Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Company P acquired an 80% interest in Company S on January 1, 2018. In addition, Company P purchased a 20% interest in Company

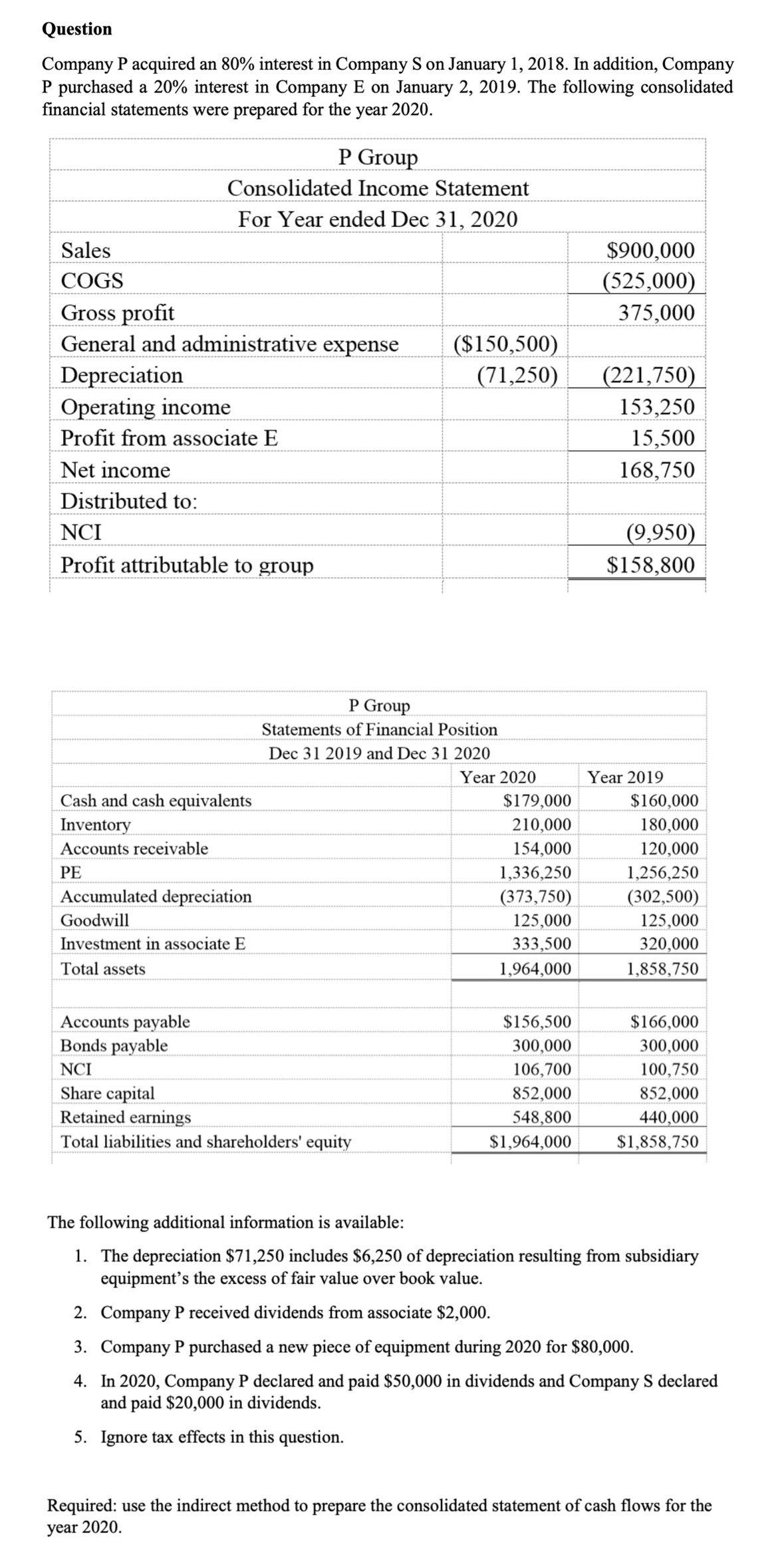

Question Company P acquired an 80% interest in Company S on January 1, 2018. In addition, Company P purchased a 20% interest in Company E on January 2, 2019. The following consolidated financial statements were prepared for the year 2020. P Group Consolidated Income Statement For Year ended Dec 31, 2020 Sales $900,000 COGS (525,000) Gross profit 375,000 General and administrative expense ($150,500) Depreciation (71,250) (221,750) Operating income 153,250 Profit from associate E 15,500 Net income Distributed to: NCI Profit attributable to group 168,750 (9,950) $158,800 P Group Statements of Financial Position Dec 31 2019 and Dec 31 2020 Year 2020 Year 2019 Cash and cash equivalents Inventory $179,000 $160,000 210,000 180,000 Accounts receivable 154,000 120,000 PE 1,336,250 1,256,250 Accumulated depreciation (373,750) (302,500) Goodwill 125,000 125,000 Investment in associate E 333,500 320,000 Total assets 1,964,000 1,858,750 Accounts payable Bonds payable NCI Share capital Retained earnings Total liabilities and shareholders' equity $156,500 $166,000 300,000 300,000 106,700 100,750 852,000 852,000 548,800 440,000 $1,964,000 $1,858,750 The following additional information is available: 1. The depreciation $71,250 includes $6,250 of depreciation resulting from subsidiary equipment's the excess of fair value over book value. 2. Company P received dividends from associate $2,000. 3. Company P purchased a new piece of equipment during 2020 for $80,000. 4. In 2020, Company P declared and paid $50,000 in dividends and Company S declared and paid $20,000 in dividends. 5. Ignore tax effects in this question. Required: use the indirect method to prepare the consolidated statement of cash flows for the year 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started