Answered step by step

Verified Expert Solution

Question

1 Approved Answer

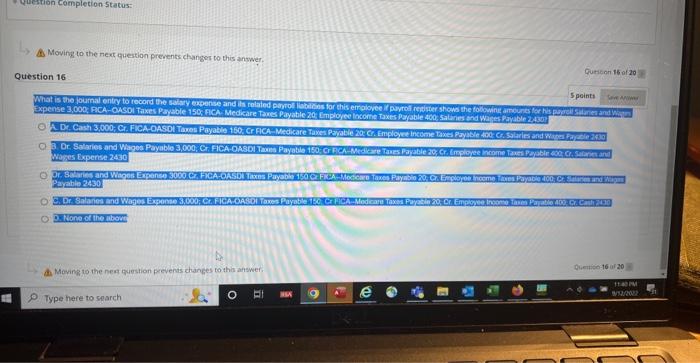

Question Completion Status: Moving to the next question prevents changes to this answer. Question 16 Question 16 of 20 5 points Save What is

Question Completion Status: Moving to the next question prevents changes to this answer. Question 16 Question 16 of 20 5 points Save What is the journal entry to record the salary expense and its related payroll abilities for this employee if payroll register shows the following amounts for his payroll Salanes and W Expense 3,000; FICA-OASDI Taxes Payable 150; FICA Medicare Taxes Payable 20: Employee Income Taxes Payable 400; Salaries and Wages Payable 2,430 OA Dr. Cash 3,000; Cr. FICA-OASDI Taxes Payable 150, Cr FICA-Medicare Taxes Payable 20: Cr. Employee Income Taxes Payable 400: Cr. Salaries and Wages Payable 2430 OB. Dr. Salaries and Wages Payable 3,000, Cr. FICA-OASDI Taxes Payable 150, Cr RCA-Medicare Taxes Payable 20, Cr. Employee income Taxes Payable 400 Cr, Salanes and Wages Expense 2430 O Dr. Salaries and Wages Expense 3000 CZ FICA-OASDI Taxes Payable 150 C FKCA-Medicare Taxes Payable 20, Cr. Employee Income Taxes Payable 400, Cr Salaries and We Payable 2430 O. Dr. Salaries and Wages Expense 3,000; Cr. FICA OASDI Taxes Payable 150 Cr FICA-Medicare Taxes Payable 20, Cr Employee Income Taxes Payable 400 Crash 2430 OD. None of the above Moving to the next question prevents changes to this answer Type here to search i 17 Question 16 of 20 11:40 PM W/13/2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started