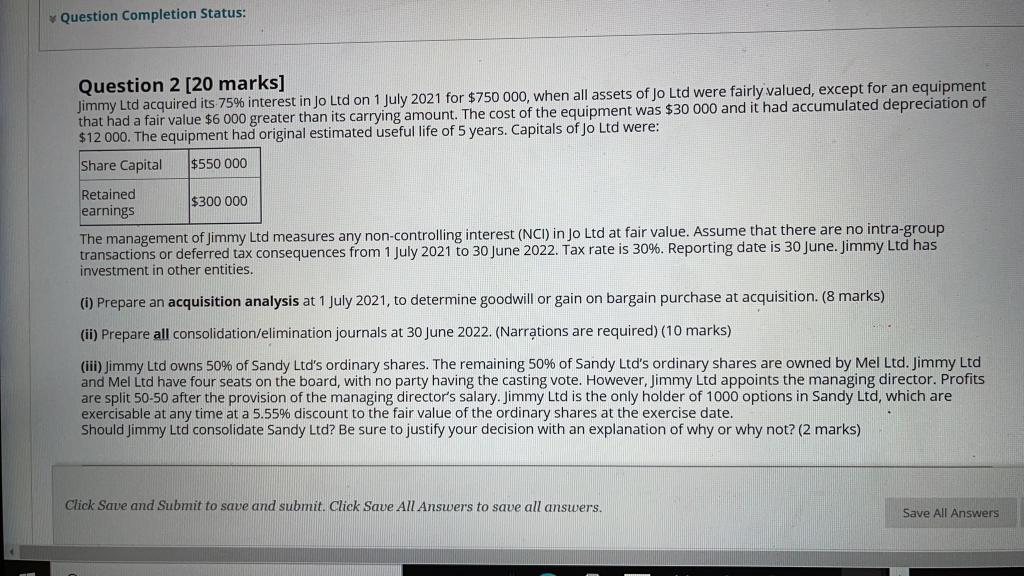

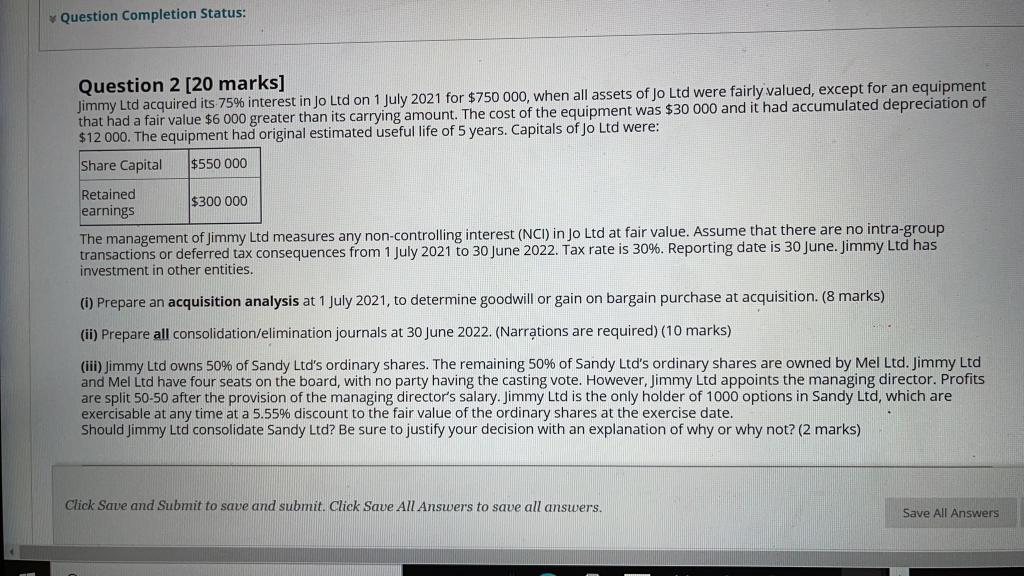

Question Completion Status: Question 2 [20 marks] Jimmy Ltd acquired its 75% interest in Jo Ltd on 1 July 2021 for $750 000, when all assets of Jo Ltd were fairly valued, except for an equipment that had a fair value $6000 greater than its carrying amount. The cost of the equipment was $30 000 and it had accumulated depreciation of $12 000. The equipment had original estimated useful life of 5 years, Capitals of Jo Ltd were: Share Capital $550 000 Retained $300 000 earnings The management of Jimmy Ltd measures any non-controlling interest (NCI) in Jo Ltd at fair value. Assume that there are no intra-group transactions or deferred tax consequences from 1 July 2021 to 30 June 2022. Tax rate is 30%. Reporting date is 30 June. Jimmy Ltd has investment in other entities. (1) Prepare an acquisition analysis at 1 July 2021, to determine goodwill or gain on bargain purchase at acquisition. (8 marks) (ii) Prepare all consolidation/elimination journals at 30 June 2022. (Narrations are required) (10 marks) (iii) Jimmy Ltd owns 50% of Sandy Ltd's ordinary shares. The remaining 50% of Sandy Ltd's ordinary shares are owned by Mel Ltd. Jimmy Ltd and Mel Ltd have four seats on the board, with no party having the casting vote. However, Jimmy Ltd appoints the managing director. Profits are split 50-50 after the provision of the managing director's salary. Jimmy Ltd is the only holder of 1000 options in Sandy Ltd, which are exercisable at any time at a 5.55% discount to the fair value of the ordinary shares at the exercise date. Should Jimmy Ltd consolidate Sandy Ltd? Be sure to justify your decision with an explanation of why or why not? (2 marks) Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Question Completion Status: Question 2 [20 marks] Jimmy Ltd acquired its 75% interest in Jo Ltd on 1 July 2021 for $750 000, when all assets of Jo Ltd were fairly valued, except for an equipment that had a fair value $6000 greater than its carrying amount. The cost of the equipment was $30 000 and it had accumulated depreciation of $12 000. The equipment had original estimated useful life of 5 years, Capitals of Jo Ltd were: Share Capital $550 000 Retained $300 000 earnings The management of Jimmy Ltd measures any non-controlling interest (NCI) in Jo Ltd at fair value. Assume that there are no intra-group transactions or deferred tax consequences from 1 July 2021 to 30 June 2022. Tax rate is 30%. Reporting date is 30 June. Jimmy Ltd has investment in other entities. (1) Prepare an acquisition analysis at 1 July 2021, to determine goodwill or gain on bargain purchase at acquisition. (8 marks) (ii) Prepare all consolidation/elimination journals at 30 June 2022. (Narrations are required) (10 marks) (iii) Jimmy Ltd owns 50% of Sandy Ltd's ordinary shares. The remaining 50% of Sandy Ltd's ordinary shares are owned by Mel Ltd. Jimmy Ltd and Mel Ltd have four seats on the board, with no party having the casting vote. However, Jimmy Ltd appoints the managing director. Profits are split 50-50 after the provision of the managing director's salary. Jimmy Ltd is the only holder of 1000 options in Sandy Ltd, which are exercisable at any time at a 5.55% discount to the fair value of the ordinary shares at the exercise date. Should Jimmy Ltd consolidate Sandy Ltd? Be sure to justify your decision with an explanation of why or why not? (2 marks) Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers