Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Completion Status: 1 2 3 4 5 6. 6 8. 9 10 11 12 13 FO A Moving to another question will save this

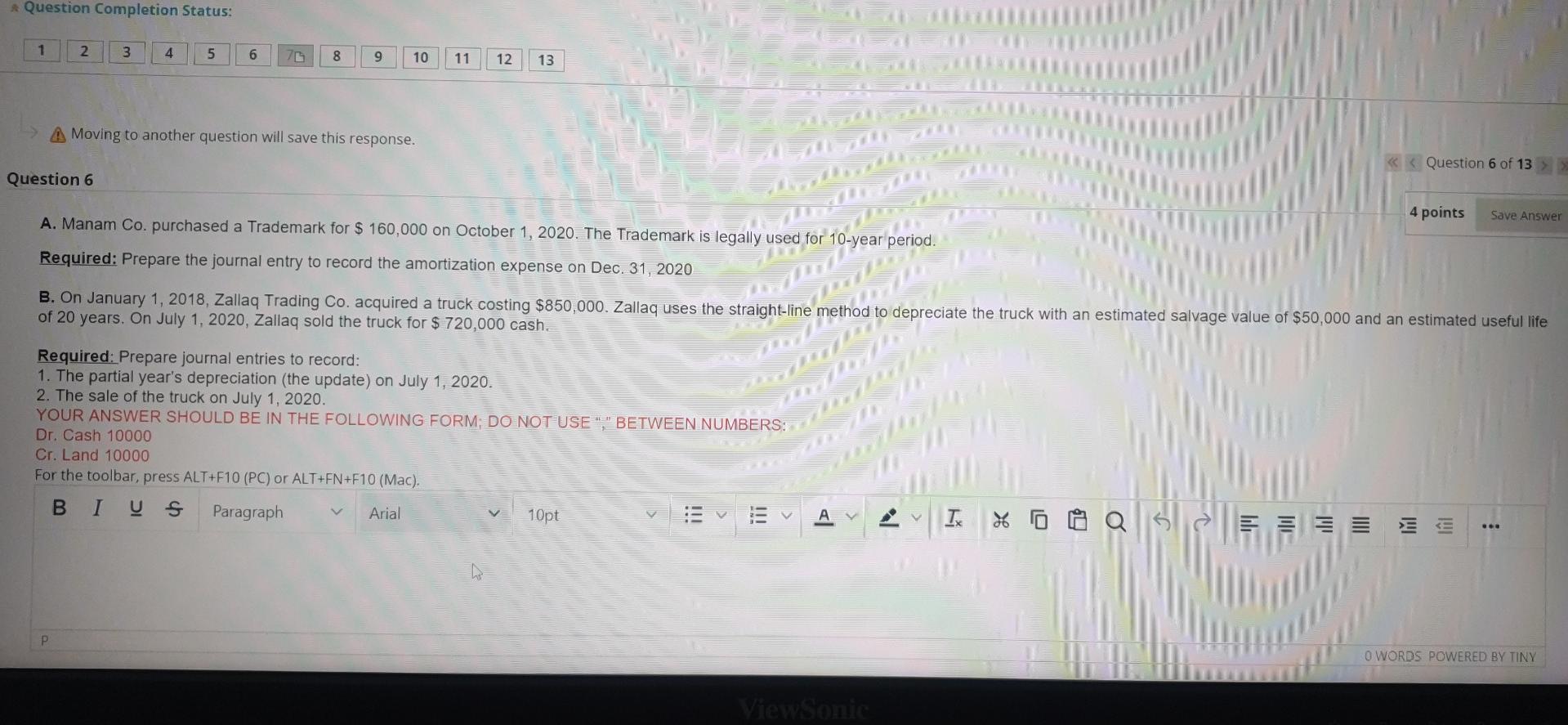

Question Completion Status: 1 2 3 4 5 6. 6 8. 9 10 11 12 13 FO A Moving to another question will save this response. >> Question 6 4 points Save Answer A. Manam Co. purchased a Trademark for $ 160,000 on October 1, 2020. The Trademark is legally used for 10-year period. Required: Prepare the journal entry to record the amortization expense on Dec. 31, 2020 B. On January 1, 2018, Zallaq Trading Co. acquired a truck costing $850,000. Zallaq uses the straight-line method to depreciate the truck with an estimated salvage value of $50,000 and an estimated useful life of 20 years. On July 1, 2020, Zallaq sold the truck for $ 720,000 cash. Required: Prepare journal entries to record: 1. The partial year's depreciation (the update) on July 1, 2020. 2. The sale of the truck on July 1, 2020. YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM; DO NOT USE "," BETWEEN NUMBERS: Dr. Cash 10000 Cr. Land 10000 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI U S Paragraph Arial 10pt V I * a ... P O WORDS POWERED BY TINY ViewSonic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started