Answered step by step

Verified Expert Solution

Question

1 Approved Answer

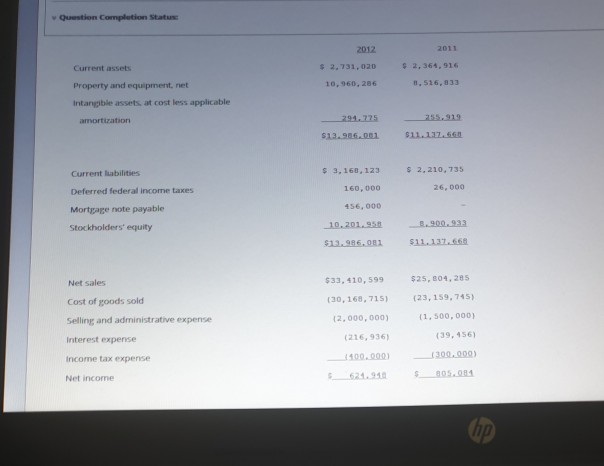

Question Completion Status 2012 2011 $ 2.731.020 2.364,916 Current assets Property and equipment, net Intangible assets at cost less applicable 10,960, 266 11.516, 333 amortization

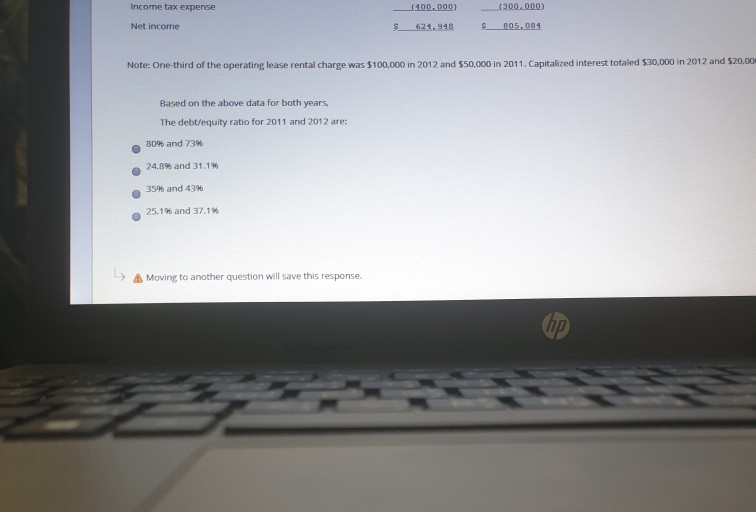

Question Completion Status 2012 2011 $ 2.731.020 2.364,916 Current assets Property and equipment, net Intangible assets at cost less applicable 10,960, 266 11.516, 333 amortization 7294.725 $13.906.001 $11. 132.60 Current abilities $ 3, 160, 123 $ 2,210, 735 Deferred federal income taxes 160,000 26,000 Mortgage note payable 456.000 Stockholders' equity 10. 201.95 3.900.933 $11.137.663 $13,986,081 Net sales $33,410,599 $25,604,285 (30, 168, 715) (23, 159, 7453 Cost of goods sold Selling and administrative expense 12,000,000) (1,500,000) Interest expense (216,936) (39,156) 1300.000) Income tax expense Net income hp Income tax expense 1400,000) 4300.000) Net income $ 624.948 $ R05, 084 Note: One third of the operating lease rental charge was $100,000 in 2012 and 550,000 in 2011. Capitalized interest totaled $30,000 in 2012 and $20,00 Based on the above data for both years, The debt/equity ratio for 2011 and 2012 are: 80% and 73% 24.8% and 31.1% 35% and 43% 25.19 and 37.1% Moving to another question will save this response. OP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started