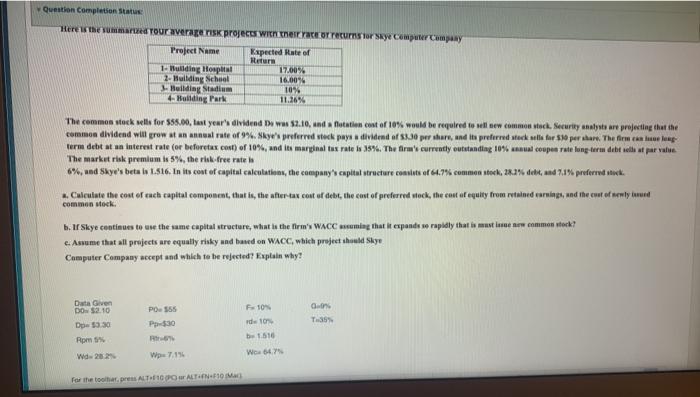

Question Completion Status Here is the smarte Tour average risk projects with their rate or recursor saye Computer Company Project Name Kaspected Rate of Rur 1- Wilding Hospital 17.00% 2- Huilding School 16.004 J-Huilding Stadium 10% 4 Bullding Park 11.16% The common stock well for 555.00, last year's dividend De was 52.10, and flotation cost of 10% would be required to well new common stock, Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye's preferred stock pays a dividend of 3.30 per share, and its preferred neck is for 50 per share. The firmas ter det at an interest rate (or beforetas cost) of 10%, and its marginal tax rate is 35%. The firm's currently outstanding 10% al coupeerste long-term dit sellest par value The market risk premium 5%, the risk-free rate is %, und Skye's beta in 1.516 In its cost of capital calculations, the company's capital structure constits of 66.7% common stock, 18.2% debt, und 2.1% preferred ok. Culculate the cost of each capital component, that in the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the coat of armly wel common Mock. b. Skye continues to wwe the same capital structure, what is the firm's WACC ming that it expande e rapidly that is must mean common stock c. Assume that all projects are equally risky and based on WACC, which project the Skye Computer Company accept and which to be rejected? Explain why? G. Data Given DO 52.10 Dpe 330 Rpm PO.555 Pp530 F. 10 de 10 be 1.510 T. Wd262 Wipe 7.15 WG 647 for the topress AT10 ALTIN 10 M Question Completion Status Here is the smarte Tour average risk projects with their rate or recursor saye Computer Company Project Name Kaspected Rate of Rur 1- Wilding Hospital 17.00% 2- Huilding School 16.004 J-Huilding Stadium 10% 4 Bullding Park 11.16% The common stock well for 555.00, last year's dividend De was 52.10, and flotation cost of 10% would be required to well new common stock, Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye's preferred stock pays a dividend of 3.30 per share, and its preferred neck is for 50 per share. The firmas ter det at an interest rate (or beforetas cost) of 10%, and its marginal tax rate is 35%. The firm's currently outstanding 10% al coupeerste long-term dit sellest par value The market risk premium 5%, the risk-free rate is %, und Skye's beta in 1.516 In its cost of capital calculations, the company's capital structure constits of 66.7% common stock, 18.2% debt, und 2.1% preferred ok. Culculate the cost of each capital component, that in the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the coat of armly wel common Mock. b. Skye continues to wwe the same capital structure, what is the firm's WACC ming that it expande e rapidly that is must mean common stock c. Assume that all projects are equally risky and based on WACC, which project the Skye Computer Company accept and which to be rejected? Explain why? G. Data Given DO 52.10 Dpe 330 Rpm PO.555 Pp530 F. 10 de 10 be 1.510 T. Wd262 Wipe 7.15 WG 647 for the topress AT10 ALTIN 10 M