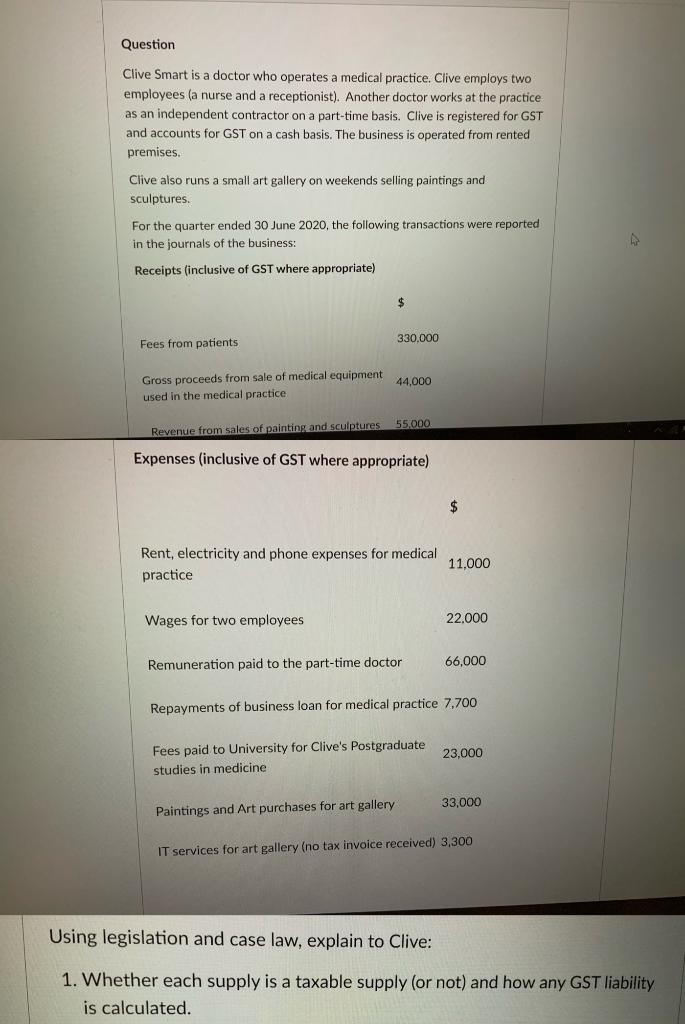

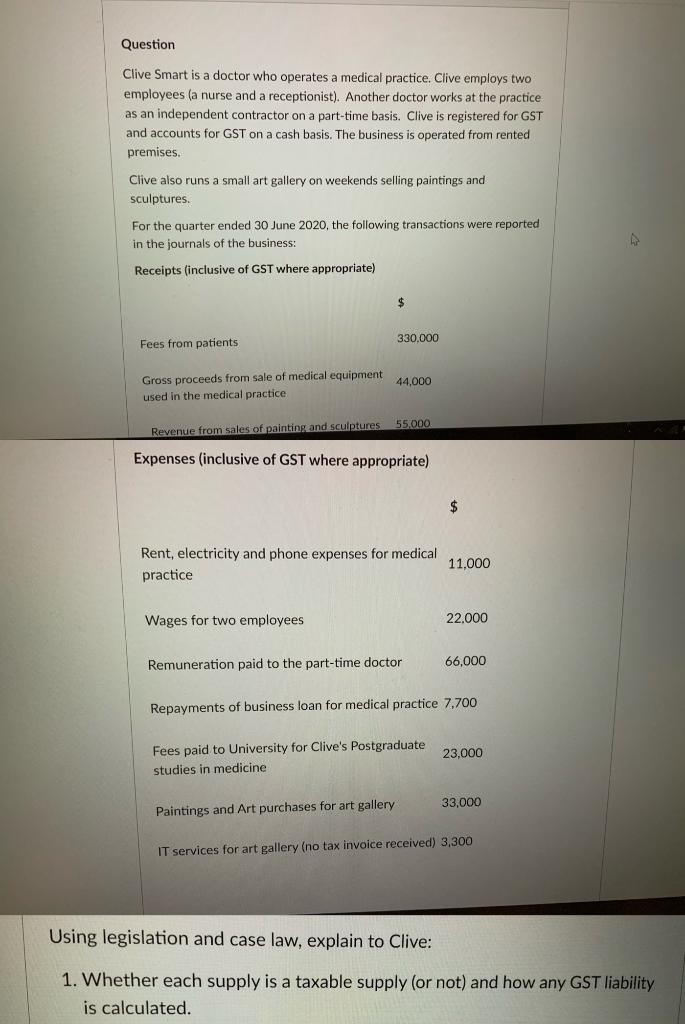

Question Clive Smart is a doctor who operates a medical practice. Clive employs two employees (a nurse and a receptionist). Another doctor works at the practice as an independent contractor on a part-time basis. Clive is registered for GST and accounts for GST on a cash basis. The business is operated from rented premises Clive also runs a small art gallery on weekends selling paintings and sculptures For the quarter ended 30 June 2020, the following transactions were reported in the journals of the business: Receipts (inclusive of GST where appropriate) $ 330.000 Fees from patients 44,000 Gross proceeds from sale of medical equipment used in the medical practice 55.000 Revenue from sales of painting and sculptures Expenses (inclusive of GST where appropriate) $ Rent, electricity and phone expenses for medical practice 11,000 Wages for two employees 22.000 Remuneration paid to the part-time doctor 66,000 Repayments of business loan for medical practice 7,700 Fees paid to University for Clive's Postgraduate studies in medicine 23,000 33.000 Paintings and Art purchases for art gallery IT services for art gallery (no tax invoice received) 3,300 Using legislation and case law, explain to Clive: 1. Whether each supply is a taxable supply (or not) and how any GST liability is calculated. Question Clive Smart is a doctor who operates a medical practice. Clive employs two employees (a nurse and a receptionist). Another doctor works at the practice as an independent contractor on a part-time basis. Clive is registered for GST and accounts for GST on a cash basis. The business is operated from rented premises Clive also runs a small art gallery on weekends selling paintings and sculptures For the quarter ended 30 June 2020, the following transactions were reported in the journals of the business: Receipts (inclusive of GST where appropriate) $ 330.000 Fees from patients 44,000 Gross proceeds from sale of medical equipment used in the medical practice 55.000 Revenue from sales of painting and sculptures Expenses (inclusive of GST where appropriate) $ Rent, electricity and phone expenses for medical practice 11,000 Wages for two employees 22.000 Remuneration paid to the part-time doctor 66,000 Repayments of business loan for medical practice 7,700 Fees paid to University for Clive's Postgraduate studies in medicine 23,000 33.000 Paintings and Art purchases for art gallery IT services for art gallery (no tax invoice received) 3,300 Using legislation and case law, explain to Clive: 1. Whether each supply is a taxable supply (or not) and how any GST liability is calculated