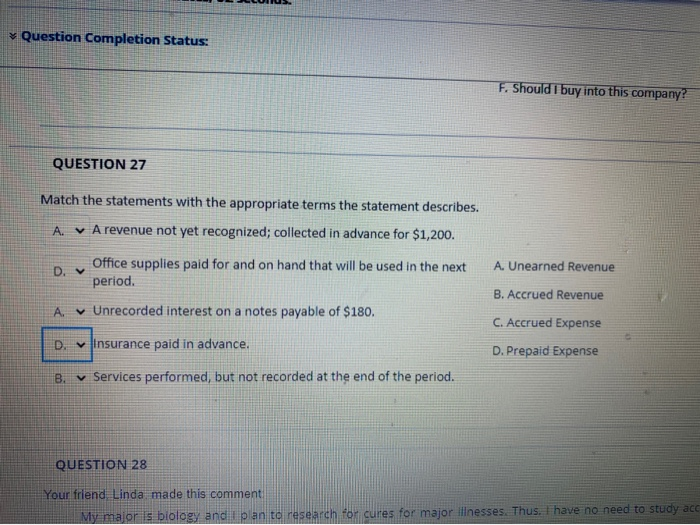

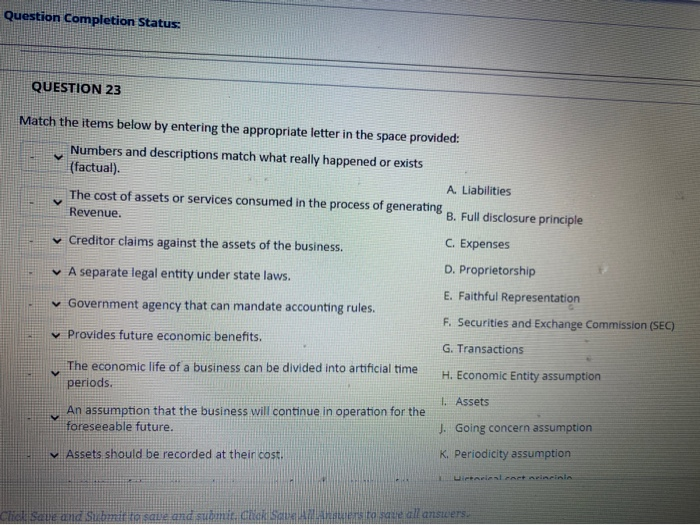

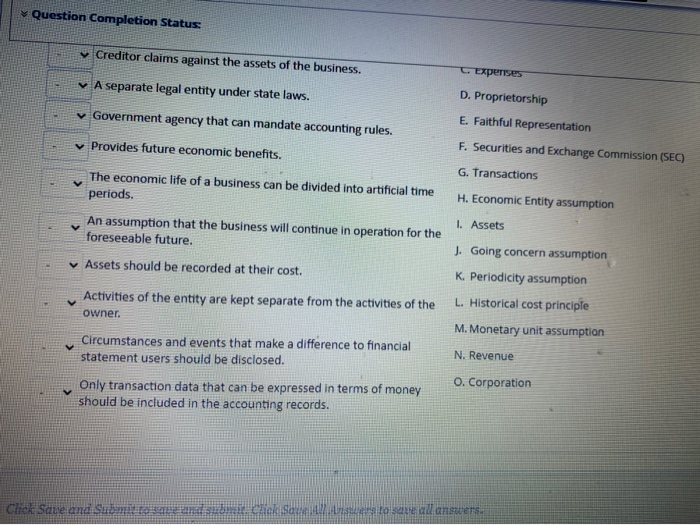

Question Completion Status: F. Should I buy into this company? QUESTION 27 Match the statements with the appropriate terms the statement describes. A. v A revenue not yet recognized; collected in advance for $1,200. A. Unearned Revenue Office supplies paid for and on hand that will be used in the next D. V period. A v Unrecorded interest on a notes payable of $180. B. Accrued Revenue C. Accrued Expense D. Insurance paid in advance. D. Prepaid Expense 8. v Services performed, but not recorded at the end of the period. QUESTION 28 Your friend Linda made this comment My major is biology and plan to research for cures for major illnesses. Thus. I have no need to study acc Question Completion Status: QUESTION 23 Match the items below by entering the appropriate letter in the space provided: Numbers and descriptions match what really happened or exists (factual). A. Liabilities The cost of assets or services consumed in the process of generating Revenue. B. Full disclosure principle Creditor claims against the assets of the business. C. Expenses D. Proprietorship A separate legal entity under state laws. E. Faithful Representation Government agency that can mandate accounting rules. F. Securities and Exchange Commission (SEC) v Provides future economic benefits. G. Transactions The economic life of a business can be divided into artificial time periods. H. Economic Entity assumption 1. Assets An assumption that the business will continue in operation for the foreseeable future. J. Going concern assumption Assets should be recorded at their cost. K. Periodicity assumption Click Save and Submit to save and submi. Click Save anders to save all answers Question Completion Status: Creditor claims against the assets of the business. A separate legal entity under state laws. v Government agency that can mandate accounting rules. Experises D. Proprietorship E. Faithful Representation F. Securities and Exchange Commission (SEC) Provides future economic benefits. G. Transactions V The economic life of a business can be divided into artificial time periods. H. Economic Entity assumption An assumption that the business will continue in operation for the foreseeable future. I. Assets Assets should be recorded at their cost. Activities of the entity are kept separate from the activities of the owner. J. Going concern assumption K. Periodicity assumption L. Historical cost principle M. Monetary unit assumption N. Revenue Circumstances and events that make a difference to financial statement users should be disclosed. Only transaction data that can be expressed in terms of money should be included in the accounting records. O. Corporation Click Save and Sudad de Chick Sauerstene toe all answers