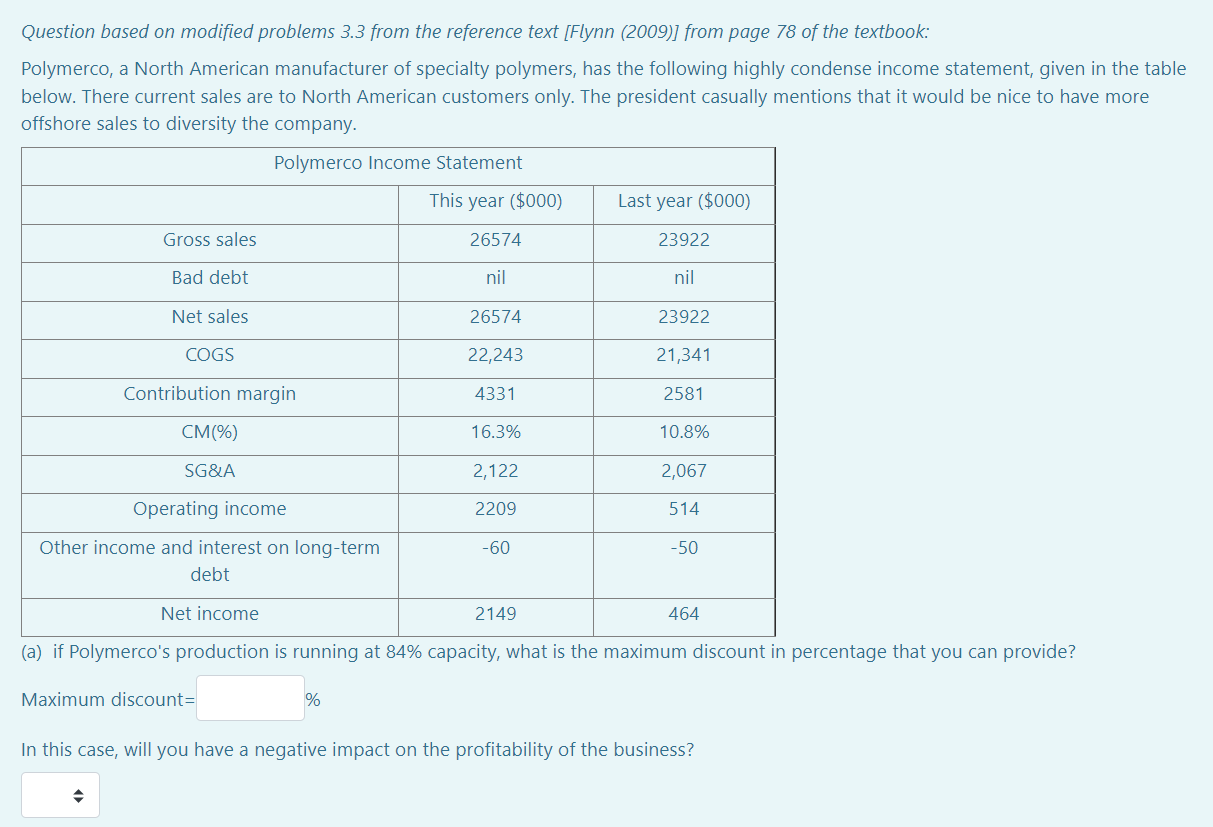

Question based on modified problems 3.3 from the reference text [Flynn (2009)] from page 78 of the textbook: Polymerco, a North American manufacturer of

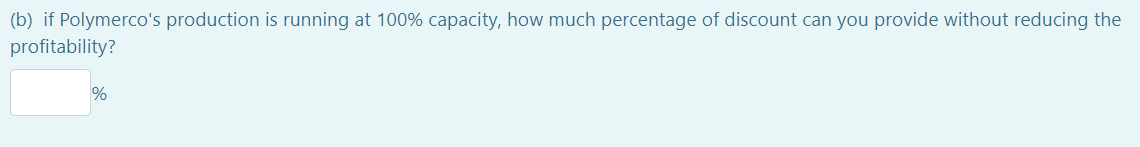

Question based on modified problems 3.3 from the reference text [Flynn (2009)] from page 78 of the textbook: Polymerco, a North American manufacturer of specialty polymers, has the following highly condense income statement, given in the table below. There current sales are to North American customers only. The president casually mentions that it would be nice to have more offshore sales to diversity the company. Polymerco Income Statement This year ($000) Last year ($000) Gross sales 26574 23922 Bad debt nil nil Net sales 26574 23922 COGS 22,243 21,341 Contribution margin 4331 2581 CM(%) 16.3% 10.8% SG&A 2,122 2,067 Operating income 2209 514 Other income and interest on long-term -60 -50 debt Net income 2149 464 (a) if Polymerco's production is running at 84% capacity, what is the maximum discount in percentage that you can provide? Maximum discount= % In this case, will you have a negative impact on the profitability of the business?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started