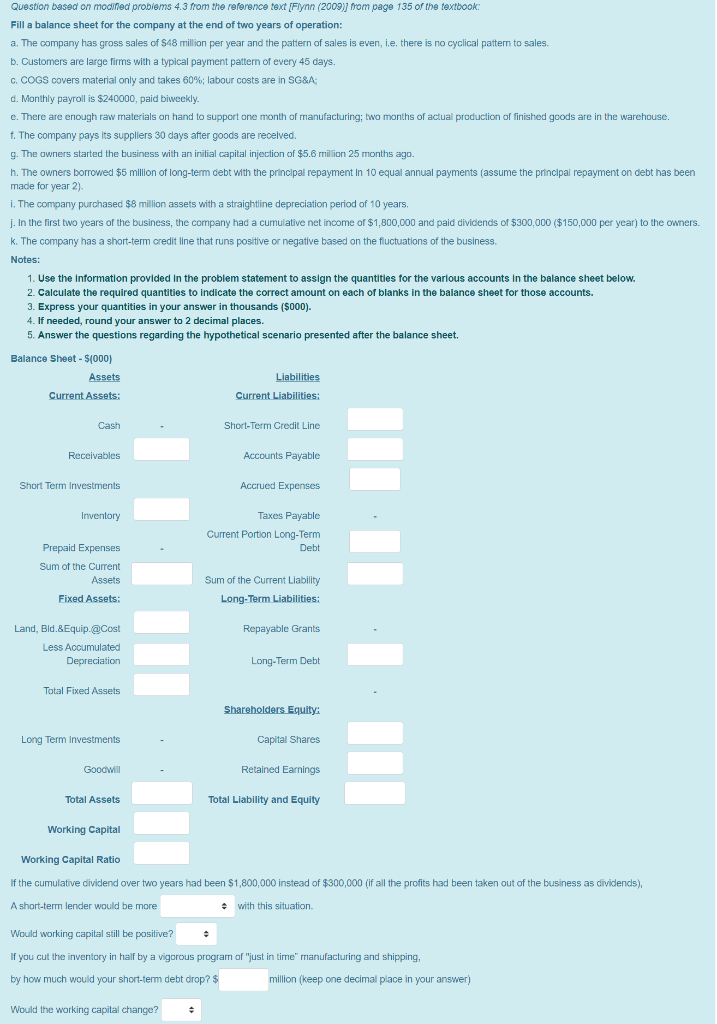

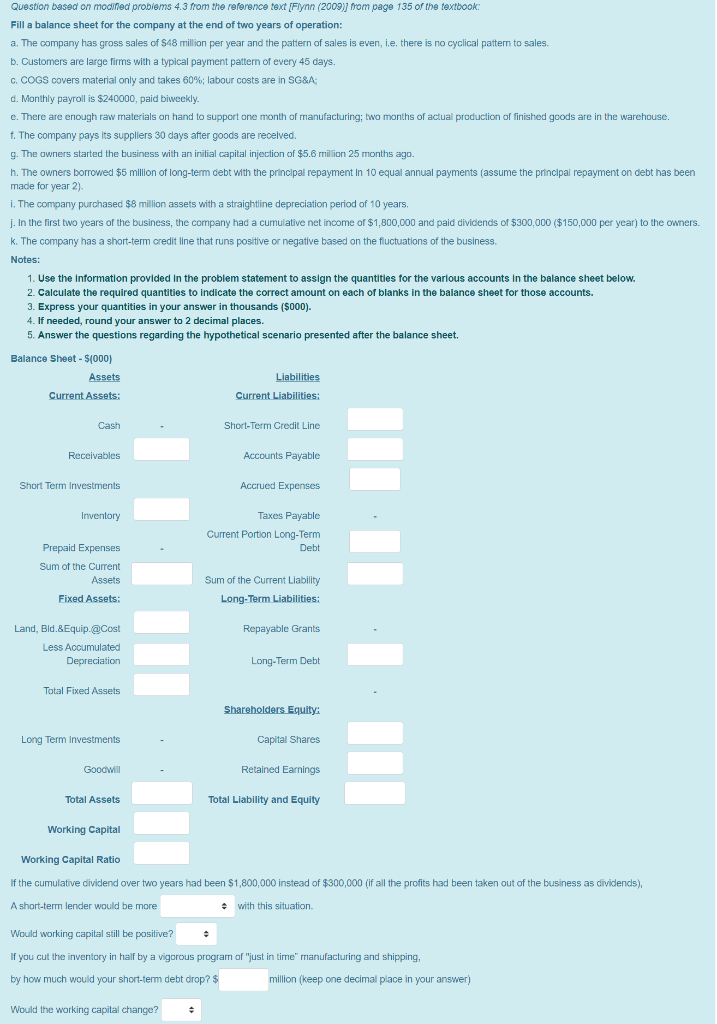

Question based on modified problems 4.3 from the reference text (Flynn (2009) from page 135 of the textbook: Fill a balance sheet for the company at the end of two years of operation: a. The company has gross sales of $48 million per year and the pattern of sales is even, i.e. there is no cyclical pattern to sales. b. Customers are large firms with a typical payment pattern of every 45 days. C. COGS covers material only and takes 60%; labour costs are in SG&A: d. Monthly payroll is $240000, paid biweekly. e. There are enough raw materials on hand to support one month of manufacturing; two months of actual production of finished goods are in the warehouse. f. The company pays its suppliers 30 days after goods are recelved. g. The owners started the business with an initial capital injection of $5.6 million 25 months ago h. The owners borrowed $5 million of long-term debt with the principal repayment in 10 equal annual payments (assume the principal repayment on debt has been made for year 2) i. The company purchased $8 million assets with a straightline depreciation period of 10 years, j. In the first two years of the business, the company had a cumulative net income of $1,800,000 and paid dividends of $300,000 ($150,000 per year) to the owners. k. The company has a short-term credit line that runs positive or negative based on the fluctuations of the business. Notes: 1. Use the information provided in the problem statement to assign the quantities for the various accounts in the balance sheet below. 2. Calculate the required quantities to indicate the correct amount on each of blanks in the balance sheet for those accounts. 3. Express your quantities in your answer in thousands ($000). 4. If needed, round your answer to 2 decimal places. 5. Answer the questions regarding the hypothetical scenario presented after the balance sheet. Balance Sheet - $1000) - ) Assets Liabilities Current Assets: Current Liabilities: Cash Short-Term Credit Line Receivables Accounts Payable Short Term Investments Accrued Expenses Inventory Taxes Payable Current Portion Long-Term Debt Prepaid Expenses Sum of the Current Assets Fixed Assets: Sum of the Current Liability Long-Term Liabilities: Repayable Grants Land, Bld.&Equip@Cost Less Accumulated Depreciation Long-Term Debt Total Fixed Assets Shareholders Equity: Long Term Investments Capital Shares Goodwill Retained Earnings Total Assets Total Liability and Equity Working Capital Working Capital Ratio If the cumulative dividend over two years had been $1,800,000 instead of $300,000 (if all the profits had been taken out of the business as dividends), A short-term lender would be more with this situation. . Would working capital still be positive? If you cut the inventory in half by a vigorous program of "just in time" manufacturing and shipping, by how much would your short-term debt drop? $ million (keep one decimal place in your answer) Would the working capital change? Question based on modified problems 4.3 from the reference text (Flynn (2009) from page 135 of the textbook: Fill a balance sheet for the company at the end of two years of operation: a. The company has gross sales of $48 million per year and the pattern of sales is even, i.e. there is no cyclical pattern to sales. b. Customers are large firms with a typical payment pattern of every 45 days. C. COGS covers material only and takes 60%; labour costs are in SG&A: d. Monthly payroll is $240000, paid biweekly. e. There are enough raw materials on hand to support one month of manufacturing; two months of actual production of finished goods are in the warehouse. f. The company pays its suppliers 30 days after goods are recelved. g. The owners started the business with an initial capital injection of $5.6 million 25 months ago h. The owners borrowed $5 million of long-term debt with the principal repayment in 10 equal annual payments (assume the principal repayment on debt has been made for year 2) i. The company purchased $8 million assets with a straightline depreciation period of 10 years, j. In the first two years of the business, the company had a cumulative net income of $1,800,000 and paid dividends of $300,000 ($150,000 per year) to the owners. k. The company has a short-term credit line that runs positive or negative based on the fluctuations of the business. Notes: 1. Use the information provided in the problem statement to assign the quantities for the various accounts in the balance sheet below. 2. Calculate the required quantities to indicate the correct amount on each of blanks in the balance sheet for those accounts. 3. Express your quantities in your answer in thousands ($000). 4. If needed, round your answer to 2 decimal places. 5. Answer the questions regarding the hypothetical scenario presented after the balance sheet. Balance Sheet - $1000) - ) Assets Liabilities Current Assets: Current Liabilities: Cash Short-Term Credit Line Receivables Accounts Payable Short Term Investments Accrued Expenses Inventory Taxes Payable Current Portion Long-Term Debt Prepaid Expenses Sum of the Current Assets Fixed Assets: Sum of the Current Liability Long-Term Liabilities: Repayable Grants Land, Bld.&Equip@Cost Less Accumulated Depreciation Long-Term Debt Total Fixed Assets Shareholders Equity: Long Term Investments Capital Shares Goodwill Retained Earnings Total Assets Total Liability and Equity Working Capital Working Capital Ratio If the cumulative dividend over two years had been $1,800,000 instead of $300,000 (if all the profits had been taken out of the business as dividends), A short-term lender would be more with this situation. . Would working capital still be positive? If you cut the inventory in half by a vigorous program of "just in time" manufacturing and shipping, by how much would your short-term debt drop? $ million (keep one decimal place in your answer) Would the working capital change