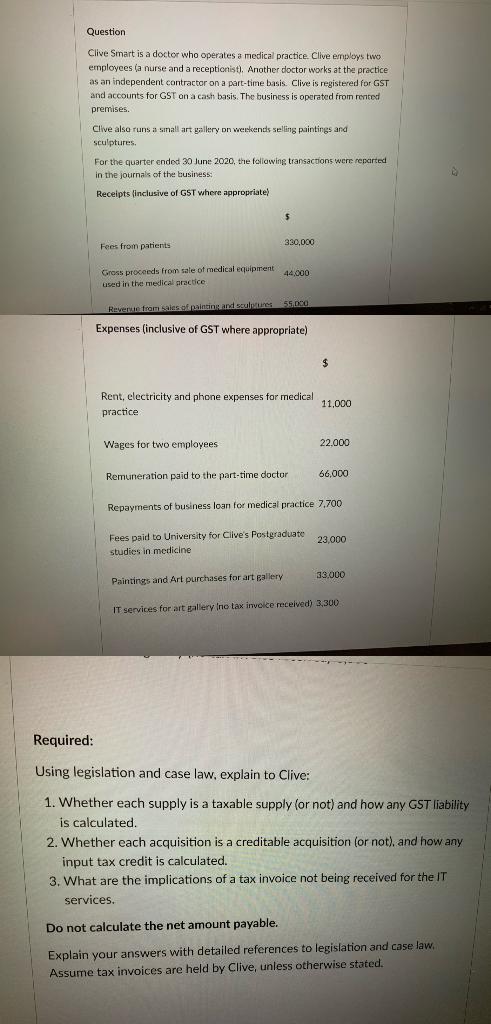

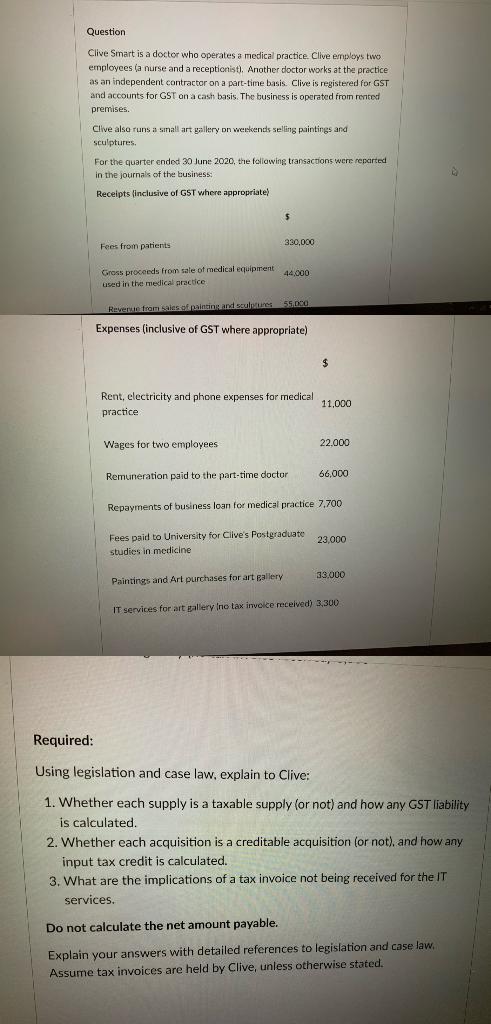

Question Clive Smart is a doctor who operates a medical practice. Clive employs two employees a nurse and a receptionist). Another doctor works at the practice as an independent contractor on a part-time basis. Clive is registered for GST and accounts for GST on a cash basis. The business is operated from rented premises Clive also runs a small art gallery on weekend selling paintings and Sculptures. For the quarter ended 30 June 2020, the following transactions were reported in the journals of the business: Receipts (inclusive of GST where appropriate 5 330,000 Fees from patients 44,000 Gross proceeds from sale of medical equipment used in the medical practice Reverd from sales of painting and stures 55.000 Expenses (inclusive of GST where appropriate) $ Rent, electricity and phone expenses for medical practice 11,000 Wages for two employees 22.000 66.000 Remuneration paid to the part-time doctor Repayments of business loan for medical practice 7.700 Fees paid to University for Clive's Postgraduate studies in medicine 23,000 33 000 Paintings and Art purchases for art gallery IT services for art gallery Ino tax invoice received) 3.300 Required: Using legislation and case law, explain to Clive: 1. Whether each supply is a taxable supply for not) and how any GST liability is calculated. 2. Whether each acquisition is a creditable acquisition (or not), and how any input tax credit is calculated. 3. What are the implications of a tax invoice not being received for the IT services. Do not calculate the net amount payable. Explain your answers with detailed references to legislation and case law. Assume tax invoices are held by Clive, unless otherwise stated. Question Clive Smart is a doctor who operates a medical practice. Clive employs two employees a nurse and a receptionist). Another doctor works at the practice as an independent contractor on a part-time basis. Clive is registered for GST and accounts for GST on a cash basis. The business is operated from rented premises Clive also runs a small art gallery on weekend selling paintings and Sculptures. For the quarter ended 30 June 2020, the following transactions were reported in the journals of the business: Receipts (inclusive of GST where appropriate 5 330,000 Fees from patients 44,000 Gross proceeds from sale of medical equipment used in the medical practice Reverd from sales of painting and stures 55.000 Expenses (inclusive of GST where appropriate) $ Rent, electricity and phone expenses for medical practice 11,000 Wages for two employees 22.000 66.000 Remuneration paid to the part-time doctor Repayments of business loan for medical practice 7.700 Fees paid to University for Clive's Postgraduate studies in medicine 23,000 33 000 Paintings and Art purchases for art gallery IT services for art gallery Ino tax invoice received) 3.300 Required: Using legislation and case law, explain to Clive: 1. Whether each supply is a taxable supply for not) and how any GST liability is calculated. 2. Whether each acquisition is a creditable acquisition (or not), and how any input tax credit is calculated. 3. What are the implications of a tax invoice not being received for the IT services. Do not calculate the net amount payable. Explain your answers with detailed references to legislation and case law. Assume tax invoices are held by Clive, unless otherwise stated